Seventy-three percent of construction firms nationwide plan to expand their payrolls in 2017 as contractors expect private and public sector demand to grow in all market segments, according to survey results released today by the Associated General Contractors of America and Sage Construction and Real Estate. Here in Colorado, 67% of Colorado contractors reported they plan to increase their headcount in 2017 by 1%-25%.

“Contractors have relatively high expectations for 2017 as they predict the economy and demands for all types of construction will grow,” said Stephen E. Sandherr, the association’s chief executive officer. “As a result of this optimism, many firms expect to expand their headcount next year.”

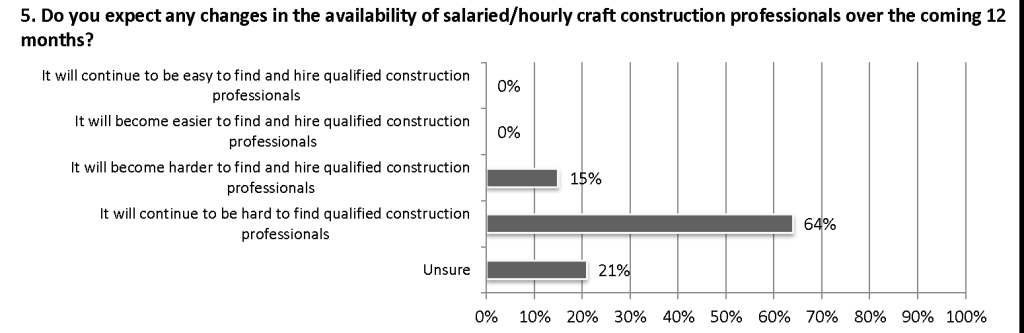

Labor Shortages

Despite the general optimism outlined in Expecting a Post-Election Bump: The 2017 Construction Industry Hiring and Business Outlook, many firms report they remain worried about the availability of qualified workers and rising health and regulatory costs. 64% of Colorado firms reported that it will continue to be hard to find qualified construction professionals in the next 12 months.

“Contractors remain quite concerned about labor shortages, tight margins and growing costs,” said Ken Simonson, the association’s chief economist. “In particular, as additional older workers reach retirement age, firms will struggle to find qualified workers to replace them.”

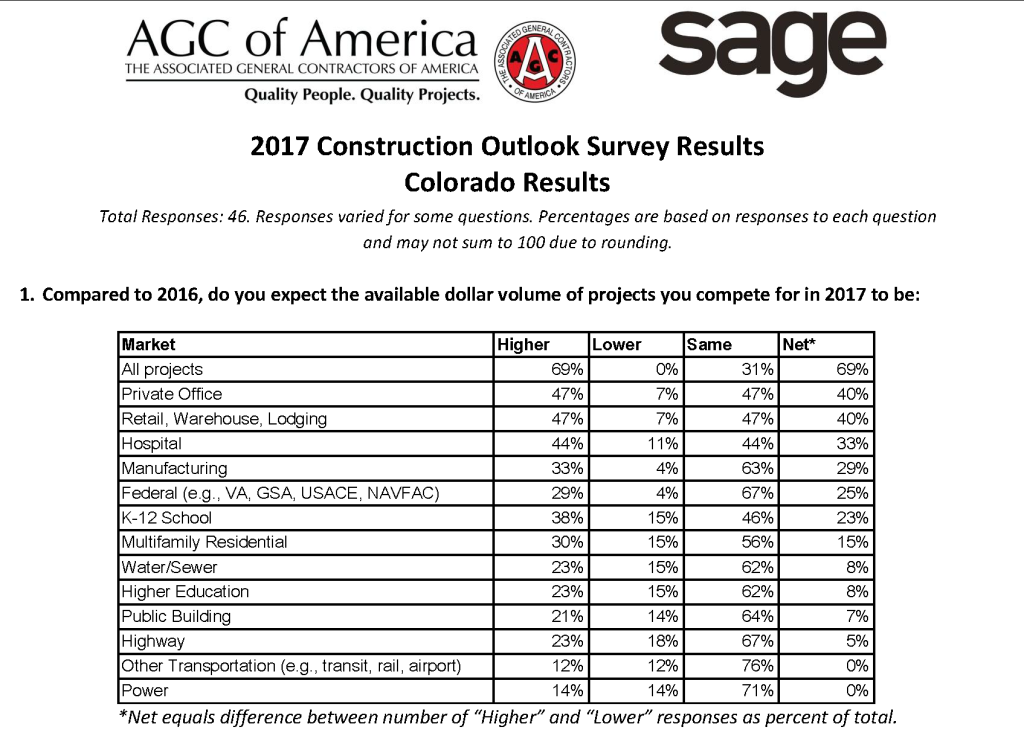

Expected Dollar Volume of Projects

All but a handful of contractors nationwide expect the overall construction market to expand or remain roughly the same in 2017 compared to 2016. A total of 46% of respondents in the U.S. said they expect a higher dollar volume of projects in 2017 than in 2016, versus just 9& who expect a lower volume, for a net positive reading (based on unrounded numbers) of 36 percent. A total of 69% of Colorado contractors reported higher dollar volume of projects in 2017 versus 2016.

Expected dollar volume of projects in 2017 for Colorado are listed below.

Association officials noted that overall economic conditions indicate 2017 should continue to be positive for the construction industry. But they added that it appears the Outlook responses are based as much in high expectations for the incoming administration and the President-elect’s commitment to investing in infrastructure, improving federal health care laws and reducing regulatory burdens.

“While the new administration and its stated policy objectives offer many reasons for optimism, there is a significant risk to the industry if the new Congress and administration under-deliver,” Sandherr said referring to policy proposals the association is making. “If plans to invest in infrastructure, reform healthcare laws and roll back regulations are delayed, many contractors will likely scale back their plans to expand headcounts.”

Plans to Offer Construction Solutions

Sandherr added that the association has crafted two plans to help guide the administration and Congress and ensure they act quickly to deliver on their election pledges. The first plan is the association’s Agenda to Rebuild Infrastructure and the Construction Workforce, which outlines a series of steps federal officials should take to finance and fund new infrastructure investments and accelerate federal reviews. The second plan identifies regulations and executive orders that new administration should cancel, improve or reconsider.

“Together these two plans offer a clear roadmap for the administration and new Congress to help deliver on the promise of this year’s relatively positive construction outlook,” Sandherr said. “As long as the new administration follows through on its commitments, construction firms will see more demand for their services and, potentially, slightly better profit margins.”

The Outlook was based on survey results from nearly 1,300 construction firms from 49 states and the District of Columbia. Varying numbers responded to each question. Contractors of every size answered over 30 questions about their hiring, workforce, business and information technology plans.

Graphs courtesy of the Associated General Contractors of America

Main image: Stock photography via Pixabay.com