DENVER – Shoppers’ growing preference for variety and value will drive CBRE’s anticipated holiday retail trends for this season, including an even greater proliferation of pop-up stores, the emergence of “pop-up warehouses,” an expansion of mobile commerce and strength in discount retailing, according to a new report from CBRE.

“As e-commerce reshapes modern retailing, blurring the lines between online and in-store activity, retailers and shopping center owners must continue to adapt with fresh approaches,” said Melina Cordero, CBRE head of retail research, the Americas. “We anticipate that this season will showcase strategies of reaching customers through multiple selling channels as well as catering to their demand for new concepts and value pricing.”

CBRE’s 2017 U.S. Holiday Trends Guide outlines four trends shaping this season as it unfolds. Pop-Up Mania Short-term retail leases – often called pop-up shops – have evolved from a trend last season to a full-blown phenomenon this season. Retailers, and now retail-center owners, favor the flexibility and experimentation allowed by short-term leases, and shoppers appreciate the variety of a shifting roster of stores. Several of the largest U.S. mall owners have designated space in their strongest properties for pop ups.

More M-Commerce

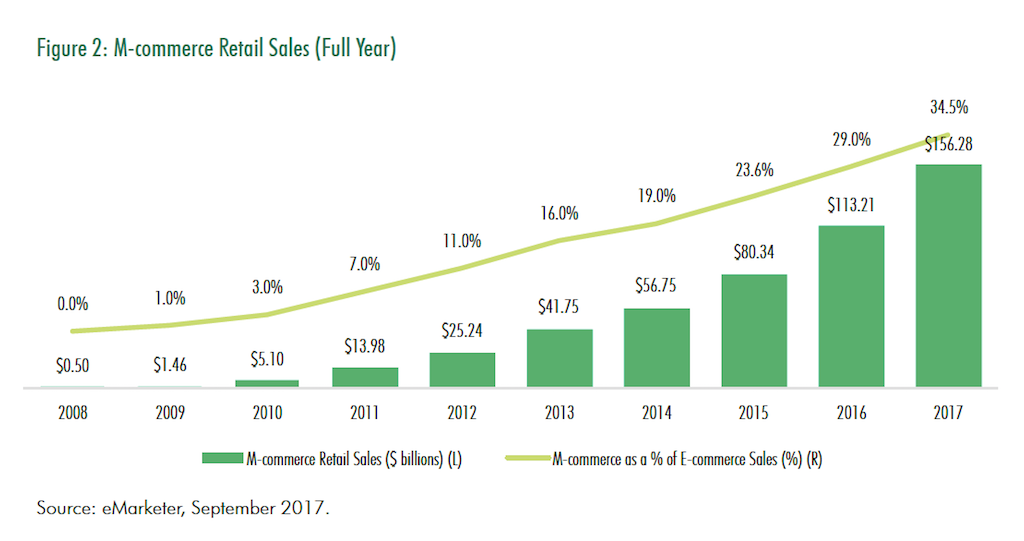

It’s no secret that e-commerce is claiming a growing portion of retail sales. What’s less often highlighted is the growth of mobile commerce; eMarketer forecasts that more than a third of online sales this year will occur on phones and tablets. CBRE expects more widespread use by retailers this year of m-commerce tools for handling customer-service, mobile marketing and facilitating sales.

“M-commerce has the power to impact retail in several ways. Beyond simply making purchases via phone or tablet, m-commerce opens the door to creative ways to engage shoppers in store and incentivize purchases. We see many retailers gravitating toward technology that delivers customized discount offers to a phone depending on where the person is standing in the store. Retail strategy is no longer online or brick-and- mortar, today it’s the combination bricks-and-clicks approach that is strengthening sales overall,” said Jon Weisiger, senior vice president, CBRE Retail Services, Denver.

Dawn of the Discounters

Discount and off-price retailers gained momentum during the Great Recession and have sustained it in the years since with a mix of value pricing and treasure-hunt merchandising. CBRE predicts that the category will take additional marketshare this season, spurring mid-market retailers to discount their prices to compete.

“Discount retailers have been a strong segment of Denver retail leasing activity in recent years, and we expect them to do well this holiday season. Whereas recessions often cause temporary changes in shopping habits, in the case of pursuing value over brand, it seems the sentiment is here to stay,” added Mr. Weisiger.

Warehouse Space, On Demand

The surge of online sales during the holiday season can create instant, short-term demand for warehouse and distribution-center space – potential headache for retailers trying to ensure prompt delivery to customers. New services have emerged to provide a “pop-up warehouse” model in which demand for short-term industrial space in a given market is matched with suppliers. Early results show higher efficiency and lower costs.

“CBRE has identified these trends by examining public and proprietary data, querying our Retail professionals and listening to our clients,” said Brandon Famous, CBRE senior managing director of Retail Advisory & Transaction Services and retail leader, the Americas. “We see these trends as natural steps for retailers striving to perfect their omnichannel operations for selling across all channels and to enhance consumers’ experiences in each.”