DENVER — CBRE just released its Q2 reports on Denver’s Office, Industrial and Retail sectors. All three markets demonstrated continued growth during the second quarter of the year.

“Overall Denver’s commercial real estate markets continue to show strength in the second quarter of the year. Nearly 10 million square feet under construction across the industrial, office and retail sectors—of which a large percentage is speculative—shows that developers continue to feel confident in our market. All that new construction is driving up the average asking lease rates of available space, which are at or near record levels across the board. Despite the rising costs, demand for space from office, industrial and retail users is hearty with more than 1.3 million square feet of positive net absorption in Denver this past quarter,” said Matt Vance, CBRE economist and director of research.

Office Highlights

Office Highlights

- Driven by occupancy in newly constructed buildings, positive net absorption of 853,716 sq. ft. was recorded in Q2 2018, bringing year-to-date net absorption to over 1.1 million sq. ft.

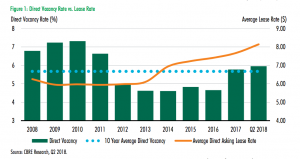

- The average direct asking lease rate increased to a record high of $27.66 per sq. ft. FSG, a 2.2 increase quarter-over-quarter.

- Though still elevated, the direct vacancy rate decreased 8 bps quarter-over-quarter to 13.6%.

- Investment activity in metro Denver reached $501.9 million in Q2 2018, a 5.3% increase year-over-year.

- Notable new lease transactions in the quarter included 88,294 sq. ft. to AppExtremes at ATRIA in the Northwest, 74,068 sq. ft. to Pax 8 at 5500 S Quebec Street in the Southeast, and 65,720 sq. ft. to Faegre Baker Daniels at 1144 Fifteenth in the Downtown submarket.

Industrial Highlights

Industrial Highlights

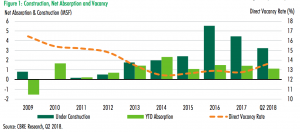

- 419,516 sq. ft. of positive net absorption was recorded in Q2 2018, posting the 33rd straight quarter of positive net absorption.

- The overall average asking lease rate rose to $8.14 per sq. ft. NNN—the highest rate ever recorded in metro Denver.

- Year-to-date overall (investment and owner/user) sales volume totaled $762.6 million, up nearly 50% compared to the first half of last year.

- The most notable investment sale transaction in Q2 2018 was JP Morgan’s acquisition of the 421,499-sq.-ft. Hub 25 Portfolio for $175.56 per sq. ft.

Retail Highlights

Positive net absorption of 65,330 sq. ft. was recorded in Q2 2018 despite nearly 250,000 sq. ft. of Toys “R” Us closures in the metro Denver area.

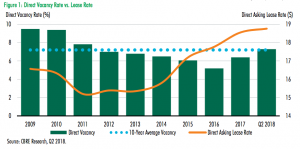

Positive net absorption of 65,330 sq. ft. was recorded in Q2 2018 despite nearly 250,000 sq. ft. of Toys “R” Us closures in the metro Denver area.- Overall direct vacancy increased 40 bps quarter-over-quarter to 7.3%, in line with the 10-year average.

- In Q2 2018, the average direct asking lease rate increased by $0.08 per sq. ft. quarter-over quarter to $18.76 per sq. ft. NNN.

- Construction activity remained heightened with over 1.5 million sq. ft. underway with an additional 270,000 sq. ft. delivering this quarter.

- Total transaction volume in Q2 2018 was $166.1 million with 17 retail properties priced above $3.0 million trading hands.

Images courtesy of CBRE