by: Julie Wanzer, LEED AP

Providing alternative funding sources allows those transactions that may not be appetizing to traditional banks to become a reality and provide for diversity of projects in the commercial real estate industry.

Denver, CO – Crowdfunding has long been synonymous with raising donations for fundraisers and supplying start-up companies with the needed capital to launch their latest innovations. The commercial real estate industry is now taking advantage of this technology as an alternative investment source.

Crowdfunding for real estate was accredited by Title II of the JOBS Act that was enacted in September of 2013. According to research released by the SEC, almost $27 billion has been raised through crowdfunding since Title II was made available, with real estate as one of the most active sectors using Title II.

One such company, iFunding, has already provided capital for several deals in Colorado. iFunding is an investment platform that aggregates investor capital to provide equity and debt financing to owners, developers, and fund managers. Accredited investors can register on their website to review their online investment marketplace, which includes investment positions in all asset classes and throughout the capital stack.

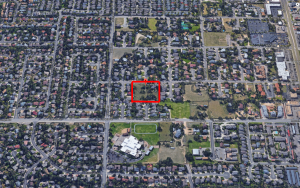

iFunding recently raised $750,000 of senior debt for the acquisition, renovation, and development of an in-fill site in Denver. The senior bridge loan is structured to accommodate an evolving real estate strategy for a developer in a market that is experiencing some of the lowest available inventory in years.

iFunding recently raised $750,000 of senior debt for the acquisition, renovation, and development of an in-fill site in Denver. The senior bridge loan is structured to accommodate an evolving real estate strategy for a developer in a market that is experiencing some of the lowest available inventory in years.

The Bruckal Group is an active developer that has been involved in over 5,000 residential units, and maintains a full-time local presence in Denver. Myles Bruckal, the CEO of the Bruckal Group observed, “We are very excited about the financing on this project. It was a pleasure to work with iFunding to create a structured loan on a dynamic asset.” iFunding also raised $1 million in preferred equity for the Bruckal Group for Cottage Grove, a multifamily development in Aurora.

The commercial real estate industry, which is historically slow to evolve with the latest technology, has the opportunity with crowdfunding to provide their clients greater access to funding and therefore the ability to broker more deals. According to the Colorado Crowdfunding Meetup group, “Crowdfunding is all about democratizing the manner in which capital is raised for business startups and for charitable, artistic, commercial and other business ventures.” Providing alternative funding sources allows those transactions that may not be appetizing to traditional banks to become a reality and provide for diversity of projects in the commercial real estate industry.

Other commercial real estate crowdfunding companies making waves in the industry include:

– Fundrise

Main photo courtesy of Business Rewritten

Inset photo: Aerial view of iFunding Kingston Court project. Photo credit: The Bruckal Group