By: Richard L. Wobbekind, Executive Director, Business Research Division

Colorado’s Employment to Grow by 2.4% in 2017, Adding Jobs in Nearly Every Sector

![]()

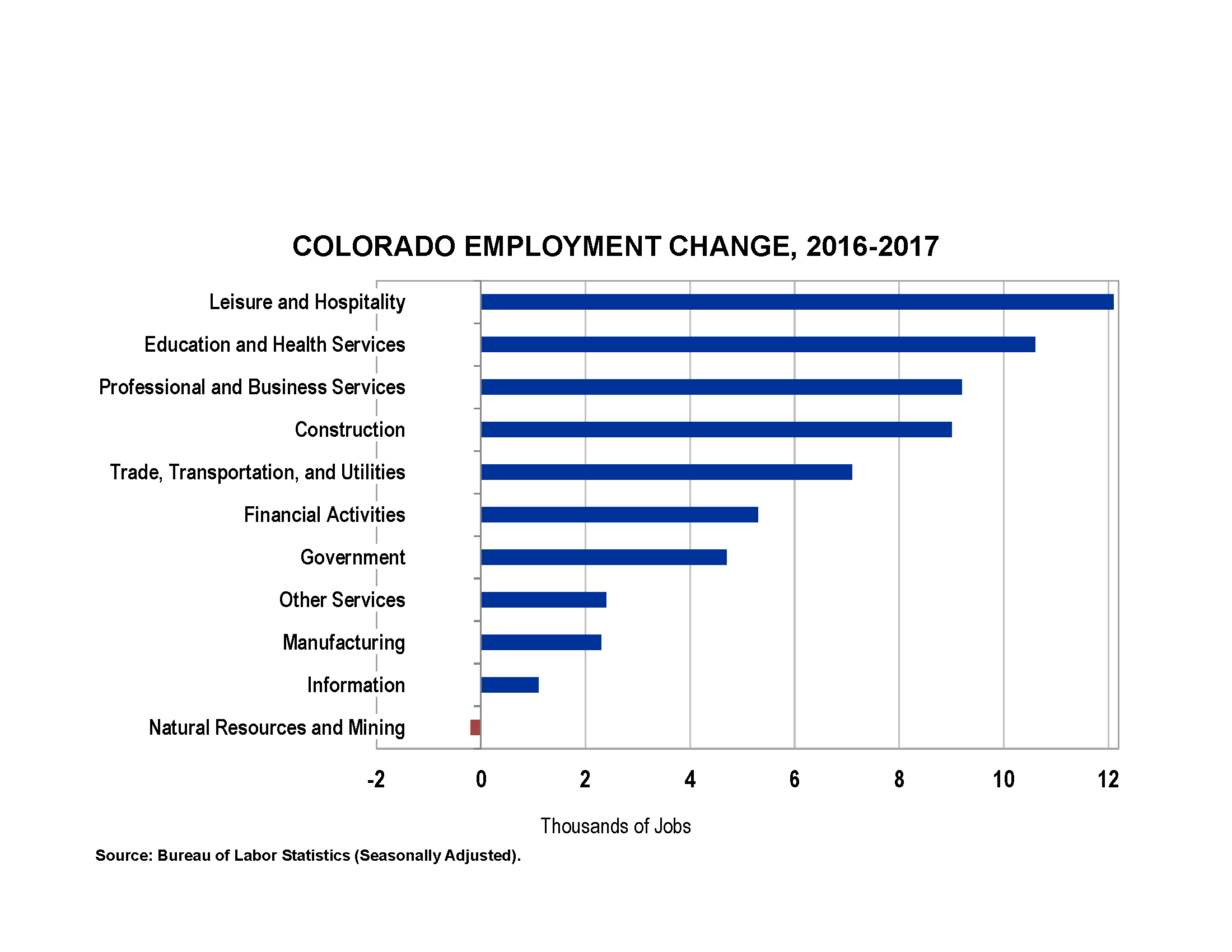

Colorado added 76,200 jobs in 2015, growing by 3.1% and resulting in the second-best year of employment growth since 2000. Job growth continued in 2016, at a slower rate, adding 54,800 total jobs for a 2.2% increase. In 2017, Colorado’s employment growth is anticipated to occur at a slightly faster pace from the previous year, increasing by 2.4% statewide and adding 63,400 new jobs.

Colorado added 76,200 jobs in 2015, growing by 3.1% and resulting in the second-best year of employment growth since 2000. Job growth continued in 2016, at a slower rate, adding 54,800 total jobs for a 2.2% increase. In 2017, Colorado’s employment growth is anticipated to occur at a slightly faster pace from the previous year, increasing by 2.4% statewide and adding 63,400 new jobs.

Colorado is expected to add far more services-producing jobs than goods-producing jobs, continuing a long-term trend. From 2006–2016, the state added 329,200 services-producing jobs, while the total goods-producing employment has fallen by 12,200 jobs across the same period.

Job growth throughout the state has exemplified Colorado’s recovery from the Great Recession. Since 2012, statewide job growth has reached levels not seen since the tech boom of the late 1990s.

Each services-producing sector is expected to add jobs during 2017, while two out of three goods-producing sectors are anticipated to post positive employment growth during the year. Only Natural Resources and Mining is projected to record modest job losses in 2017.

Agriculture—The Agriculture Sector will post lower net income for the second consecutive year in 2017 due to low cattle and grain prices. Following a decrease in net income of $850 million from $1.3 billion in 2015 to $444 million 2016, profits are expected to fall again to $392 million in 2017. The industry has been negatively affected by the increase in the value of the dollar as exports have declined.

Construction—The demand for housing units in 2016 is expected to exceed supply by the greatest amount in over 18 years, due to increased migration into the state. While multifamily construction is expected to fall slightly in 2017, strong growth in single-family homes is forecasted to make up for any decline, with single-family permit growth exceeding the national average by 8 percentage points. Along with growth in both nonresidential and nonbuilding construction, industry employment is expected to reach 166,000 jobs in 2017.

Manufacturing—Following 10 years of decline, the Manufacturing Sector is expected to grow for the seventh consecutive year in 2017, increasing 1.6% in 2017. The growth is equally weighted between the durable goods and nondurable goods subsectors, adding 1,200 jobs and 1,100 jobs, respectively. Every subsector is expected to post modest employment increases except fabricated metals and computer and electronics. The increased use of robotics and automation is increasing the productivity in the Manufacturing Sector but at the cost of declining employment growth.

Natural Resources and Mining—Compared to the rest of the nation, Colorado ranks 7th in oil and gas reserves, 10th in coal production, 4th in gold production, and 1st in molybdenum production. Colorado is also a leading producer of renewable energy, including wind, solar, biomass, and hydroelectric energy sources. The total value of Colorado’s Natural Resources and Mining production in 2016 is forecast to decline due to low oil and natural gas prices—34% lower than its peak value in 2014. Industry employment is also expected to continue to decrease in 2017, declining less than 1%.

Professional and Business Services—Professional and Business Services (PBS) Sector employment growth continues to increase, but at a slower rate. The sector is expected to post employment growth of 1.5% in 2016, down from 2.9% in 2015. Growth is projected to rebound to 2.3%, or 9,200 jobs in 2017. One of the main drivers of growth will be the come from the Professional, Scientific, and Technical Services Sector.

Trade, Transportation and Utilities—TTU employment is anticipated to increase by 1.6% to total 461,800 jobs in 2017, with retail trade contributing the majority of industry growth. Retail sales forecast for Colorado calls for a 2.9% increase in 2016, slower than in year 2015, but stronger than current data suggest. Employment in this sector is forecast to increase by 6,600 jobs in 2017.

Education and Health Services—Private education and health care services are expected to continue their trend modest growth, adding 12,100 and 10,600 jobs in 2016 and 2017, respectively. The majority of sector employment is made up of health care professionals, and the growing demand for health care is driven primarily by growth in the population and the expansion of healthcare coverage.

Leisure and Hospitality—Tourism-related employment is expected to grow by 10,800 jobs in 2016, marking the seventh consecutive year of growth. Colorado recorded a record number of visitors in 2015 thanks to a strong convention calendar and new lodging options in Denver, a gain in national park visits, and ski traffic that outperformed the rest of the nation. Momentum in Colorado’s tourism industry is anticipated to continue into 2017, with a forecasted increase of 12,100 jobs.

Government—Government employment within Colorado is expected to post a gain of 1.1% in 2017, driven by state and local government. Local government accounts for 60% of government employment in the state, the majority of which are teachers or staff in K–12 schools, and is expected to grow by 1% in 2017, roughly the same rate as Colorado’s population. Local government benefits from higher home values and increased consumer expenditures as revenues come from property taxes and sales and use taxes. State tax revenues in Colorado are capped at a TABOR limit, and any excess revenues are refunded to taxpayers.

Financial Activities—The Financial Activities Sector is expected to continue to grow in Colorado in 2017, adding 5,300 jobs to reach total employment of 169,400. The forecasted increase in growth is driven by expectations of a stronger overall economy that provides more job opportunities within banking, insurance, and real estate. Financial Activities employment has recorded positive growth each year since 2012, illustrating a strong recovery from the recession.

Information—Broad but modest growth will be observed in the Information sectors, including publishing, film, telecom, and broadcasting. The Information industry is expected to add 700 jobs in 2016 and grow by 1,100 jobs in 2017. Even as employment growth in the industry has fallen in recent years, the Information Sector continues to provide a substantial contribution to Colorado’s GDP and ranks as one of the state’s fastest-growing industries in terms of long-term output growth.

National and International

- Weak commodity prices will continue to negatively affect the agricultural and natural resources sectors, but will benefit consumers.

- Slowdown in the global economy and a strong U.S. dollar pose risks for Colorado’s exports.

- U.S. GDP growth will likely remain in the 2 – 3% range in 2017.

- Changes in Fed policy will put upward pressure on interest rates.

- Inflation will remain in check for another year while interest rates remain low.

Colorado

- Employment growth will place Colorado in the top 10 states in 2017.

- Drought and weather fluctuations will cause volatility for agricultural producers.

- Strong in-migration will cause the demand for housing to outpace supply, resulting in higher home prices.

- In terms of population, Colorado is the second-fastest growing state in percentage terms. The state will continue to attract people from outside Colorado, contributing to an anticipated population increase of 100,000 people between 2016 and 2017.

- Colorado will sustain a sub-5% unemployment rate.

With Colorado’s skilled workforce; high-tech, diversified economy; relatively low cost of doing business; global economic access; and exceptional quality of life, the state remains poised for long-term economic growth.

For more information on each industry sector, click here

Photo credit: Business Research Division, Leeds School of Business