Denver, CO – JLL Research recently released their fourth quarter 2016 office statistics which indicated a positive net absorption for Denver’s office market in Q4, after experiencing negative net absorption during the first three quarters of 2016. The negative net absorption in Q1 – Q3 of 2016 came after 13 consecutive quarters of positive net absorption in the market, the longest and strongest streak in history.

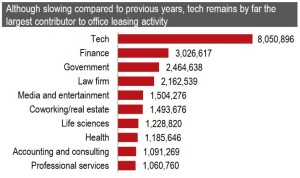

Denver’s office market followed national trends in that tech-related companies such as SendGrid, which occupied 107,581 square feet at 1801 California in Midtown Central Business District (CBD), remain the largest contributor to office leasing activity.

Denver’s office market followed national trends in that tech-related companies such as SendGrid, which occupied 107,581 square feet at 1801 California in Midtown Central Business District (CBD), remain the largest contributor to office leasing activity.

Other significant office deals in Denver contributing to positive absorption this past quarter included:

- CoBiz Financial occupied 44,010 square feet

- Northern Trust Bank occupied 10,760 square feet

- Polsinelli occupied 86,664 square feet at 1401 Lawrence in West CBD

The three deals contributing to negative absorption in the fourth quarter of 2016 included:

- Square Two Financial vacated 118,267 square feet at 4340 S Monaco in Southeast Suburban

- Polsinelli vacated a 47,427 square foot sublease at 1515 Wynkoop in Lodo

- Rio Tinto vacated a 32,000 square foot sublease at 8051 E Maplewood Ave in Southeast Suburban

Denver’s overall office market recorded 334,675 square feet of direct net absorption and 266,577 square feet of total net absorption (including subleases) in the 4th quarter, bringing year-to-date totals to 859,967 square feet of direct net absorption and 260,990 square feet for total net absorption.

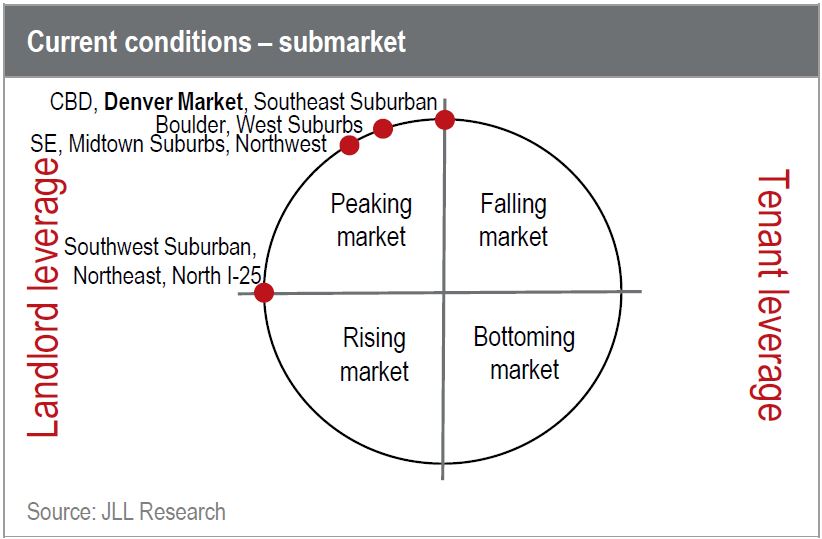

Metro-wide average asking rates grew by 1.6 percent from last quarter to $26.99 per square foot, up 4.0 percent y-o-y, and 30.3 percent since Q1 2010. Although rental growth continues, the rate of growth has slowed indicating more stable increases and rental rate flattening in some submarkets.

Images/charts/graphs courtesy of JLL Research