HFF closes $57.8 million sale of and arranges $46 million financing for multi-housing community in Denver

Holliday Fenoglio Fowler, L.P. (HFF) announced today that it has closed the $57.8 million sale of and arranged $46 million in acquisition financing for Silver Cliff, a 312-unit, garden-style multi-housing community in the south Denver suburb of Englewood, Colorado.

HFF marketed the asset exclusively on behalf of Weidner Apartment Homes. Phoenix Realty Group (PRG), a national multifamily real estate fund manager, investor, operator and developer, purchased the unencumbered property jointly with a third-party family office and discretionary-affiliated investment vehicle. Additionally, working on behalf of the new owner, HFF placed the seven-year, fixed-rate loan with three years of interest only amortization with Freddie Mac’s (Federal Home Loan Mortgage Corporation) CME Program. The securitized loan allows flexible prepayment in year six to seven and will be serviced by HFF, a Freddie Mac Multifamily Approved Seller/Servicer for Conventional Loans.

Silver Cliff is situated on approximately 10.6 acres at 5275 South Delaware Street just west of the intersection of South Broadway and Belleview Avenue. Bounded by two of the region’s most affluent suburbs, Greenwood Village and Littleton, the community is proximate to numerous parks, major retailers, the South Broadway corridor and RTD Light Rail service. Silver Cliff has nine residential buildings consisting of one- and two-bedroom units averaging 815 square feet along with a full suite of amenities, including a swimming pool, dog run, playground, 24-hour fitness center, garages and carports and sweeping views of the Rocky Mountains. The property was 97 percent leased at closing.

The HFF investment sales team representing the seller was led by managing director Jordan Robbins and associate directors Jeff Haag and Anna Stevens.

HFF’s debt placement team representing the new owner was led by managing director Josh Simon.

Cushman & Wakefield’s Hendrickson and Johnson Close Three Recent Transactions

Jon Hendrickson and Aaron Johnson, Managing Directors at Cushman & Wakefield’s Denver office, have completed three office and retail sale transactions in the last few months. Arapahoe Plaza, a 37,933-square-foot multi-tenant office building located at 7700 East Arapahoe Road in Centennial, Colorado, closed in April 2017. A private partnership fulfilling a 1031 exchange purchased the property for $4,825,000. Arapahoe Plaza is located near the intersection of Interstate 25 and Arapahoe Road.

“The property caters to tenants coming from the extensive surrounding executive and employee housing seeking a quality, small tenant environment,” said Johnson. “The asset provides numerous walkable restaurant and retail amenities rare in suburban submarkets. Investors were attracted to the improvements in the common areas and tenant suites, coupled with the strong historical occupancy.”

In June 2017, a local private partnership fulfilling a 1031 exchange bought Lincoln Center, a 16,392 square foot multi-tenant shopping center at 12501 and 12509 East Lincoln Avenue in Englewood, Colorado.

“Lincoln Center represents the current strength of the retail market,” said Hendrickson. “The property has a tenant mix of restaurants, services and local business all within an affluent, growing trade area of Metro Denver.”

Erindale Square, a 103,571-square-foot multi-tenant shopping center located at 5881-5975 North Academy Boulevard in Colorado Springs, Colorado, closed in June 2017 for $8,100,000. The property was built in 1981 and 1988, and consists of three multi-tenant retail buildings as well as an additional single-tenant pad.

“Erindale Square was an opportunity for a California-based purchaser to acquire significant yield in a proven shopping center,” said Hendrickson. “The established surrounding neighborhood and substantial traffic volumes on Academy Boulevard will continue to support the tenant mix. The seller reinvested substantial capital expenditures to set up the property and buyer for long-term success.”

NavPoint Real Estate Group Closes Gas Station Land in Golden, CO

NavPoint Real Estate Group is pleased to announce the sale of 1.88 acres to Kum & Go Gas Station at Gateway Village. The seller was Gateway Investments an investment entity founded by Northstar Commercial Partners. The buyers were KG Store 319 LLC. Heather Taylor and Matt Call of NavPoint Real Estate Group represented the seller. This deal successfully closed in June 2017.

Gateway Village encompasses 22 acres designated for mixed-use development such as retail, restaurant, bar, and event space located at I-70 Exit 259 and Hwy. 40, just west of the I-70 and 470 junctions. This new, regional retail project will also include a hotel, gas station convenience store, dining, and much more! There is still room in the retail project which is almost 50 percent preleased and a few pad sites available for sale or build-to- suit. It has high visibility from both routes with extremely high traffic counts and is adjacent to the RTD Dinosaur Park and Ride lots.

NavPoint Sells 13,201 SF Industrial Building in Denver

NavPoint Real Estate Group also sold a 13,201 SF Industrial Building at 3035-3037 E 42nd Ave in Denver. The seller was DOR Real Estate, LLC. The buyer was GES Building Holding Corporation. Matt Kulbe, Brent Ham, and Anthony Damico of NavPoint Real Estate Group represented the seller. This deal successfully closed in May 2017. The property is conveniently located off Steele St and E 42nd Ave located 4 blocks south of I-70. This building was constructed in 1954 in the heart of Denver’s Industrial Hub and in between two of Denver’s hottest areas, River North Art District and Park Hill.

NavPoint Real Estate Group is a comprehensive Commercial Real Estate Services Firm that handles a wide variety of investment assignments. The company provides services including Exclusive Brokerage Representation, Property/Asset Management, and Consulting, throughout Colorado and the Western US covering all Commercial Property types. NavPoint brings an experienced team to every assignment that has a broad understanding of the national Commercial Real Estate market while also bringing acute local knowledge to each assignment. The firm is currently involved in the exclusive brokerage or management of over 1,500,000 SF of commercial real estate.

Pinnacle Announces Sale of 3724 Walnut Street

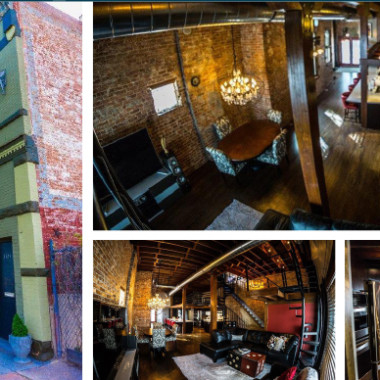

Pinnacle Real Estate Advisors, LLC is pleased to announce the sale of 3724 Walnut Street located in Denver, CO. The property contains a 2,394-square-foot, two-story fully renovated building on 14,068-square-foot site zoned C-MX-8. The RiNo infill property is adjacent to the World Trade Center site and the 38th & Blake Light Rail station.

Billy Riesing, Senior Advisor, represented the seller in the transaction and the principal buyer purchased the site for $2,115,030 on June 26th.