CBRE has released its Q3 multifamily figures for the Denver market. Completions were down for a third consecutive quarter and dropped 62.8% year-over-year after the delivery of 1,659 units in Q3 2025.

Denver Multifamily Figures Q3 2025

- In Q3 2025, the Denver multifamily occupancy rate fell 60 basis points (bps) quarter-over-quarter to 94.0%. Occupancy was unchanged from a year ago, signaling a greater balance between supply and demand over the longer run.

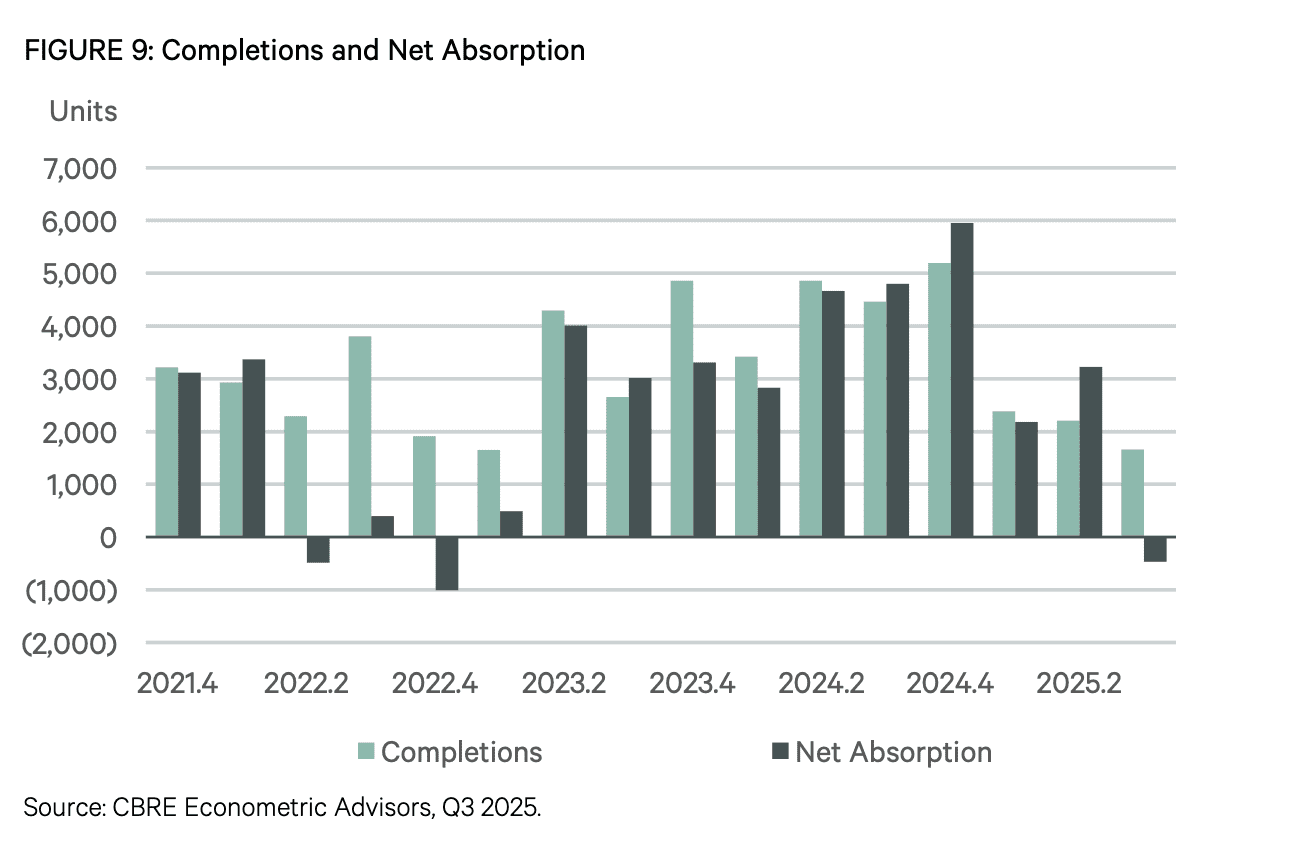

- The third quarter of 2025 recorded negative net absorption of 474 units, a significant decline from the positive 3,223 units absorbed last quarter. This was the Denver market’s first quarter of negative net absorption since Q4 2022.

- Completions were down for a third consecutive quarter and dropped 62.8% year-over-year after the delivery of 1,659 units in Q3 2025.

- The average rent per unit decreased 2.2% quarter-over-quarter to $1,814. On an annual basis, rents were down by an average of 7.2% from $1,955.

- Investment sales volume totaled $919 million in Q3 2025, up from $506 million last quarter but down considerably from $1.8 billion a year ago. The average price per unit fell quarter-over-quarter from $305,000 to $278,000.

Download the report here.