CBRE has just released its Q4 2025 reports for Denver’s office and industrial markets.

The Denver office market saw clearer signs of stabilization to end 2025, as net absorption turned positive for the first time since early 2022 and vacancy realized its first post-pandemic decline.

Denver’s industrial market performance reflected sustained positive fundamentals, with ample net absorption, an uptick in both leasing and sales activity, and moderating vacancy and new construction.

Click on the links to read each report in full.

- Net absorption totaled positive 203,000 sq. ft., helping to partially offset 2025’s total of negative 1.8 million sq. ft., which aligned with the recent five-year historical average.

- Total vacancy declined by a slight 20 basis points (bps) in Q4 to 28.3% but was still up 150 bps year-over-year.

- Rolling four-quarter leasing activity declined 12.0% quarter-over-quarter to 4.4 million sq. ft., while Q4 activity alone was largely stable at 888,000 sq. ft.

- Investment activity improved in Q4 2025, with 16 transactions at a total volume of $370 million compared to $220 million across six transactions in Q3.

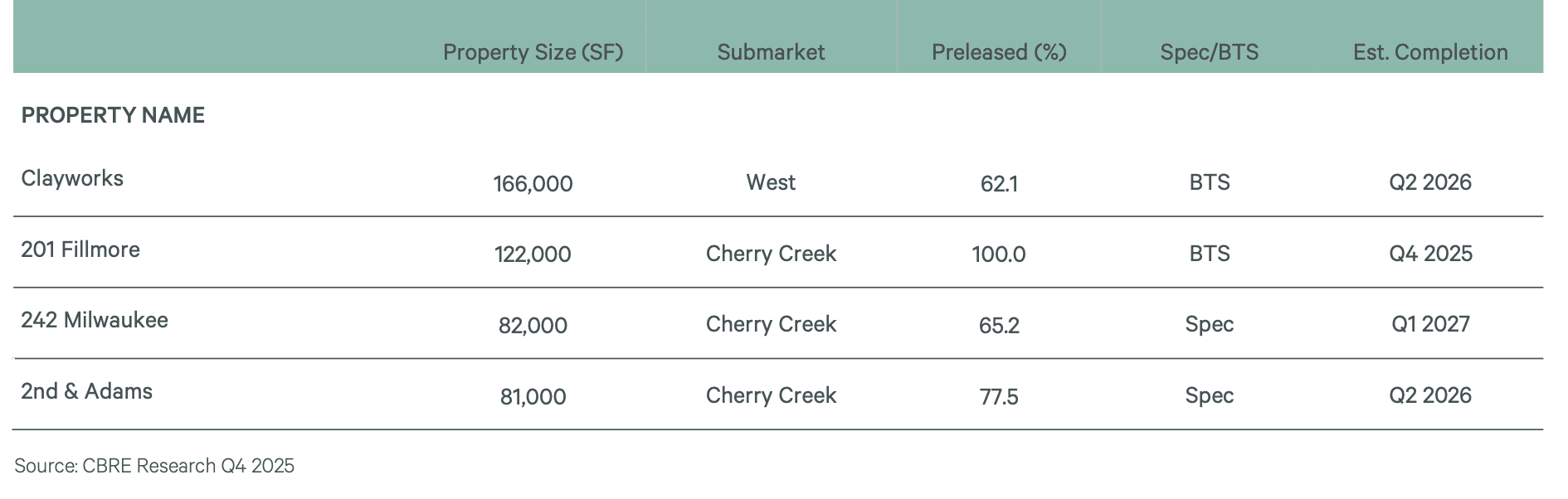

- At the end of 2025, there were 5 projects totaling 476,000 sq. ft. under construction in the Denver metro. Cherry Creek remains the most active area for development.

Denver Industrial Figures Q4 2025

- Total net absorption reached positive 1.0 million sq. ft. for the quarter and 3.6 million sq. ft. for the year, 32.8% higher than 2024’s total.

- Direct vacancy declined 10 basis points (bps) to 7.5%, indicative of the greater balance between supply and demand as the amount of new speculative construction continues to slow.

- The construction pipeline remained largely stable quarter-over-quarter at 3.3 million sq. ft., with 640,000 sq. ft. of new construction breaking ground and 668,000 sq. ft. of deliveries.

- Leasing volume in Q4 2025 totaled 2.9 million sq. ft., the strongest quarter of 2025 that brought the annual total to 10.5 million sq. ft.

- Industrial sales volume totaled $575 million in Q4, up 17.8% from the previous quarter and pushing the 2025 total 40.6% higher than last year’s volume.