U.S. life sciences employment has wavered between small gains and declines since 2022 as the sector grappled with capital constraints and layoffs, leaving its growth prospects fragile this year, according to a new report from CBRE.

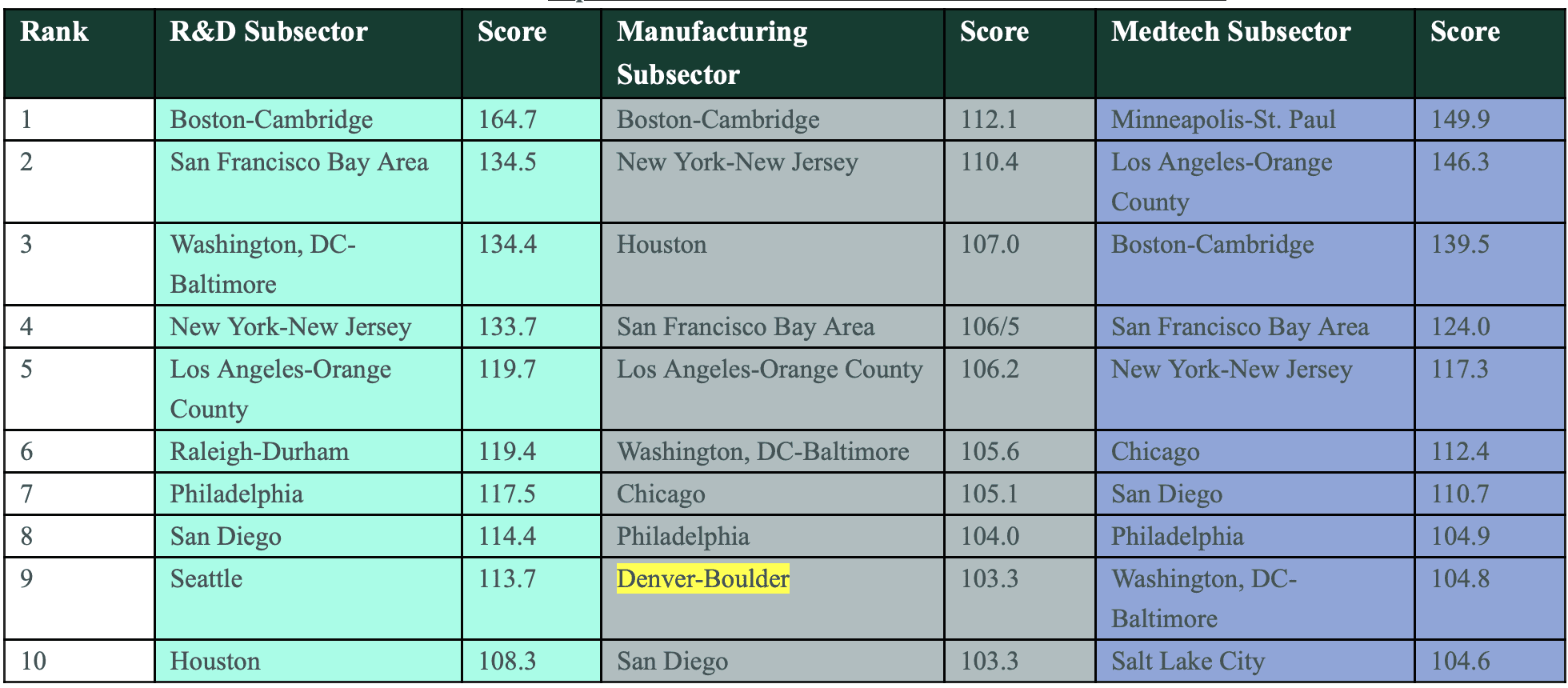

CBRE analyzed 100 U.S. life sciences markets in its 2025 Life Sciences Talent Trends report, updating its talent rankings of the top 25 markets in each of three subsectors: research and development, manufacturing and medtech.

Denver-Boulder breached the top 10 markets in life sciences manufacturing talent this year, moving up seven spots to rank No. 9 among markets measured in the report. The industry boasts a talent pool of 12,060, making up 0.7% of the total workforce metro-wide.

“The Denver-Boulder area continues to solidify itself as a rising life sciences hub,” said Erik Abrahamson, a senior vice president at CBRE in Boulder. “Our metro has not only maintained its momentum but has also become increasingly attractive to manufacturers seeking cost-effective, high-quality talent.”

Among all graduates, 2,103 degrees in biological and biomedical sciences were completed in Denver-Boulder in 2023, 3.9% of the total degrees completed that year in the area. The University of Colorado Boulder awarded the highest number of degrees, followed by the University of Colorado Denver/Anschutz Medical Campus and the University of Denver. Of the biological and biomedical science degrees awarded in the area in 2023, 79% were in specialty disciplines, one of the highest specialty ratios among the measured markets.

Nationally, life sciences employment reached a record 2.1 million people in March but then posted a 0.4% decline (nearly 9,000 jobs) in April. Multiple factors have hindered the sector in the past three years, including falloffs in venture capital funding and initial public offerings, subsequent layoffs and, this year, cuts in federal research spending. The unemployment rate for life sciences professions nearly doubled in the past year to 3.1% in comparison to the overall U.S. rate of 3.9%.

“The underlying science of the life sciences sector—drug development—is strong,” said Matt Gardner, CBRE Americas Life Sciences leader. “We’re dealing with a tough environment for funding, and the outlook for the sector’s job growth currently is fragile. But the foundation is in place for further growth once the sector’s challenges are surpassed.”

The sector has more than enough space to accommodate its workforce. Robust building in recent years contributed to the average vacancy rate climbing to 21.4% in this year’s first quarter from a recent low of 5% in Q2 2022. A decline in construction activity will provide some relief; In-progress construction fell to 8 million sq. ft. in the first quarter from more than 35 million two years prior.

Research & Development

Core life sciences R&D jobs include biochemists, biophysicists, bioengineers, biomedical engineers, biological scientists and biological technicians. The subsector’s biggest riser this year is Houston, which climbed three spots to No. 10.

Denver-Boulder ranks No. 11 in research and development talent with 12,450 total occupations, remaining steady year-over-year.

Manufacturing

Boston-Cambridge leapfrogged New York-New Jersey for the top ranking in life sciences manufacturing this year after Boston posted a greater gain in biological and chemical technicians. Gains in these professions give Boston an edge in more sophisticated biomanufacturing talent, whereas New York-New Jersey has an advantage in talent for high-volume pharmaceutical manufacturing.

The biggest gainer in this year’s manufacturing rankings was Denver-Boulder, which climbed seven spots from No. 16 to No. 9.

Medtech

The medtech subsector encompasses designing and producing medical devices. CBRE determined its medtech rankings by assessing markets for certain occupations within engineering, biological, medical and tech disciplines. This year’s biggest gainer is Washington, DC-Baltimore, which climbed two spots to No. 9.

Denver-Boulder ranked No. 21 in medtech with 13,450 occupations, moving down three places from 2024.

To read the full report, click here.