CBRE has released Q4 2025 office figures for Denver’s Downtown and Southeast office markets specifically.

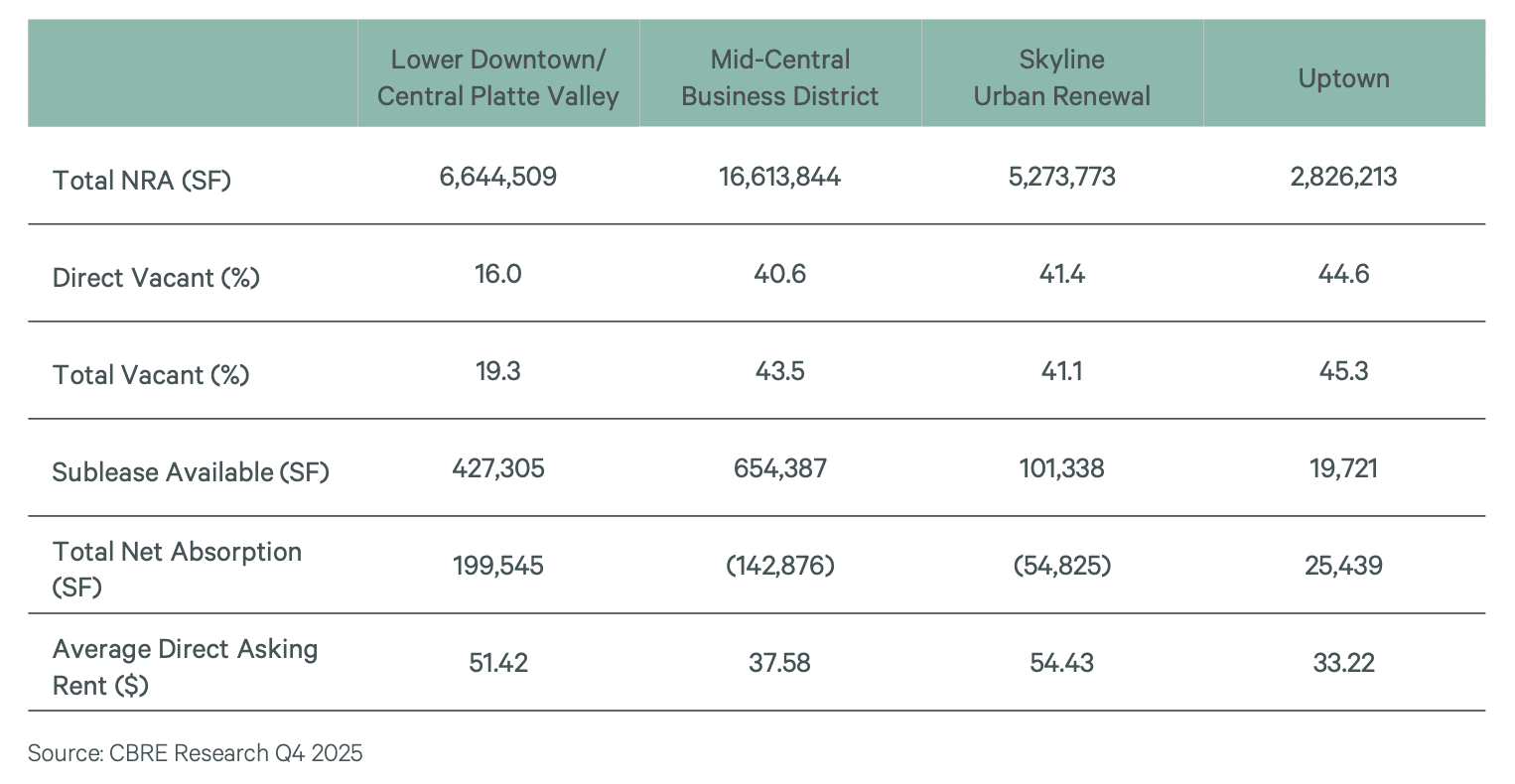

Denver Downtown Office Figures Q4 2025

Downtown’s market fundamentals trended closer to stabilization to end 2025, with vacancy remaining nearly flat and net absorption only slightly negative. Expectations of a gradual demand recovery in 2026, combined with the pause in new development and removal of several largely vacant buildings planned for conversion, will allow for vacancy rates to further stabilize.

- Total vacancy rose just 10 basis points in Q4 2025 to 38.2%.

- Sublease availability declined for the seventh straight quarter and was down 30.0% on the year, signaling increased company alignment on in-office attendance and space needs.

- Investment sales totaled $391 million in 2025, a strong improvement on the $137 million recorded in 2024.

- The development pipeline remained stagnant, with no new projects having broken ground for the third consecutive year. More distressed and high-vacancy buildings are being targeted for multifamily conversion, with three projects having recently received special loans from the Downtown Development Authority.

Denver Southeast Office Figures Q4 2025

Net absorption turned positive for the first time in two years in Q4 2025, driving a moderate decline in vacancy and indicating signs of an emerging recovery but demand-side fundamentals are still demonstrating some volatility through the lens of leasing activity.

- Net absorption amounted to positive 142,000 sq. ft. in Q4 2025, a shift from seven straight quarters of negative absorption.

- Total vacancy declined 40 basis points in Q4 2025 and posted a slight increase of just 80 basis points year-over-year.

- Sublease availability declined 152,000 sq. ft. in Q4 2025, falling to 1.7 million sq. ft.

- The submarket’s construction pipeline remained at a standstill, with the trend unlikely to change in 2026, given persistent softer demand among larger users that necessitates preleasing along with elevated construction and capital costs.