CBRE has released its Q2 2025 industrial figures for metro Denver:

- The Denver metro industrial market began to face some turbulence in the second quarter of 2025 as total net absorption achieved positive 79,600 sq. ft., well below the five-year historical quarterly average of 1.3 million sq. ft.

- Industrial sales volume in Q2 2025 saw a significant increase compared to the previous quarter, rising 67.0% to reach $717.0 million. This marked the highest quarterly total since Q2 2022 and a strong improvement year-over-year, jumping 113.8% compared to the $335.3 million that transacted in Q2 2024.

- The construction pipeline saw a modest decrease as 462,000 sq. ft. broke ground and 662,000 sq. ft. delivered.

- The overall average direct asking rent reached $9.72 per sq. ft., a 1.4% increase compared to Q1 2025 and a 3.4% increase year-over-year.

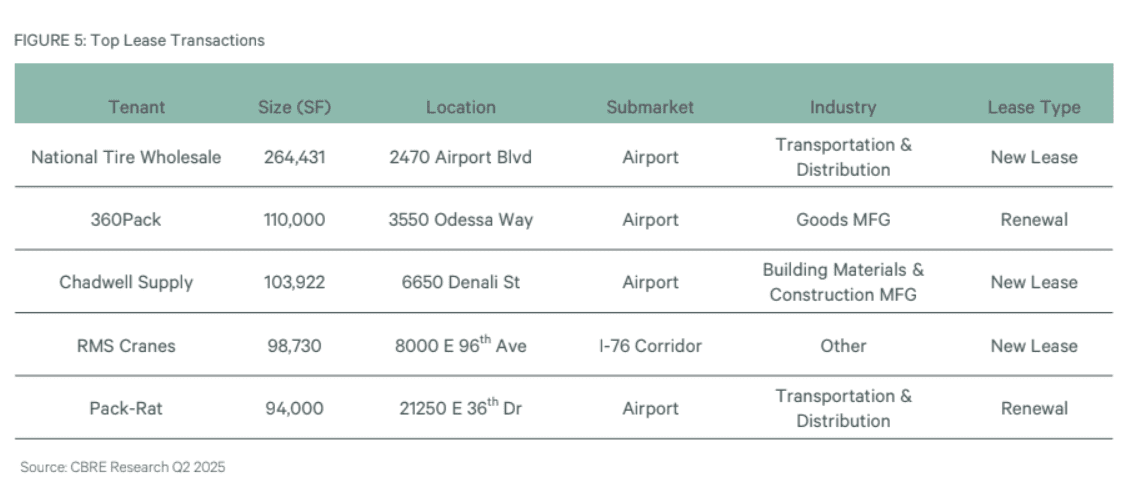

- Leasing volume in Q2 2025 totaled 2.3 million sq. ft., a 18.9% decrease compared to the previous quarter and an 11.2% decrease year-over-year.

“Investors are illustrating their belief in the industrial story with industrial sales volume in Q2 2025 totaling $717 million, the highest quarter since Q2 2022. In a way, the investment market is healthier today than it has been in years, focusing now on fundamentals instead of interest rates. The best deals are seeing great activity and the harder deals are hard (as they should be),” said Jeremy Ballenger, an executive vice president at CBRE in Denver.

To read the full report, click here.