DENVER RETAIL MARKET OVERVIEW

RAY ROSADO, CCIM, principal, Lee & Associates

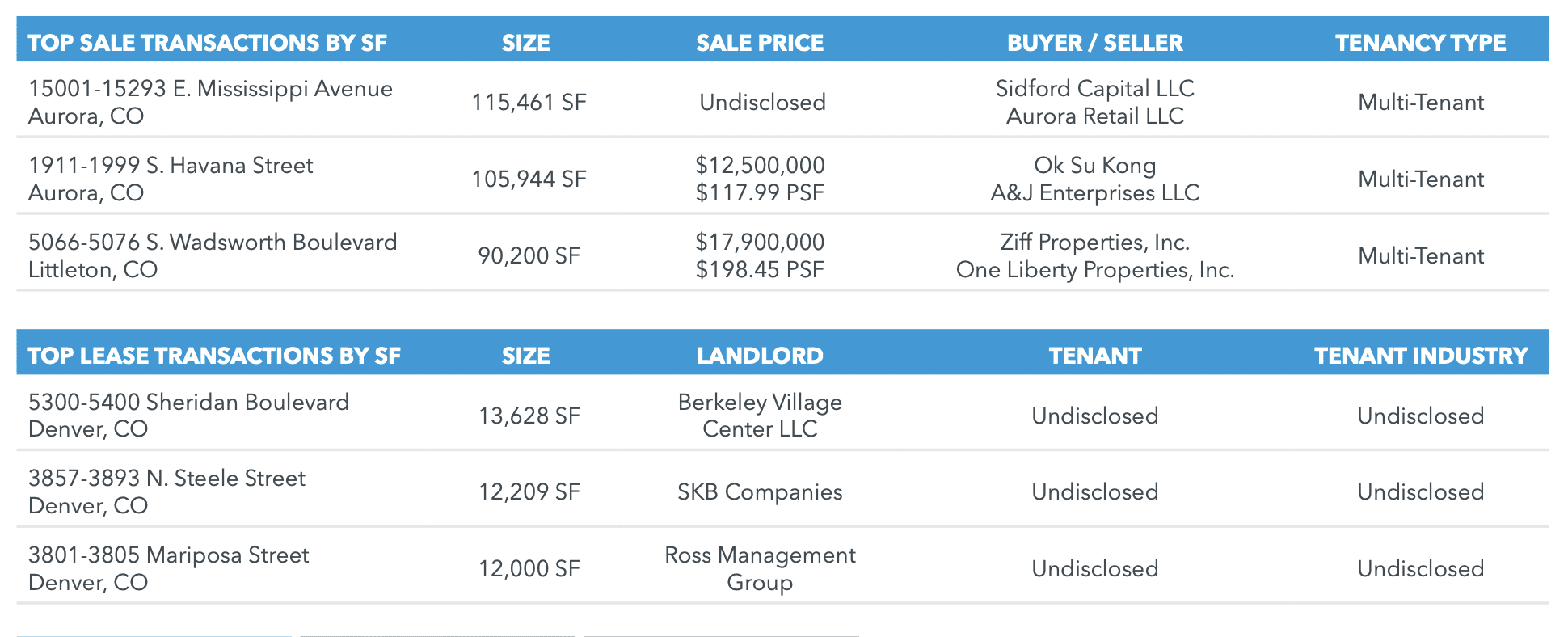

Denver’s retail market remains fundamentally strong despite a slight cooling in Q2. Vacancy rose modestly to 4.4% from 4.1% last quarter, and the market recorded negative net absorption for the first time in over a year (538,000 SF). Leasing activity remains healthy in key submarkets like Cherry Creek and RiNo, where national brands and experience-driven retailers continue to seek space. However, elevated construction costs and broader economic uncertainty have slowed some expansion plans and delayed deal flow. Average asking rents held steady at $26.48 per square foot NNN, and construction activity remains minimal, with just 0.2% of inventory underway, most of it preleased. Investment volume is relatively muted, with private buyers continuing to dominate transactions under $5 million and cap rates inching higher. Denver’s retail market remains resilient. Fundamentals are solid and demand is expected to hold steady as economic headwinds ease.

DENVER INDUSTRIAL MARKET OVERVIEW

RON WEBERT, SIOR, principal, Lee & Associates

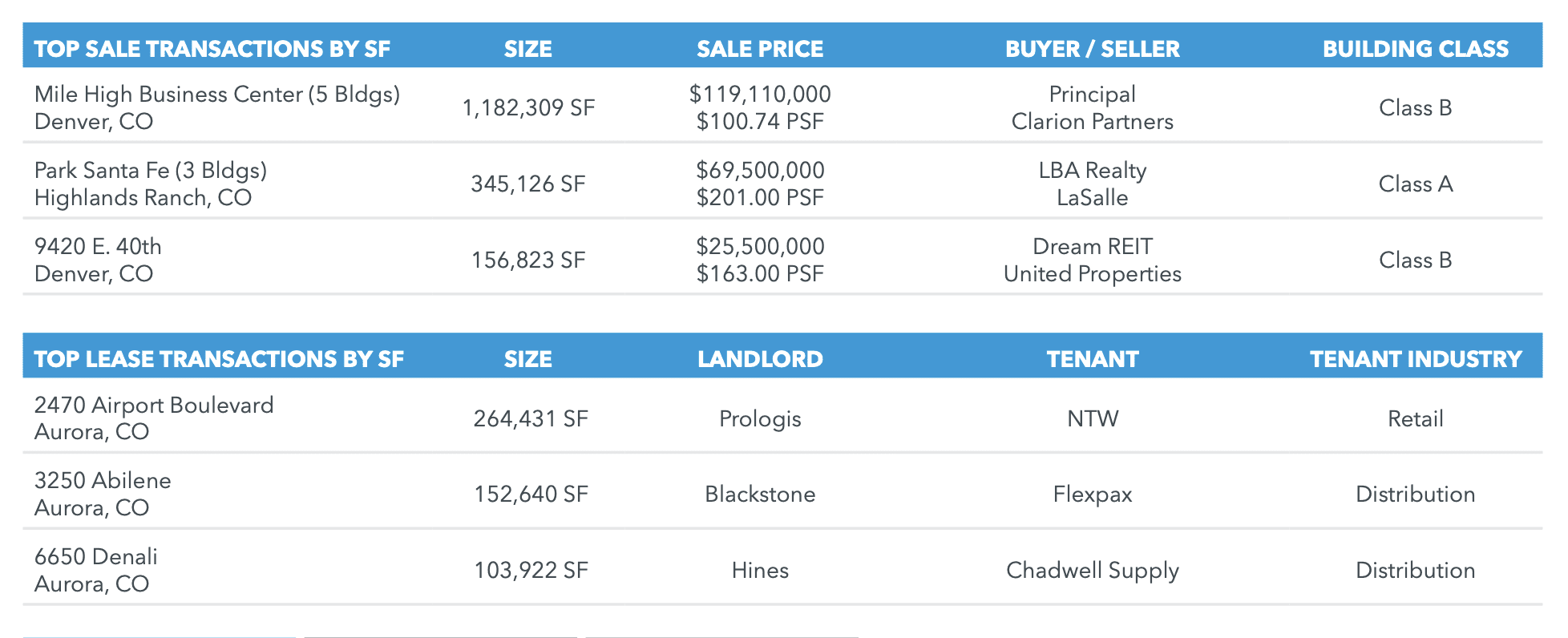

Uncertainty seems to be the term most used for today’s economic outlook. With tariff levels yet to be determined, many companies are not feeling the need to make any major adjustments in their space needs. The Denver Industrial market is fairly quiet right now, with leasing activity below average for the quarter, and only a handful of user transactions over 100,000 SF, and none surpassing 300,000 SF. We feel this will change in the coming quarters as there are a few large requirements making their way to the finish line that may help improve the metrics. On a positive note, sales volume is up and consistent despite no softening in the interest rates. Look for Landlords to get very aggressive to land the quality deals as we move into the latter half of the year.

To read the full report, CLICK HERE.