Marcus & Millichap has released a Research Brief on the federal government shutdown, which began on October 1, 2025. According to its analysis, the commercial real estate (CRE) sector is expected to experience minimal direct impacts in the short term, but potential risks could arise if the shutdown is prolonged.

Potential economic fallout:

- Reduced GDP growth: Each week the shutdown continues could reduce U.S. GDP growth by 15 to 20 basis points. However, most of this lost growth is typically recovered after the government reopens.

- Data disruption: The shutdown is delaying the release of crucial economic data, including reports on employment and consumer prices from agencies like the Bureau of Labor Statistics (BLS). This creates uncertainty for investors and policymakers, who will have to rely on alternative data sources.

- Minimal immediate CRE impact: Past shutdowns have shown that the long-term effects on commercial real estate are limited. The biggest short-term risk to the CRE market comes from potential declines in consumer and business confidence, which could impact spending and property sales.

- Federal Reserve action: Despite the interruption to data, the Federal Reserve is still expected to move forward with monetary policy decisions. The potential for future rate cuts remains a possibility.

Key takeaways from the brief:

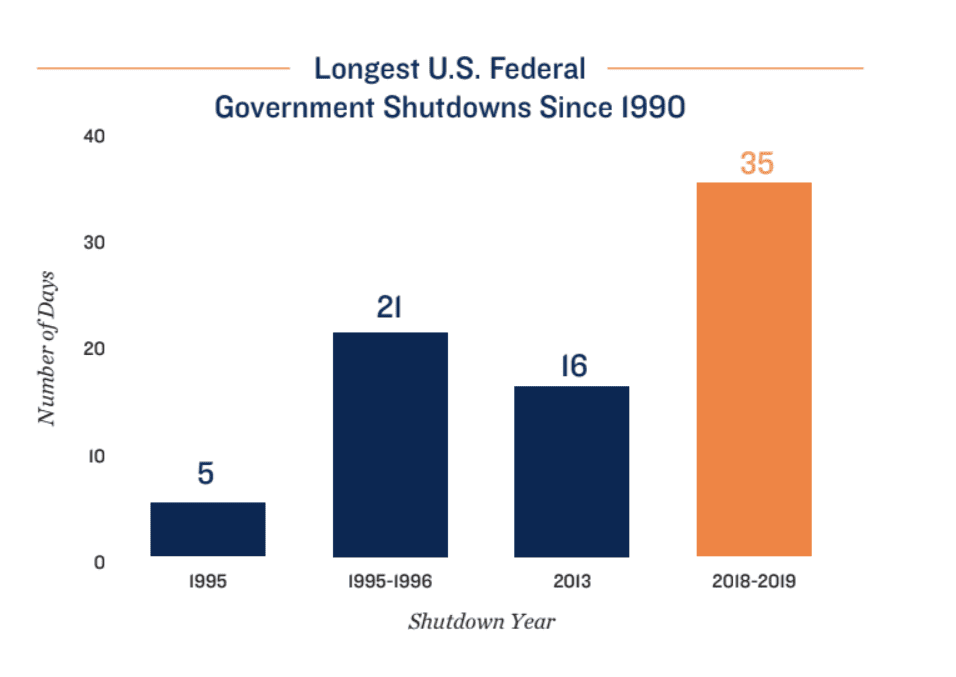

- Comparison to past events: The 2025 shutdown is more similar to the full closure in 2013 than the partial 2018–2019 shutdown. The 2013 event led to the furlough of 850,000 workers and a notable loss of GDP, but much of that economic activity was later recovered.

- Direct vs. indirect effects: Marcus & Millichap highlighted that the indirect, market-driven effects of the shutdown are the main concern for the commercial real estate sector. The direct effects are expected to be contained.

- Worker furloughs: An estimated 550,000 to 750,000 government employees are expected to be furloughed.

What this means for commercial real estate:

While the immediate fallout is expected to be minimal, Marcus & Millichap warns that a longer-term closure could weaken employment prospects and negatively affect:

- Household formation

- Consumer spending

- Home sales