By Frank Swain, originations leader, PACE Equity

The commercial real estate sector entered 2025 under considerable pressure. Elevated interest rates, a volatile market, tighter underwriting, and a looming $1 trillion debt-maturity wall contributed to a year that required strategic planning. New development also pulled back as borrowing costs climbed and traditional capital sources tightened. Rather than accept expensive short-term bridge solutions, many developers began turning to C-PACE (Commercial Property Assessed Clean Energy) financing as a strategic, lower-cost alternative to recapitalize projects and extend runway in a constrained credit environment.

The Value of C-PACE Financing

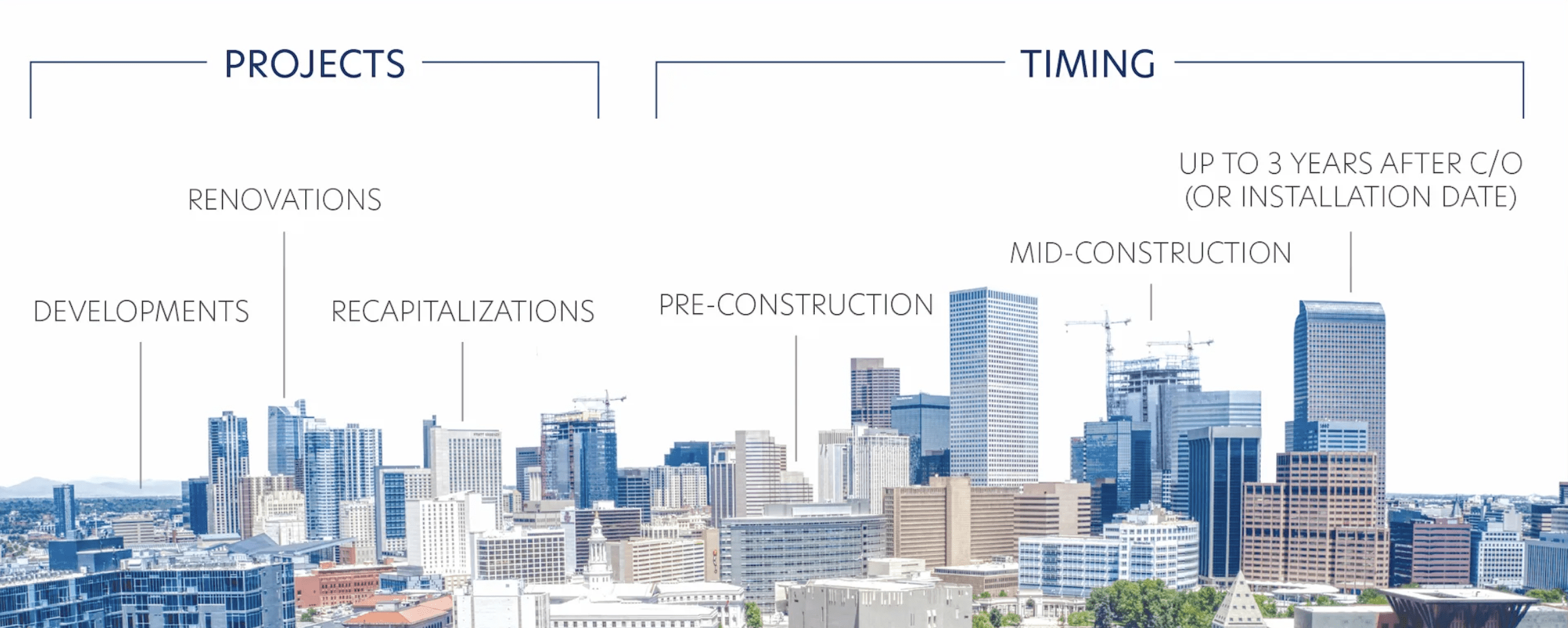

While C-PACE financing has become widely recognized for financing energy-efficient upgrades and renewable energy building improvements, today more developers are moving to C-PACE financing to recapitalize existing developments and leverage its flexible nature across the building lifecycle.

C-PACE financing is available in 40 states with total lending volume approaching $10 billion at the end of 2025. The industry is expected to continue its explosive growth as more and more developers use C-PACE financing as both a mainstream financing solution for large projects and as a way to recapture equity, replace high-cost debt, and take advantage of deferred payments, even during a lengthy lease-up period.

C-PACE financing offers developers fixed-rate capital with terms of up to 30 years. This provides a compelling alternative to expensive mezzanine debt, private credit funds, and outside equity. With non-recourse structures that reduce personal risk and improvements that lift NOI and property value, C-PACE is more than an energy-upgrade tool because it is earning its place as a balance-sheet strategy. As market pressures persist, these advantages position C-PACE as playing a more central role in recapitalizing existing assets and reshaping capital stacks.

A Focus on Recapitalization Moving Forward

In the challenging CRE environment we see today, with the costs of labor and construction materials rising, there has not been the same volume and momentum with new construction projects. Instead, developers are taking advantage where they see opportunities with existing assets and are choosing to recapitalize with C-PACE.

In Denver, for example, we’ve seen multifamily rent prices drop 10-11%; something we haven’t seen for decades. Due to this drop coupled with record-setting concessions, buildings are not hitting pro forma, creating a difficult spot for multi-family asset managers. C-PACE financing is a way to recapitalize said assets and give them more time to lease up and stabilize cash flow.

Mountain Resort: A Model for Larger C-PACE Loans

One positive area for development moving forward has been the investment in mountain towns. The West Slope of Colorado continues to see steady investments. and I anticipate areas like Summit and Routt counties along with the Springs will see an uptick in volume, not only with C-PACE financing transactions but commercial real estate as a whole.

Just outside Colorado, in Deer Valley, Utah, PACE Equity recently financed its largest C-PACE project to date in the SkyRidge Resort, a premier luxury hospitality and mixed-use development. PACE Equity funded $63.3 million in fixed-rate C-PACE financing for the development, which is anchored by the six-story luxury resort, theStelle Lodge.

The SkyRidge Resort highlights the flexibility and low-cost nature of C-PACE financing. The developer liked that they didn’t have to seek out complicated bank financing and instead saw a lower cost and fixed-rate with the C-PACE loan.

C-PACE financing covered an impressive 41.63% of the resort’s total loan-to-cost, which enabled the resort’s development team to complete key improvements to the golf course, lodge, and clubhouse without relying on high-cost bridge loans.

The development also qualified for PACE Equity’s proprietary CIRRUS Low Carbon verification, which offers a lower rate of financing to developers pursuing a low-carbon building design. The SkyRidge Resort incorporated high-performance upgrades to the building envelope, electrical systems, HVAC, lighting, and plumbing.

The SkyRidge Resort project also signals a notable shift in the market: the emergence of significantly larger C-PACE transactions. It demonstrates how C-PACE capital has evolved far beyond mid-market, independently-developed projects and is now being deployed at an institutional scale, attracting sophisticated developers and supporting complex, high-value assets.

Signals and Forecasting 2026

Many of the pressures that defined the commercial real estate market in 2025 are expected to persist into 2026. Developers will continue to face market volatility and elevated interest rates, but early signals suggest a gradual normalization in capital markets. As stability returns, new construction activity is projected to begin a measured recovery.

C-PACE financing will continue to be utilized in three specific ways: rich capital for new construction, hybrid models like the adaptive reuse of aging office developments, and perhaps the most prominent, bridging the gap in a capital stack with recapitalization.

In this volatile and rapidly evolving real estate market, developers and property owners are turning to C-PACE financing as a strategic tool to restructure debt, resulting in both improvements in short-term economics and long-term capital management.

Across every stage of the development cycle, from pre-construction, mid-construction, to lease-up and stabilization, we see the future of C-PACE financing as one that offers a competitive edge in financial structuring.