GoDocs, the automation leader in commercial loan document generation, released its 7 Facts: How Federal Interest Rate Increases Affect CRE Multifamily Infographic, which provides a visual guide to quickly understand how changing interest rates may or may not affect the commercial multifamily housing lending landscape.

The easily digestible infographic not only provides more context for the CRE multifamily housing market but also breaks everything down into real numbers. That is why this infographic is a valuable resource for anyone with an interest in, or ties to, commercial multifamily housing lending and development.

“Any changes in the market can create anxiety, but it is important to put things in perspective before reacting. That is why we have used our resources and expertise to take a deep dive into what an interest rate hike means for commercial multifamily lenders,” said GoDocs CEO Steve Butler. “If you take a look at trends and statistics, it is clear that a nominal increase in interest rates will not significantly slow commercial multifamily housing development projects, especially when considering the need and demand for such housing solutions that we have today.”

Fact #1 Rent Rates Stay Strong

Despite this latest hike in rates, interest rates still remain at a historic low overall, which is expected to continue to spur growth. Experts at the National Apartment Association are predicting that rent rates will stay strong and even reach record-breaking levels, which means that the demand for commercial multifamily lending will also keep steady.

The pandemic certainly highlighted the need for affordable housing and investors and lenders have been leading the charge to find solutions. While the government has been working on various programs and initiatives that would address the shortage, bureaucracy moves slowly and the U.S. is still about 7 million short of rental homes.

Fact #2 Workforce Apartment Communities Attract Strong Demand in 2022

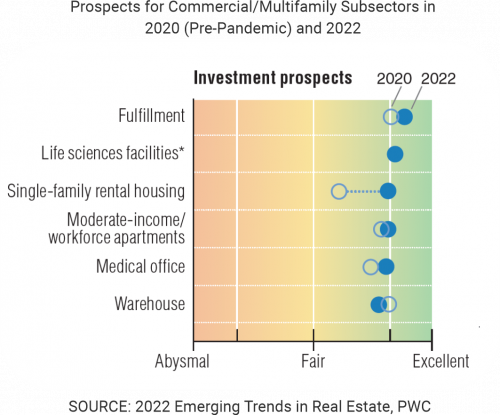

According to the “Emerging Trends in Real Estate” survey, workforce housing is on track to be one of the most performant prospects for investors. Workforce housing is and will continue to rate as an ‘excellent’ prospect in the years to come.

Fact #3 Impressive Workforce Housing Performance Since 2010

The performance of workforce housing has been no less impressive when viewed historically since the Great Recession, consistently tracking higher than low- and high-income apartments and single-family rentals.

Fact #4 Repurposing Vacant Office Space for Workforce Housing

One interesting category folded into the larger category of workforce housing? Vacant office space that has been repurposed for workforce housing. According to Yardi Matrix, 41 percent of the 32,000 legacy buildings that were renovated into residential spaces between 2020 and 2022 were originally office spaces. With office vacancies spiking by over 12 percent in the start of 2022, this subcategory may offer even more opportunities and sustain the momentum of workforce housing moving forward.

Fact #5 Top-Performing Lenders Experience Growth

The health of the multifamily housing market is certainly reflected in the lending space, as well. Top-performing lenders are reporting sustained growth in multifamily lending.

Fact #6 Bridge Loans are Effective at Times Like This

Those who want to take advantage of the wealth of opportunity in this space can benefit from considering bridge loans. These products are an ideal answer for financing rehabs on existing real estate, such as retail or office spaces that can be converted into affordable or workforce housing rentals. A bridge loan serves as a short-term real estate financing solution, providing an influx of cash for borrowers seeking to sell newly-rehabilitated income-producing properties. With bridge loans, developers can get units rented expeditiously to enjoy a greater return by benefiting from the higher rents happening now — even in affordable housing scenarios.

Fact #7 Digital Technology Balancing Act

Any slowdown in the multifamily sector is simply a natural balancing out after such a record-breaking 2021. While increasing interest rates are bound to have some effect on lending practices and development across all real estate sectors, multifamily lending and development will remain strong for the rest of 2022, and GoDocs users will be able to handle significantly higher loan volume and keep pace with demand.

Download the infographic HERE