According to CBRE’s Q1 reports, the downtown Denver office market experienced subdued demand in Q1 driving slow leasing velocity and another moderate rise in vacancy. The Southeast Denver office market fundamentals remained stable, while investment sales and development hit zero.

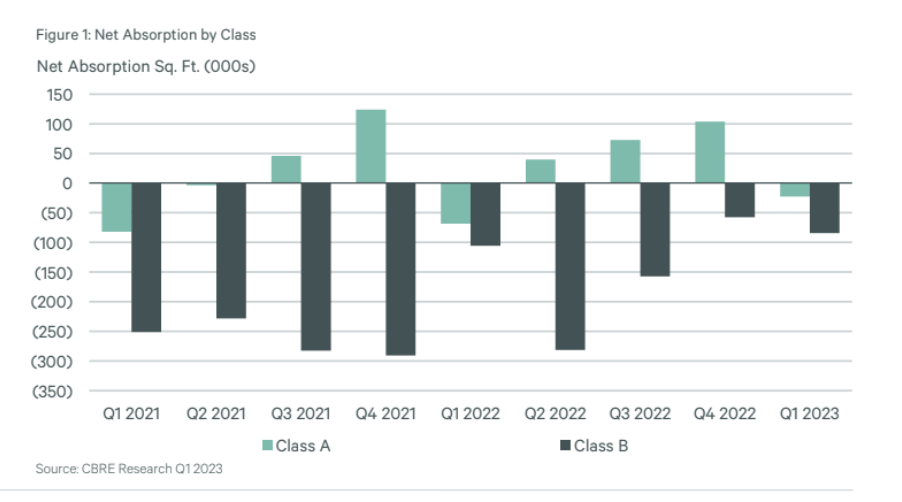

- Negative 97,300 sq. ft. of direct net absorption was recorded in Q1 2023, a year-over-year improvement from the negative 204,500 sq. ft. recorded in Q1 2022.

- Sublease availability reached a new peak for the third consecutive quarter, increasing 50.3% year-over-year to 2.3 million sq. ft.

- Leasing activity slowed in Q1 2023 with 141,300 sq. ft. transacted, marking a 53.7% decrease from the prior quarter and a decrease of 70.7% year-over-year.

- The average direct asking lease rate recorded a 1.1% annual dip to $39.42 per sq. ft. FSG.

- Total and direct vacancy remained elevated, increasing 330 bps and 210 bps year-over-year to 28.3% and 23.9%, respectively.

- 1900 Lawrence remains the sole property under construction, keeping the development pipeline static at 704,000 sq. ft.

- Positive 108,000 sq. ft. of direct net absorption was posted in Q1 2023, the second consecutive quarter of growth for the submarket. The lack of any large move-outs was the catalyst to net absorption remaining positive.

- After the completion of Vectra Bank’s headquarters in Q4 2022, the office development pipeline has been tepid. Currently there are no projects under construction.

- Leasing activity decreased 8.4% quarter-over-quarter to 270,000 sq. ft., with Class A properties receiving 81.6% of total activity.

- Sublease availability increased 12.1% quarter-over-quarter to 2.1 million sq. ft., as multiple large blocks of additional space hit the market.

- Total vacancy dropped 50 bps to 18.3% and direct vacancy declined 30 bps to 15.4%.

- The average direct asking lease rate dropped slightly, decreasing 0.2% quarter-over-quarter to $27.92 per sq. ft. FSG.