Global real estate advisory firm, Avison Young, has been tapped to exclusively market The Crags Resort. This historic mountain getaway opened in 1914 and is located at 300 Riverside Drive in Estes Park. Perched above Estes Park and overlooking Rocky Mountain National Park, the four-acre, 33-room property is now available for acquisition-revitalization under the newly enhanced Opportunity Zone program created by the One Big Beautiful Bill that was signed into law July 4, 2025.

The Avison Young team responsible for marketing the project includes Senior Hospitality Brokers, Chris Kilcullen and Thierry Roch.

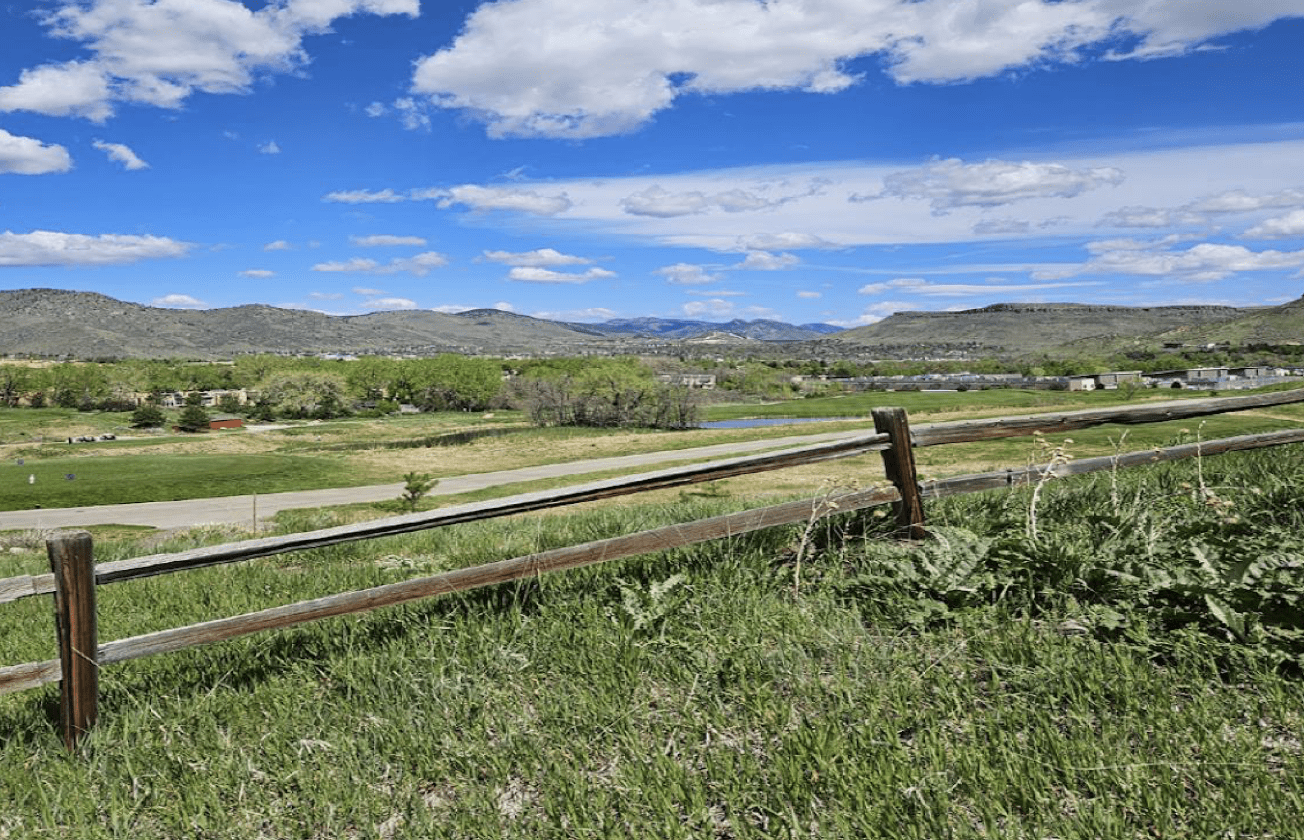

The Crags Resort is a stone-and-timber gem featuring 33 kitchen-equipped units (27 currently ready to open), a spectacular dining room with a full kitchen, multiple stone fireplaces, and towering mountain views overlooking downtown Estes Park, The Stanley Hotel and the Lake Estes.

“This currently closed property was used as a timeshare for many years and offers a new investor fresh lodging supply in a tight market,” said Kilcullen. “This is a unique opportunity on a four-acre site to add more lodging, parking, venue space, and other amenities, as well as enjoy the potential to add value and capture both tax credits and tax-free gains.”

He added that the recent conversion of Fall River Village to affordable housing underscores a gap in upper-upscale wedding and events and group accommodations — one Crags is poised to fill.

“Estes Park draws more than four million annual visitors, and that number is anticipated to grow over the coming years,” said Roch. “The Crags Resort stands ready to capitalize on growing demand. Under new ownership from a qualified developer or hospitality operator, the property can re-open immediately, offering near-term income while redevelopment plans are executed.”

This landmark legislation from the Big Beautiful Bill institutionalizes Opportunity Zones, offering permanent capital gains deferral and tax-free appreciation after 10 years, with a 30% basis step-up after five years and reduced improvement thresholds from 100% to 50% for rural qualified funds. The property is also eligible for federal and state historic rehabilitation tax credits and additional OZ incentives that can defer and even permanently eliminate capital gains.