By David Henry, Namaste Solar

The “One Big Beautiful Bill” (OBBB) was signed into law July 2025 and represents a significant shift in American energy policy. The Treasury Department also released rules to clarify some of the language in the bill. These changes accelerated the step-down of tax credits, thus increasing the importance of safe harboring solar projects. Now is the time to capture the most savings potential with commercial solar to reduce your operating expenses and increase NOI.

Because building a commercial solar project typically takes a considerable amount of time, now is the time to safe harbor these projects. Safe harboring is a provision of tax law which allows customers to preserve the tax credit for a given year, even if construction of the system isn’t completed or the system isn’t in service.

To help you unravel the bill and additional rules, we’ve dug into the details to bring you the key changes you need to know about.

Please note that Namaste Solar is not a tax advisor and always recommends that you consult with your tax counsel to confirm how the specifics of any IRS provisions including safe harbor, apply to your organization’s tax scenario.

Key Points to Safe Harbor Solar for Commercial:

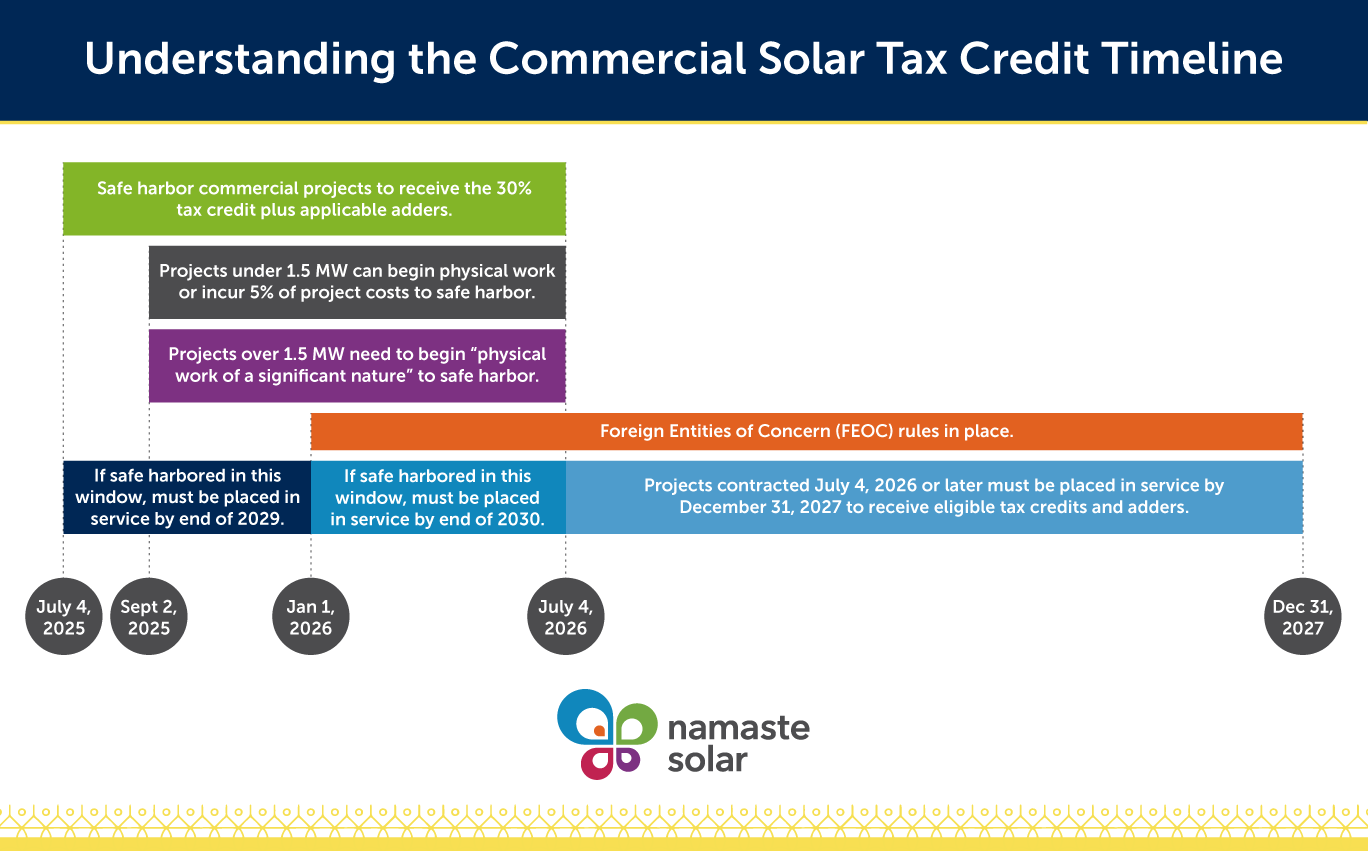

- To secure the 30% tax credit, your project must be safe harbored by July 4, 2026.

- Solar projects under 1.5 MW can either begin “physical work of a significant nature” or incur 5% of the project’s cost to secure safe harbor. Project over 1.5 MW need to begin “physical work of a significant nature” to achieve safe harbor.

- On January 1, 2026, Foreign Entities of Concern (FEOC) rules will go into effect. The IRS is anticipated to release rules on FEOC in 2026.

- Based on the date your solar project is safe harbored or contracted, there are requirements for when the project must be placed in service.

How does Safe Harboring Solar work?

There are two ways to safe harbor solar for commercial properties. You can either incur 5% of the total project cost or begin physical work of a significant nature.

The five percent safe harbor test requires at least 5% of the price to be incurred on qualifying equipment such as solar modules, racking, or inverters. Namaste Solar generally recommends 10% of the projects cost to be sure safe harbor is achieved. For example, if a project’s scope or costs increases after the initial design or quote, you want to make sure it won’t affect your ability to qualify for the 30% tax credit.

The physical work test may include “off-site” or “on-site” work. Off-site work may include the manufacture of components, mounting equipment, support structures such (i.e. racking and rail systems), inverters and transformers and other power conditioning equipment. On-site work may include the installation of racking and other structures for PV module mounting. In addition, there is a continuity requirement to physical work, meaning the work must be continuous from start to finish.

Under the new rules, projects greater than 1.5 MW are required to use the physical work test to qualify for safe harbor between September 2, 2025, and July 4, 2026. Projects less than 1.5 MW can use either the physical work test or the 5% rule to qualify for safe harbor during that same time period.

Safe Harbor, Solar, and FEOC Rules

An additional layer to all this are the new Foreign Entities of Concern (FEOC) restrictions that were put in place by the OBBB. These new rules begin on January 1st, 2026 and will impact any solar project not safe harbored at that time.

The IRS is anticipated to release rules on FEOC in 2026. We’ll continue to provide updated information to you as it becomes available.

While we have highlighted significant changes to the commercial solar landscape, commercial solar will continue to provide great value while lowering operating expenses and boasting a strong ROI.

To learn more about safe harboring your commercial solar project, give Namaste Solar a call at 303-536-8920 or visit us at namastesolar.com/business.

About the author: Since joining Namaste Solar in 2007, David Henry has played an instrumental role in establishing Namaste Solar’s Commercial Solar and Operations & Maintenance programs, as well as developing notable solar projects with key clients, including the National Renewable Energy Laboratory, Denver Public Schools, and New Belgium Brewing, among others. Additionally, David has served in a multitude of roles for the company, including as general manager, director of commercial sales, director of operations and maintenance, and has served on the Namaste Solar Board of Directors as both a board member and as board chair. David is currently focused on commercial business development efforts for Namaste Solar’s worker-owned cooperative and utilizes his deep and lengthy industry experience to support clients in navigating the intricacies of implementing solar PV projects to achieve their renewable energy goals.