International property and construction consultancy firm Rider Levett Bucknall (RLB) has released its Quarterly Cost Report, providing an on-the-ground picture of construction activity in 14 key North American markets and data-driven insights into the industry for the third quarter of 2025.

In today’s dynamic AEC environment, owners are facing a fast-evolving mix of innovation, shifting costs, and rising expectations. While national construction figures suggest stability, local pressures—like persistent labor shortages and the surge in mega-projects—reveal underlying shifts shaping the industry’s future.

“Owners today face an AEC landscape defined by volatility, rapid innovation, and rising expectations. The projects that succeed will be those that are managed not just for delivery—but for resilience, efficiency, and my recommendation is for owners to future-proof their investments through proactive cost forecasting, disciplined project management, and integration of technology and sustainability strategies. By treating budgets as living frameworks, applying consistent project delivery standards across portfolios, and linking sustainability decisions to long-term ROI, our industry will be able to move beyond reacting to today’s market into shaping tomorrow’s opportunities.” – Paul Brussow, president, RLB North America.

Central Region

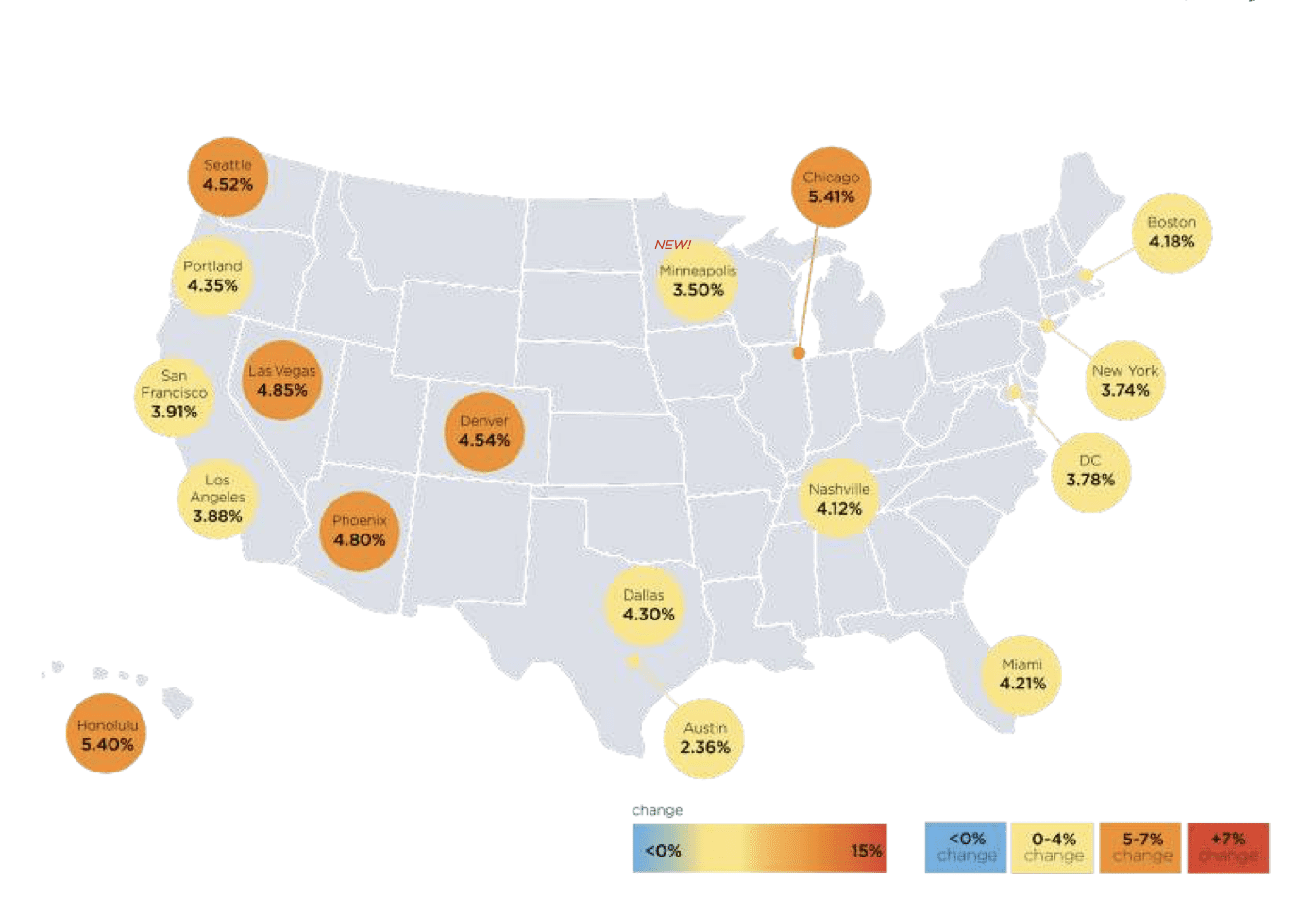

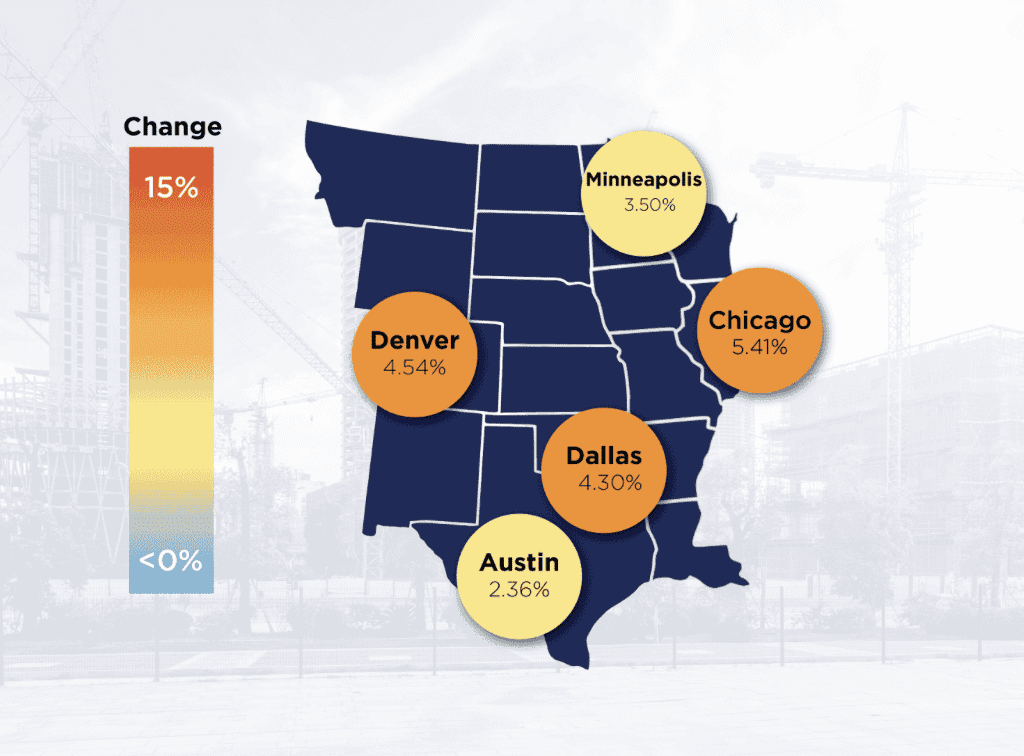

The Central U.S. region experienced an average year-over-year construction cost increase of 4.02% (below the national average of 4.50%). These cities include Austin (2.36%), Chicago (5.41%), Dallas (4.30%), Denver (4.54%), and Minneapolis (3.50%).

A shared focus on innovation, resilience, and strategic adaptation defines construction activity across the Central region. These cities are embracing technology at scale, with AI, BIM, drones, and CRM platforms becoming essential tools for improving project efficiency and managing risk. Sustainability is no longer optional—energy-efficient systems, LEED certification, and smart infrastructure are now standard features in both new builds and adaptive reuse projects.

Despite strong backlogs and steady investment, the industry faces persistent risks. Labor shortages continue to challenge project timelines, driven by workforce aging and immigration enforcement. Rising tariffs on key materials like steel and copper are inflating costs, while long lead times and municipal delays are straining supply chains.

Economic momentum is fueled by federal infrastructure funding, particularly through the One Big Beautiful Bill Act (OBBBA), which is accelerating industrial and public-sector projects. Population growth in cities like Austin and Denver is driving demand for housing and mixed-use developments, while Chicago and Dallas are seeing steady expansion in healthcare and industrial sectors.

Read the full report here.