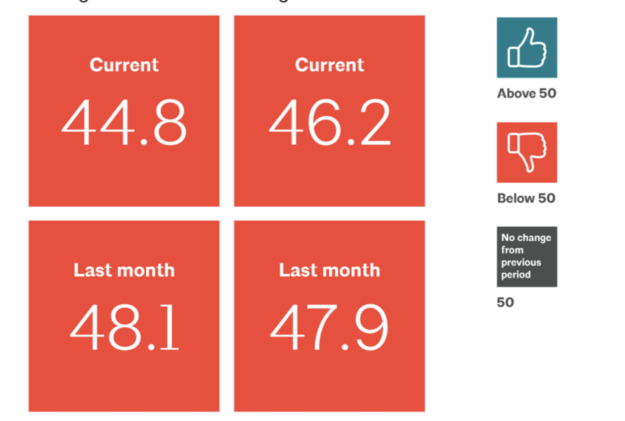

Business conditions at architecture firms declined again in September, the AIA/Deltek Architecture Billings Index (ABI) reports. The score of 44.8 for September is the lowest score reported since December 2020 during the height of the pandemic. Any score below 50.0 indicates decreasing business conditions and this score indicates a significant increase in firms reporting declining billings.

“The September ABI score reflects a marked downturn in business conditions at architecture firms, with the sharpest decline observed since the peak of the pandemic,” said Kermit Baker, PhD, AIA Chief Economist. “While more firms are reporting a decrease in billings, the report also shows the hesitance among clients to commit to new projects with a slump in newly signed design contracts. As a result, backlogs at architecture firms fell to 6.5 months on average in the third quarter, their lowest level since the fourth quarter of 2021.”

It’s clear that all regions of the country are feeling this impact, with firms in the West continuing to face particularly challenging conditions. Only one sector, firms with an institutional specialization, remained flat while all other sectors reported declining billings. Firms with a multifamily residential specialization saw more decline, a continuation of month over month declines since August 2022.

The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the billings from the previous month.

Key ABI highlights for September include:

- Regional averages: Northeast (46.4); South (46.2); Midwest (49.3); West (44.3)

- Sector index breakdown: commercial/industrial (45.0); institutional (50.1); mixed practice (firms that do not have at least half of their billings in any one other category) (46.2); multifamily residential (43.5)

- Project inquiries index: 53.7

- Design contracts index: 46.2

The regional and sector categories are calculated as three-month moving averages and may not always average out to the national score.

Investment groups like Wells Fargo, media outlets, firms of all sizes, and business leaders rely on this leading monthly economic indicator to assess business conditions and predict and track the market.

Visit AIA’s website for detailed information about this, and past billing index reports.