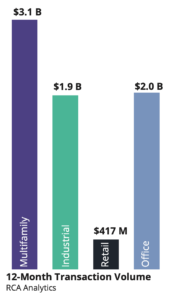

In 2020, Denver remained in the top twenty markets for total investment volume for the year ending in 3Q 2020, with large deals occurring across the sectors even amidst the pandemic. And, according to the Avison Young market forecast for Denver in 2021, Denver’s investor interest will likely persist next year, possibly rebounding to pre-pandemic figures depending on how the virus trends and how economic recovery fares as a result.

However, perhaps the biggest shift in Denver is the growth in office sublease space — up nearly 53.7 percent year-over-year as of the third quarter of 2020 — as tenants re-examine their need for a physical office space.

“While the consensus seems to be that there is still value in having an office for the purpose of fostering collaboration and culture, Denver is seeing a number of large-scale tenants reevaluating their real estate footprint as corporate America experiences a tonal shift towards a more flexible working model” — Avison Young.

“While the consensus seems to be that there is still value in having an office for the purpose of fostering collaboration and culture, Denver is seeing a number of large-scale tenants reevaluating their real estate footprint as corporate America experiences a tonal shift towards a more flexible working model” — Avison Young.

Forecast Summary

- Corporate in-migration remains largely unchanged by COVID-19 as companies continue relocating to Denver.

- Office sublease space is on the rise as tenants re-examine their need for a physical office space. The Southeast suburban office market continues to draw both foreign and out-of-state investors.

- The multifamily sector is king in Denver even as rents drop and potential loan exposure grows. Denver remained in the top four U.S. major metro markets for total absorption year-over-year through 3Q 2020 and has outpaced the national rent collection average since the start of the pandemic.

- With COVID-19’s effect on e-commerce, cold storage and “last-mile” warehouses remain in high demand with institutional investors looking to capitalize on Denver’s growth potential.

-

For retail, grocery and grocery-anchored properties have become all-important as consumer habits shift to accommodate spending more time at home, driving grocery profits and rents.

- Denver’s growth and competitive building values coupled with low interest rates continue to attract investors.

To read the full report click here