Avison Young has released its global 2020 Forecast, including ten trends to know for 2020, and national and local property market outlooks for the U.S. and around the world. The annual report series provides perspective on how global events, trends and indicators impact commercial real estate in a variety of sectors, including capital markets, office, retail, industrial, multi-family and hospitality, among others.

“Understanding economic, geopolitical and business drivers is central to how we help clients navigate the current market and prepare real estate strategies that have resilience for the future,” said Dr. Nick Axford, global head of research for Avison Young.

Among the trends impacting real estate strategies and business identified by Avison Young:

- Lower for longer: How investors are dealing with a low inflation, low interest rate world.

- Power to the people: Landlords, developers and occupiers need to pay increasing attention to local political activism, as today’s street protests increasingly signal tomorrow’s policy initiatives.

- (De)globalization: The pace of globalization is slowing, and in some areas is starting to reverse as nearshoring and the localization of supply chains gathers momentum.

- Building resilience: Cities across the world are leading the charge in responding to climate change, to ensure economic, social and environmental sustainability

- (Place)making an impact: Placemaking is becoming the focus of socially responsible investors looking for impact investment opportunities.

Denver

Following another year of sustained population and economic growth in 2019, Avison Young predicts a strong performance in the Denver commercial real estate market in 2020, with the expansion of the cannabis industry, continued tech migration from the West coast, and influx of out-of-state and foreign capital to the investment market all spelling prosperity in the new year.

- Denver’s population has grown 20 percent since 2010, with millennials accounting for 52 percent of in-migration. With a relatively young and well-educated population, Denver continues to attract new employers seeking talent.

- The number of tech companies relocating to Denver from San Francisco and the Silicon Valley have had a positive effect on both absorption and rents in the office sector. Tech companies absorbed more than 1.3 million square feet from 2018 through third quarter 2019, accounting for 35 percent of total office space absorption during that period. 2020 will undoubtedly see the tech presence grow throughout Denver, especially in the Central Business District and surrounding submarkets.

- After a period of bullish development from 2016-2018, the office development pipeline in Denver has thinned. However, the new space is seeing healthy leasing activity. As a result, vacancy is likely to continue trending down in 2020, with absorption holding steady. Like many other markets across the United States, Denver waits to see what impact WeWork’s future will have on both absorption and vacancy figures in 2020. WeWork has leased more than 606,000 sf in Denver since 2016, and 2020 will likely see landlords exhibiting more caution when negotiating with the coworking titan.

- The industrial sector in Denver remains white-hot as increased consumer demand continues to drive last-mile and logistics real estate in the progressively tight in-fill submarkets. Land in key submarkets like the E I-70/Montbello has all been snapped up and promptly developed over the last five years.

- Five years after recreational cannabis sales began in Denver, the industry continues to boom, with the focus shifting from recreational marijuana to the extraction, production, and sale of the federally legal, hemp-based CBD oil. With a broader customer base than psychoactive marijuana products, consumer demand for CBD-related products continues to drive industrial rents and property values.

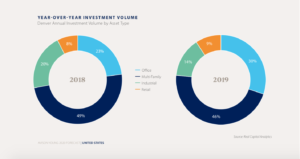

- Denver has continued to enjoy an increase in both domestic and foreign capital in 2019, a shift that will likely persist in 2020. Denver had more than $805 million in foreign investments between 2018 and 2019, a 650% increase from 2007. Given Denver’s rapid rent growth and comparably lower property costs, it remains a market in which both foreign and domestic investors can achieve favorable yields.

View the full Denver report here

Images courtesy of Avison Young