According to CBRE’s research report, Denver Office

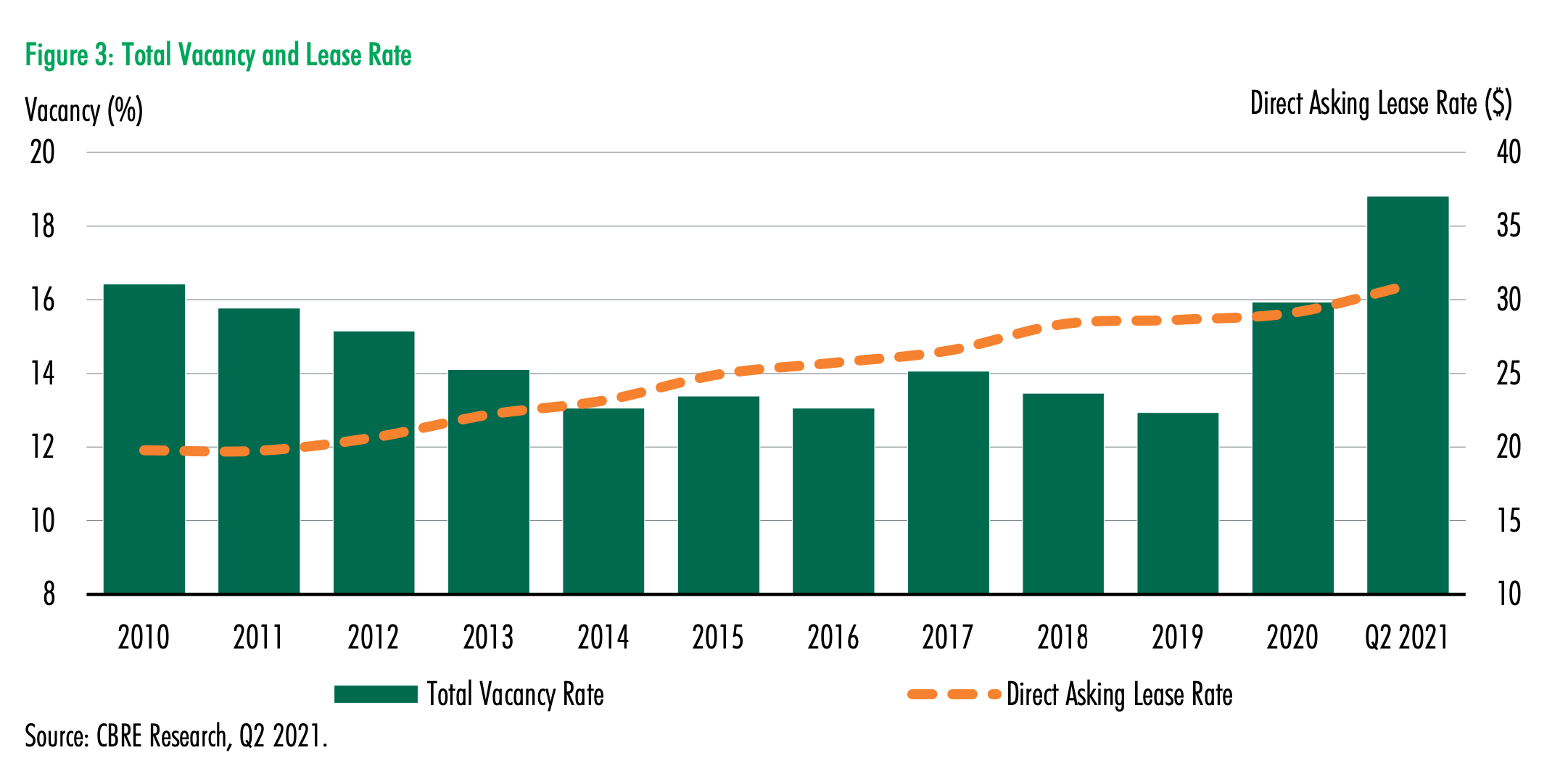

Total vacancy grew 140 basis points (bps) quarter-over-quarter to 18.8%, prompted by multiple large office properties in downtown delivering mostly vacant. Sublease available space increased, albeit marginally compared to previous quarters, as occupiers weigh their office requirement needs.

Leasing activity continued to improve, posting approximately 1.0 million sq. ft. as Denver office interest persists and competition for space picks up. The average direct asking lease rate continued upward, reaching $30.96 per sq. ft. full service gross (FSG).

Construction starts slowed as 1.3 million sq. ft. of office space was under construction during Q2 2021 and only one property broke ground. New office completions were plentiful as eight buildings delivered 1.3 million sq. ft. of new space, including Block 162, McGregor Square and Market Station in the Downtown submarket.

Highlights:

- Metro Denver posted 430,000 sq. ft. of negative net absorption in Q2 2021—the fifth straight quarter of negative

activity. - Total vacancy reached its highest level as tracked by CBRE, increasing 140 bps quarter-over-quarter to 18.8%.

- 1.3 million sq. ft. was under construction at the end of Q2 2021 with only one office property breaking ground.

- 1.3 million sq. ft. delivered in Q2 2021— notably three deliveries in downtown totaling 885,000 sq. ft.

- Investment sales activity continued its upward trajectory, posting $591 million in transaction value in Q2 2021.

- The average direct asking lease rate increased $1.55 quarter-over-quarter to $30.96 per sq. ft. FSG.

- Leasing activity totaled over 1.0 million sq. ft. for Q2 2021, up 44.4% from the previous quarter.

Read the full report here