DENVER — CBRE just released their first quarter 2018 research reports covering the office, industrial and retail sectors for the metro area. The industrial market looks exceptionally strong. Five projects delivered in Q1 2018, adding 517,547 sq. ft. of new space to the Denver industrial market. Total sales volume exceeded $400 million. Denver’s office market posted 260,889 sq. ft. of positive net absorption in Q1 2018, with occupancy of newly delivered Class A space in the Southeast submarket as the driving force. Denver retail market remains strong despite a slow start to 2018, driven by entertainment, service retail and the food and beverage sectors.

Q1 Industrial Key Points

Q1 Industrial Key Points

- Pauls portfolio sale marked Denver’s largest industrial transaction on record (1.93 MSF, 14 Class A properties).

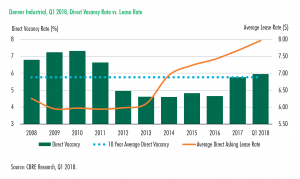

- 404,921 SF of positive net absorption was recorded, posting the 32nd straight quarter of positive net absorption.

- The overall asking lease rate rose to $7.96 PSF, up $1.77 PSF in just three years. This is a record high.

- 7 MSF of space is under construction, with the largest amounts in the North, Airport and North Central submarkets.

Q1 Office Key Points

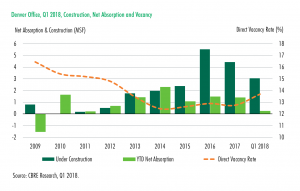

New construction and consistent demand for high quality space drove the average direct asking lease rate to a record high of $27.06 PSF, a 2.9% increase YOY.

New construction and consistent demand for high quality space drove the average direct asking lease rate to a record high of $27.06 PSF, a 2.9% increase YOY.- Development activity slowed but remained heightened with nearly 3.1 MSF under construction. Of that, 2.7 MSF are spec projects, and of those spec projects, 41% is already pre-leased.

- Nine buildings delivered in Q1, totaling over 1.6 MSF. New construction deliveries metro-wide were 61.1% pre-leased at completion. Downtown projects were 79.1% preleased and suburban projects were 35.0% pre-leased at delivery.

- Investment activity in metro Denver reached $977.9M in Q1, an 82.5% increase year-over-year, led by the partial interest sale of 1801 California in downtown Denver for $285.6M.

Q1 Retail Key Points

Q1 Retail Key Points

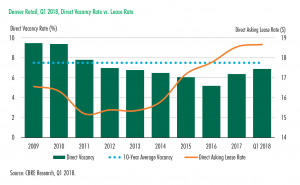

- Development continues to reshape the Denver retail landscape with current construction activity at nearly 1.6 MSF.

- Quarterly investment sales volume of $271.1 million increased significantly YOY (97.6%), due in part to investor demand for value-add properties.

- Lease rates rose to $18.68 PSF NNN and vacancy increased to 7.3%.

- Owners of retail centers will continue to diversify their tenant mix to drive traffic to centers, including discount retailers, medical clinics, chef-inspired restaurants, entertainment venues and grocery stores.