CBRE Research has released its year-end 2023 reports for metro Denver office and industrial property sectors. The office market closed out a tumultuous 2023 with a calm quarter. Robust demand for industrial product tightened availability, while large deliveries pushed annual absorption to just under 5.0 msf.

Metro Denver OFFICE Q4 2023 Takeaways

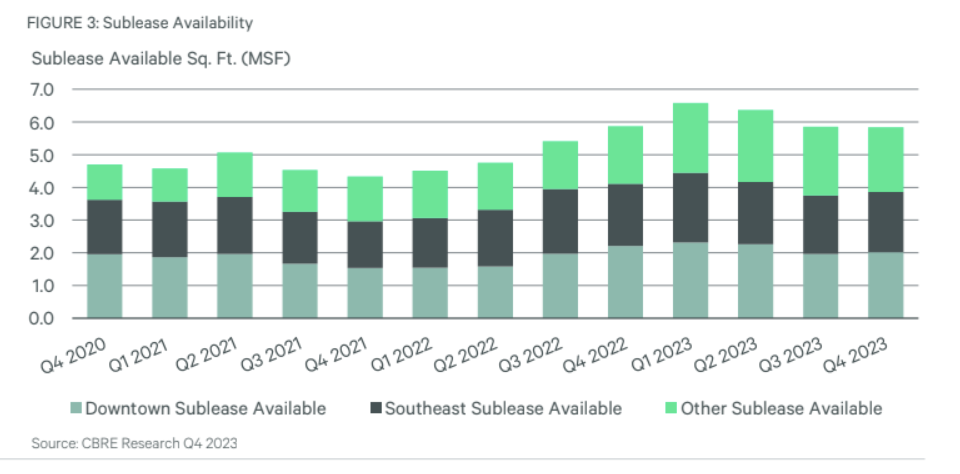

- Sublease availability fell for the third consecutive quarter, decreasing 0.3% quarter-over-quarter to 5.8 million sq. ft.

- The development pipeline fell slightly to 2.0 million sq. ft. as the 161,000-sq.-ft. Boulder29 delivered in Boulder and the 140,000-sq.-ft. 201 Fillmore broke ground in Cherry Creek.

- Negative 80,000 sq. ft. of total net absorption was posted in Q4 2023, a marked improvement from the negative 1.1 million sq. ft. recorded in Q3 2023.

- Leasing activity totaled 1.1 million sq. ft. in Q4 2023, a 13.3% decrease quarter-over-quarter and a 6.7% decrease compared to the level of activity seen a year earlier.

- Investment activity diminished in Q4 2023, totaling $192.4 million ($217.06 per sq. ft).

- Total vacancy increased 10 basis points (bps) quarter-over-quarter and 200 bps year-over-year to 23.1%. Direct vacancy saw a quarterly increase of 30 bps to 19.9%.

- The overall average direct asking rent posted an increase of 0.9% quarter-over-quarter and 2.5% year-over-year to reach $32.85 per sq. ft. FSG.

Metro Denver INDUSTRIAL Q4 2023 Takeaways

- Total leasing volume in Q4 2023 exceeded 1.4 million sq. ft., pushing the annual total to over 8.2 million sq. ft. transacted.

- Over 2.2 million sq. ft. of positive net absorption was posted in the fourth quarter, driving the 2023 total to just under 5.0 million sq. ft.

- Development activity decreased 33.3% year-over-year to 6.3 million sq. ft. under construction at the end of Q4 2023. Nearly 3.7 million sq. ft. delivered this quarter.

- Metro Denver average asking rent reached $9.12 per sq. ft. NNN in Q4 2023, recording a solid increase of 2.4% quarter-over-quarter and 5.8% year-over-year.

- Total availability decreased 20 bps quarter-over-quarter and increased 130 bps year-over-year to 8.7% in Q4 2023.

- Metro Denver posted an overall sales volume of $126.1 million in Q4 2023, a 54.9% drop from the $280.8 million seen in the previous quarter.