CBRE has just released its year-end 2022 reports on Metro Denver’s office and industrial commercial real estate sectors. Strong achieved rent growth highlighted a persistent demand for Denver industrial, while office net absorption turned positive as

development and investment sales stalled.

- Leasing activity dipped in Q4 2022 with a little over 1.0 million sq. ft. of leases transacted, bringing the year-to-date total to 4.5 million sq. ft.

- The office development pipeline stalled in Q4 2022 with no properties breaking ground, and only Vectra Bank’s 127,000-sq-ft. headquarters delivering in the Southeast submarket.

- Positive net absorption of 23,300 sq. ft. in Q4 2022 brought the annual total to just negative 2,600 sq. ft., a considerable improvement from 2021’s total of negative 2.1 million sq. ft.

- Annual sales volume totaled $2.5 billion, dipping only 2.7% year-over-year.

- Total vacancy increased slightly, rising 60 basis points (bps) year-over-year to 20.0%.

- Sublease availability increased 12.0% quarter-over-quarter and 39.9% year-over-year to 6.1 million sq. ft., breaking the record high of 5.4 million sq. ft. set last quarter.

- The overall average direct asking lease rate experienced minimal change, decreasing 0.4% quarter-over-quarter and increasing 0.5% year-over-year to $31.95 per sq. ft. FSG.

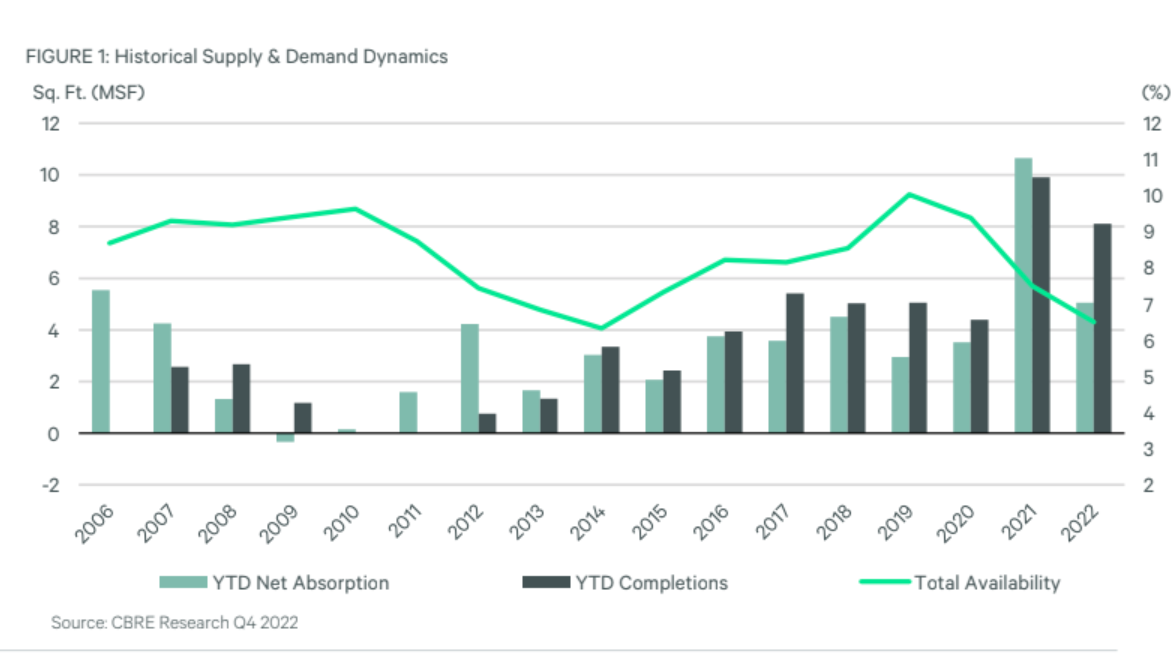

- Total leasing volume transacted in Metro Denver climbed to over 2.0 million sq. ft., pushing the annual total to over 11.2 million sq. ft.

- Construction activity decreased 2.4% quarter-over-quarter with 8.7 million sq. ft. under construction at the end of Q4 2022.

- Over 1.5 million sq. ft. of positive net absorption was posted in Q4 2022, pushing the YTD total to nearly 5.1 million sq. ft.—a 52.5% decrease from the total recorded in 2021.

- 1.3 million sq. ft. of new construction delivered in the fourth quarter, causing the total availability rate to remain stable while direct vacancy decreased 10 bps quarter-over-quarter.

- Due to tightening availability and steady tenant demand in the fourth quarter, the average achieved rate increased 16.7% year-over-year to $9.25 per sq. ft. NNN.

- As interest rates increased, sales activity continued to moderate in Q4 2022, recording $461.6 million in overall volume and driving YTD volume to $2.2 billion.