DENVER — CBRE’s H1 2018 North America Cap Rate Survey — which provides insights on movements for the major property asset classes — shows that cap rates remained broadly unchanged across the sectors in H1 2018, except for some retail segments. Industrial cap rates tightened the most and multifamily rates edged down modestly. Office cap rates were generally stable, while the hotel sector also held firm. Continued cap rate stability is expected in H2 2018.

“Cap rates have been held down by above trend economic growth and continued low interest rates. Investors are keen to buy into the innovation that is taking place in real estate, particularly logistics and office markets. The wall of capital targeting real estate is bigger than it has ever been, but there is some degree of difficulty in finding attractive investment opportunities. Existing owners want to hold, and even if they are leveraged up, have the refinancing options to be able to do that,” said Richard Barkham, global chief economist, CBRE.

“We expect cap rates to remain stable in the second half of 2018. The U.S. economy is performing very well with very modest upward pressure on inflation. These are great conditions for real estate,” Mr. Barkham added.

Among the major commercial real estate sectors:

Among the major commercial real estate sectors:

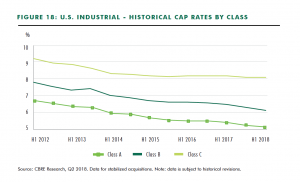

Industrial and logistics cap rates for all stabilized industrial asset classes fell by 10 bps on average to 6.42% in H1 2018. Class A industrial rates decreased by 11 bps to 5.14%, Class B fell 17 bps to 6.11% and Class C fell just 1 bps to 8.06%. Correspondingly, expected returns on cost for value-add assets decreased 13 bps overall.

“The industrial and logistics sector remains blisteringly hot and cap rates may continue to decrease in the remainder of the year, given the extremely robust market fundamentals and the tremendous institutional investor demand for industrial & logistics assets. There is much more investor demand than supply of offerings—by some estimates as high as an 8-to-1 imbalance,” said Jack Fraker, global head of Industrial & Logistics, CBRE Capital Markets.

Office cap rates decreased slightly for CBD properties and increased slightly for suburban properties in H1 2018. Demand for high-quality product was strong. Cap rates are expected to remain relatively stable for both CBD and suburban properties in H2 2018, with approximately 70% of markets expecting no change.

“There is plenty of capital that wants office product – whether core or value-add. But, there are too few quality assets on the market to satisfy capital demand. If more of the product that capital wants becomes available, it would be absorbed. While the market can get lumpy from quarter to quarter, commercial real estate remains attractive to investors because of its continued liquidity and sound fundamentals in a strong economy,” said Chris Ludeman, global president, Capital Markets, CBRE.

Retail cap rates increased across the board in H1 2018 for both stabilized and value-add retail properties. Cap rates for stabilized grocery-anchored neighborhood/community center assets increased by a modest 9 bps to 7.41%, while value-add assets ticked up 4 bps to 9.17%, as pricing on core retail centers remained robust. The average cap rate for stabilized power centers increased across all class segments in most markets.

“Investor sentiment about the retail sector improved in early 2018, due to strong consumer spending and tax reform that offers retailers significant benefits. Investors continue to acquire grocery-anchored quality centers, as well as net-lease properties in primary trade areas. We expect cap rates to remain stable in H2 2018, as investors are attracted by the return potential of shopping centers in secondary and tertiary markets. Class A centers will fare well across markets, due to demand for prime box space by discount retailers and mass merchandisers,” said Mark Bratt, senior managing director, Investment Properties – Retail, Capital Markets, CBRE.

Multifamily cap rates maintained stable and historically very low levels in H1 2018, confirming that real estate investors remain very interested in the multifamily sector and confident in its performance. Cap rates for infill stabilized assets averaged 5.21% (down 2 bps from H2 2017), and the average expected return on cost for value-add acquisitions was 5.95% (down 3 bps). Suburban stabilized assets priced at 5.53% on average, while the expected return on costs averaged 6.27%—both down 6 bps from H2 2017.

“Multifamily cap rates edged down modestly, reflecting an ongoing capital markets trend of investors moving out the risk curve to find new opportunities and greater yields. The H2 2018 outlook is for stable multifamily cap rates and returns on cost,” said Brian McAuliffe, president, Institutional Properties, Capital Markets, CBRE.

Hotel cap rates were down slightly by 4 bps in H1 2018, reversing a more than two-year trend of modest increases. Most market segments—from economy to luxury—and geographic areas, including CBD and suburban, had modest, single-digit downticks in cap rates ranging from 1 to 9 bps.

“The hotel sector continues to provide a yield premium over most classes of real estate, as well as a significant gap between risk-free rates and cap rates. While investors remain highly disciplined in their approach to acquisitions, accelerating fundamentals and highly liquid capital markets continue to drive interest in the hotel sector,” said Kevin Mallory, global head and senior managing director, CBRE Hotels.