The implications are diverse – diverging trajectories of labor force growth, an increasing war for talent, geographic shifts in outsourcing, the need for new approaches to developing and changing workplace strategy, to name a few. Investors and occupiers will be simultaneously affected, requiring them to navigate these changes and what they mean for growth strategies into the future.

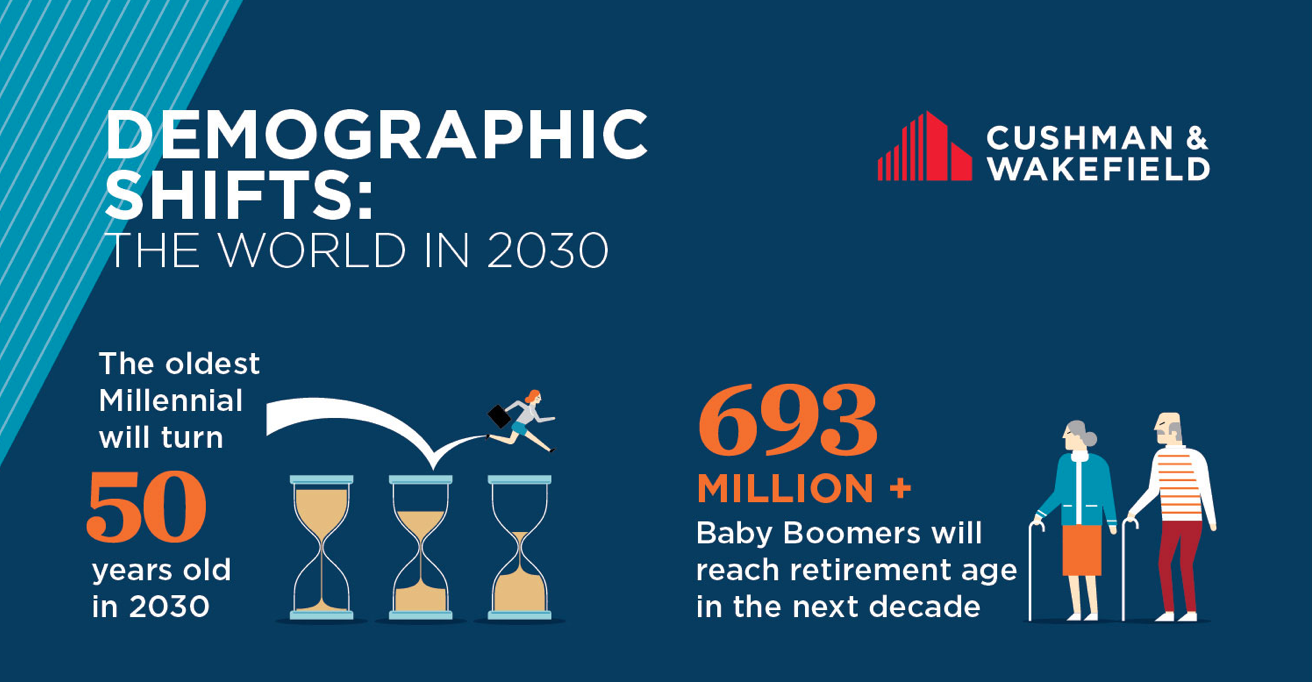

The report looks at the different approaches to work and lifestyle taken by Baby Boomers, Millennials and Gen Z around the world, and the impact on workplace strategy, sectoral growth and the changing order of the world’s cities over the next decade, as one generation exits the workforce and another enters.

“Changing demographics will drive the pace of growth in cities around the world,” said David C. Smith, Cushman & Wakefield vice president and head of Americas Occupier Research. “Global gateway markets will continue to attract high-quality workers, while emerging markets will need to establish themselves as ‘places’ to attract talent and in turn create the greatest real estate opportunities for occupiers and investors alike.”

Cushman & Wakefield compared labor force growth and GDP growth of more than 137 cities worldwide. Cities with high growth in both categories have the best prospects for strong real estate demand, while slow growth in both categories indicates a lagging market. Cities with faster growth in GDP than in the working-age population are “high productivity” markets that may appeal to investors as they rise up the value proposition. Those with greater growth in labor than GDP are considered “low productivity” markets and may need to harness that attraction of talent to boost output.

The study concluded that the world’s top-performing cities in terms of growth are located in South East Asia and India, which bodes well for the economic growth and the strength of real estate markets in these areas. High-productivity cities are located mainly in China. Most cities in Europe and North America will grow more slowly on a percentage basis and are accordingly ranked as low-productivity or lagging markets for economic and real estate growth; their trajectories need to be assessed accordingly. While individual countries and cities have their own demographic trajectories, the differences are more inter-generational than international.

“We were surprised that generational behaviors superseded cultural ones. Gen Y and Gen Z workers, to some extent, have similar workplace preferences no matter where in the world they live, but the two generations also differ in many ways,” said Kevin Thorpe, chief economist and head of global research. “For example, workplace strategy will need to account for an ever-increasing array of requirements to meet the needs of tomorrow’s professionals. Understanding these generations’ values, how and where they want to work, and their inter-personal strengths and weaknesses will lay the foundations of securing the best talent available.”