According to JLL’s Q1 2023 Office Insight report, geography more so than ever is determining which buildings stand to be the winners and losers of the post-pandemic office market. Tenants are paying premiums for office space in select micro markets like Cherry Creek and LoDo.

- Direct vacancy in Cherry Creek fell to 7.5% during the quarter and is down 34% since the end of 2020. With several buildings expected to deliver in the coming year with significant pre-leasing, vacancy will fall further to record lows. Expect bright spots like this in the market to continue to emerge as tenants adjust their office requirements and prioritize locations with higher-quality space. Rapidly rising interest rates have resulted in a slowdown of office sales transactions. In Q1 2022, 17 buildings were sold, totaling 1.9 million SF. During Q1 2023, 9 buildings traded hands, totaling 571,647 SF. The total dollar value of transactions fell as well, down 65%.

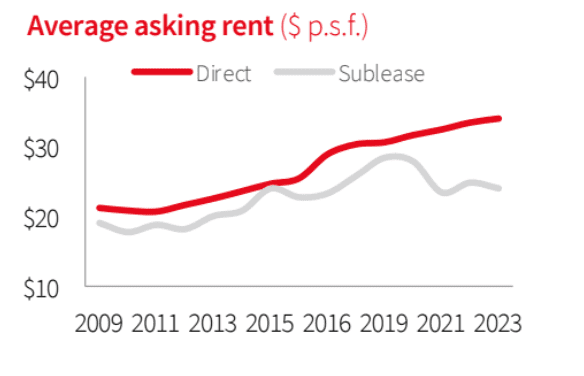

- New construction continues to support direct asking rents, which was up 5.1% year-over-year. To illustrate, as a result of Steel House breaking ground during the quarter and listing new availabilities, direct asking rents in RiNo grew 6.9% to a record $53.56.

- Credit Union o fColorado’s new. headquarters delivered during the quarter, adding 106,000 s.f. of inventory to the Northeast submarket. The building delivered vacant with employees expected to occupy in April of 2023

Move-outs exceeded move-ins and vacancy rates continued to climb for the fourth consecutive quarter. Standard & Poor vacated their entire building at 7400 S Alton (107,000 s.f.) Simultaneously, Vail Resorts is subleasing and moved out of 75,661 s.f. at 390 Interlocken.

Sublease availabilities continue to rapidly make their way to the market, up 834,019 s.f. during the first quarter, a 13% increase. Comcast Corporation added an additional 131,016 s.f. of space to the market, bringing their total amount of available sublease space to 387,346 s.f., the largest of any tenant in Denver. Nine tenants are now marketing more than 100,000 s.f. of available sublease space and are responsible for 25% of all sublease availabilities. Furthermore, 71% of all sublease space remains concentrated in the CBD and Southeast Suburban submarkets

Outlook

Perhaps at no point since the beginning of the pandemic have macroeconomic conditions weighed more heavily on determining the momentum and direction of Denver’s office market. Interest rate hikes have put a chill on capital markets and owners’ abilities to service the debt on their properties. Cracks have begun to emerge in the banking sector. Layoffs remain elevated amongst tech companies. The coming quarters will determine if these events spell further trouble for the already challenged office market or are just a blip on the radar on a path toward recovery.