According to CBRE’s Colorado Springs Office MarketView H1 2020, the Colorado Springs office market recorded positive market fundamentals in H1 2020, despite the on-going economic impacts of COVID-19. The Colorado Springs economy is largely supported by the military installations which will help support continued office-using employment growth in the defense contractor, cybersecurity and financial technology (fintech) industries.

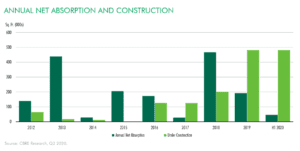

According to the report, the Colorado Springs office market has posted positive year-end net absorption for nine straight years.

- Direct vacancy dropped to 8.8% in Q2 2020, down 80 basis points (bps) from Q4 2019.

- Positive net absorption of 47,000 sq. ft. was recorded in H1 2020, an increase compared to the second half of 2019 when less than 20,000 sq. ft. of net absorption was recorded, but down compared to the first half of last year when net absorption exceeded 170,000 sq. ft.

- Construction activity remained active with over 480,000 sq. ft. of office space under development at the end of Q2 2020.

- The overall average asking lease rate continued to grow, reaching $15.53 per sq. ft. triple net (NNN) in Q2 2020.

- Investment sales declined by 8.6% year-over-year, recording nearly $90.0 million in sales volume during the first six

months of 2020.

- Four office buildings—all located in the Northeast submarket—were under construction at the end of Q2 2020, totaling over 480,000 sq. ft.

- The largest project underway is the 340,000-sq.-ft. Ent Credit Union headquarters building located near Interquest Parkway and Interstate 25.