Cushman and Wakefield has released its Q4 Office Marketbeat report for Denver that offers a cautious yet optimistic look at the office market entering 2021.

Outlook

- Leasing activity and absorption is expected to continue to be slow in first quarter 2021 but is expected to accelerate each quarter thereafter.

- While sublease space has thus far seen minimal leasing, it will become more discounted and begin to account for a disproportionate share of absorption.

- Class A space and new construction will remain a focus of tenants still seeking the healthiest office environments.

- Work From Home (WFH) strategies will continue to evolve for users as the year progresses, but by year end will be established and most likely not as significant of an impact as expected.

- Construction levels are expected to decrease throughout the remainder of 2021 and into 2022. Coupled with the lack of demand in the marketplace, expect no new developments to break ground over the next 12 to 18 months.

VACANCY: Overall Vacancy Reaches Highest Levels Since Third Quarter 2010

The Denver metro office market overall vacancy rate recorded an uptick of 140 bps quarter-over-quarter (QOQ), closing out 2020 at 17.7%. This increase is partially attributed to vacant sublease space that continued to come to market during the fourth quarter 2020 and increased 10.9% QOQ to over 3.0 million square feet (msf). The Southeast Suburban (SES) submarket was the catalyst to this large jump in vacant sublease space during the fourth quarter 2020, as Comcast added multiple vacant large-blocks available for sublease.

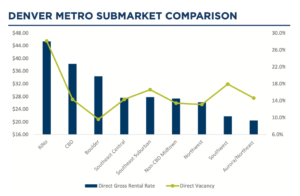

Like overall, direct vacancy also recorded a notable increase of 110 bps from the third to the fourth quarter 2020 and ended 2020 at 15.1%. This large increase is attributed to all markets tracked by Cushman and Wakefield reporting increases in direct vacancy QOQ. The most notable increase occurred in the Southwest market, which increased 650 bps due to the large vacancy that occurred at Campus 470 in Highlands Ranch. Vacancy is expected to continue to increase for the foreseeable future, as new construction delivers to the market and tenants continue to realign their footprints to meet the changing office environment of the future.

PRICING: Rental Rates Remain Relatively Flat, as Landlords Remain Reluctant to Reduce Rates

Denver’s office market continued to exhibit flattening rental rates from the third to the fourth quarter, marginally increasing by half a percentage point to $29.62 per square foot (psf) on an overall basis to close out 2020. Even with a volatile year, overall gross rental rates increased approximately 3.5% from $28.62 psf, one year ago and represented a marginal decrease from the 3.7% average rate growth ex- hibited over the prior three-year period.

Direct gross rental rates also recorded a marginal increase of 0.3% QOQ to $29.70 psf at the end of the fourth quarter 2020. This increase is predominantly due to the increase in Central Business District (CBD) direct gross rental rates which increased by approximately 1.1% QOQ to $38.22 psf and were highlighted by large block give backs in high-end Class A space by Whiting Petroleum, Extraction Oil and Gas and S&P Global during the fourth quarter 2020. Class A product was the only product type to record an increase QOQ, marginally increasing to $34.41 psf at the end of 2020. Class B product has continued to be the most impacted during this downturn and has con- tinued to exhibit softening rates over the past two quarters, decreasing approximately 0.8% QOQ to $25.88 psf at the end of the fourth quarter 2020. Rental rates should be volatile throughout the first half of 2021, as new construction delivers and landlords realign rates with demand in existing product

ACTIVITY: Leasing Increases Over Third Quarter Lows, Although Well Below Pre-Pandemic Averages

New and expansion leasing activity recorded its strongest quarter since the start of the pandemic, with over 1.4 msf

of activity during the fourth quarter 2020. Leasing activity was highly concentrated in the Southwest, CBD and SES submarkets during the fourth quarter 2020, accounting for approximately 77.2% of quarterly activity. The two largest leases that occurred during the fourth quarter 2020 were executed at Campus 470 in the Southwest market. Lockheed Martin highlights the largest lease at 8740 Lucent Boulevard, with a 203,900-sf new lease in Building One. The second deal done at Campus 470 was HCL America’s new 70,700-sf lease at 8744 Lucent Boulevard (Building Three). Lastly, the third largest transaction executed during the fourth quarter 2020 was Peaksware’s new 46,700-sf new lease at 285 Century Place in the Northwest Corridor.

Yearly new and expansion leasing activity totaled roughly 5.8 msf, representing a sharp decline from the 9.6 msf average over the prior three years. Class A product highlighted 2020 leasing activity, accounting for 61.6% of leasing activity throughout the year. As the fight against COVID-19 continues to strengthen and clarity is shed on the future of the workplace, expect to see an uptick from the lows exhibited in 2020. Expectations for 2021 should be tempered when compared to the strong activity exhibited in prior years, as headwinds remain present for the foreseeable future.

ABSORPTION: The Downward Trend Continues, As Net Absorption Remains Negative

Net absorption remained negative for the third consecutive quarter, with just under -1.6 msf of net absorption during the fourth quarter 2020. The Southwest market was the largest contributor to this negative figure with over -551,400 sf of net absorption and was largely attributed to the aforementioned large move-outs at the three buildings located at Campus 470. Throughout 2020 the Denver metro office market exhibited approximately -3.2 msf of net absorption, representing the largest decrease since the Great Financial Crisis in 2010. Class B product recorded its second consecutive year of negative absorption with approximately -1.6 msf of net absorption throughout 2020, as this Class has continued to be hit the hardest during this downturn. Net absorption is expected to remain volatile throughout the first half of 2021, as occupiers continue to shed space at a rapid pace.

CONSTRUCTION: No New Developments Break Ground, Small Building Delivers in RiNo

During the fourth quarter 2020 the Denver office market had one new development at 3501 Blake deliver 36,000 sf in RiNo and delivered roughly 30.6% preleased. Four developments, two under construction and two under renovation, were expected to deliver during the fourth quarter 2020, but delivery dates have been pushed into the first quarter 2021. At the end of 2020, just over 1.4 msf of new under construction product remained around the Denver metro area and were collectively 32.0% preleased at the end of the fourth quarter 2020. Overall, construction levels are expected to decrease throughout the remainder of 2021 and into 2022. Coupled with the lack of demand in the marketplace, expect no new developments to break ground over the next 12 to 18 months.