DENVER – CBRE’s latest U.S. Data Center Trends Report indicates that Denver’s data center industry is growing. Nearly 12 MW of capacity was under development in Denver at the end of Q1, representing a 12.5 percent increase in total data center inventory. While the supply pipeline is robust, industry experts say demand is expected to remain strong.

“Denver’s profile is growing across the data center industry, attracting attention for our strong economy, concentration of network providers, population growth, highly educated workforce and increasingly large tech presence. As tech companies based in Denver mature and expand, so do their data center requirements, creating demand for space nearby. There is also Colorado legislation that will be enacted in 2019 that will lower power costs for large users, which could position Denver even more competitively on the national stage. Overall, there’s an encouraging combination of organic and cultivated growth, which gives us confidence in the demand for data center space around Denver in the future,” said Greg Vernon, senior vice president, Data Center Solutions, CBRE.

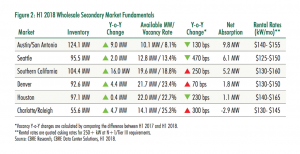

With 11.6 MW of capacity under construction, Denver ranked first for its data center supply pipeline among the secondary markets studied in the report. While net absorption was down from the year prior, totaling 1.8 MW in H1 2018, it matched Denver’s historical annual averages.

With 11.6 MW of capacity under construction, Denver ranked first for its data center supply pipeline among the secondary markets studied in the report. While net absorption was down from the year prior, totaling 1.8 MW in H1 2018, it matched Denver’s historical annual averages.

Wholesale occupiers in Denver primarily came from the healthcare and technology industries. National Trends Demand from large cloud users has set the U.S. data center market on pace to break 2017’s record leasing activity. The market saw more than 177 megawatts (MW) of net absorption in H1 2018, already nearly two-thirds of last year’s annual record net absorption total, despite the delivery of significant new supply.

Other report findings include:

- Strong demand has resulted in more than 474 MW of capacity under development in the primary U.S. markets, nearly 55 percent of which is preleased.

- U.S. data center investment volume reached $7 billion in H1 2018, inclusive of single-asset, portfolio and entity-level transactions.

- H1 2018 investment activity was balanced between transaction types, as opposed to in 2017, when investment was driven by entity-level transactions. Single-asset and portfolio transactions accounted for 48 percent of total volume in H1, compared to only 27 percent in 2017.

- Northern Virginia, Phoenix, Dallas/Ft. Worth, Silicon Valley and Austin/San Antonio saw the most leasing activity in H1 2018.

“While 2018 investment volume may not reach 2017’s record setting investment of more than $20 billion, we still expect the investment market to produce strong results, driven by sale/leasebacks from enterprise users, cloud users looking for development partners and a continued influx of new investors into the data center sector,” Mr. Lynch added.