“COVID-19 struck a nation that was already mostly struggling,” said Jesse Van Tol, CEO of NCRC. “Recovery in most places will be even more challenging than in those where investment was already concentrated. There is no doubt that the protests that have erupted nationwide are at least in part motivated by the nation’s long history of racial economic inequality.”

“COVID-19 struck a nation that was already mostly struggling,” said Jesse Van Tol, CEO of NCRC. “Recovery in most places will be even more challenging than in those where investment was already concentrated. There is no doubt that the protests that have erupted nationwide are at least in part motivated by the nation’s long history of racial economic inequality.”

In most of the country, high levels of inequality as well as low home values and incomes prevented families from building wealth at all.

“Some cities were booming, and that created unique and difficult challenges for longtime residents who were priced out and pushed out, but in most of the country, lower-income residents and neighborhoods suffered from a lack of investment, stagnant economies and fewer opportunities to accumulate personal wealth,” said Jason Richardson, NCRC director of research and evaluation, and one of the lead authors of the report.

Of the 9,743 neighborhoods found to be eligible to gentrify, meaning they were in the 40th percentile for income and home values, there were only 954 neighborhoods, or less than 10 percent, that did gentrify.

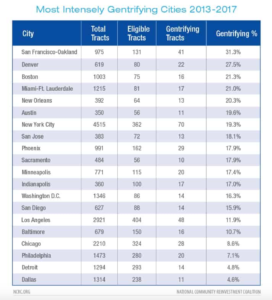

The vast majority of the gentrified neighborhoods came from just 20 cities, where each had at least ten neighborhoods gentrified during the 2013-2017 period. Nationally, half of all of the gentrifying neighborhoods were in these 20 cities.

The pattern of concentrated wealth, investment and displacement has new implications in 2020. In most of the nation, economic recovery after COVID-19 likely will be more difficult than in the thriving cities where investment capital was already concentrated. Chronic disinvestment in lower-income communities will undoubtedly be exacerbated by the COVID-19 crisis.

The study also investigated the newly-created Opportunity Zones (OZs), where the 2017 tax overhaul offered investors new tax breaks. Opportunity Zones allow investors who have capital gains earned from the sale of other property and assets to invest them and avoid some or all of the tax due on them. NCRC found that neighborhoods designated as OZs were indeed the places in the most dire need of investment. Perhaps not surprising, there was a close association between neighborhoods that gentrified and where OZs were located. Sixty-nine percent of neighborhoods experiencing gentrification from 2013-2017 were either in or adjacent to an OZ. Overall though, neighborhoods designated as OZs far outnumbered those neighborhoods where gentrification was found.

As of now, so little is known about investment in Opportunity Zones that it is difficult to tell what impact, if any, they are having on the areas included in this study. A general lack of transparency permeates the Opportunity Zone program.

“We cannot tell who is investing, where the money is going or what kinds of projects are being funded. Four months into the COVID-19 pandemic, we can assume that many of the capital gains that investors would have invested there might not exist. In that case, the question has shifted from ‘who is investing in Opportunity Zones?’ to a more fundamental ‘who has anything to invest in Opportunity Zones?’” Richardson said.

The data also reinforces the need to modernize and strengthen the Community Reinvestment Act (CRA), a 1977 law that requires banks to make loans in all communities where they take deposits. One of the agencies that enforces CRA has announced new rules that weaken requirements for banks to lend or invest in lower-income neighborhoods.

“The data on gentrification, displacement and widespread disinvestment underscores the need for stronger enforcement of CRA, not weaker rules, and new approaches so fewer communities are left behind and fewer families are displaced by gentrification,” Van Tol said.

To view the full report, visit: https://ncrc.org/gentrification20/

Photo courtesy of CU Denver