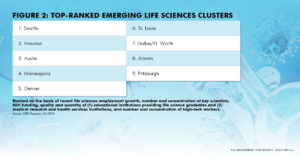

DENVER – The U.S. life sciences industry and the real estate that it occupies have ridden a wave of momentum into this year that has positioned Denver as a top five emerging market, according to a new report from CBRE.

Numerous indicators point to robust expansion for the industry, including the 86 percent increase in venture-capital funding for U.S. life sciences companies to $15.8 billion for the year ended in September from the previous year. Additionally, life sciences lab space under construction in the industry’s five largest U.S. markets expanded by 101 percent last year to 6.0 million square feet.

That momentum has several markets ascendant on CBRE’s ranking of the top established and emerging life sciences hubs. Denver has one of the nation’s largest concentrations of key scientists, and the National Institutes of Health funding to institutions in Denver has grew by 23 percent from 2017 to 2018.

That momentum has several markets ascendant on CBRE’s ranking of the top established and emerging life sciences hubs. Denver has one of the nation’s largest concentrations of key scientists, and the National Institutes of Health funding to institutions in Denver has grew by 23 percent from 2017 to 2018.

“There are many things propelling Colorado’s life sciences sector forward. We boast one of the nation’s highest-educated workforces, have outstanding academic and health institutions and an entrepreneurial culture that is renowned for being supportive and inclusive. With the majority of Colorado life sciences companies still in the pre-revenue stage, our local industry has been proactive and effective in attracting investment to help firms bring their products to market—raising more than $1 billion in bioscience investment last year alone. This has led to impressive growth, both among homegrown companies who are thriving and new life sciences firms entering our market. Colorado’s expanding industry is also serving to attract new life science talent as workers today can find not only their next job here but an entire career’s worth of opportunity,” said Brian McClenahan, vice president with CBRE in Boulder.

The human life-sciences industry encompasses manufacturing, testing and research-and-development work in the fields of biotechnology, pharmaceuticals and medical devices.

CBRE analyzed and ranked the top established life sciences hubs by weighing four main criteria for each market: number of scientists in key industry categories, industry funding for local life sciences companies, size and long-term growth of their life sciences workforce, and their inventory of industry lab space.

“Multiple indicators point to sustained, strong growth for the life sciences industry, which makes life sciences labs and offices an ideal focus for developers and investors,” said Steve Purpura, vice chairman leading CBRE’s Life Sciences business. “Few industries offer this much expansion potential, but much of the activity happens in a select number of special markets.”

To read the full report, click here.