The ongoing momentum in the life sciences sector is likely to drive tremendous opportunities for growth within the real estate industry. Consequently, the latest CommercialCafe study set out to identify which metro areas offer the most favorable combination of factors for a successful life sciences ecosystem.

The study analyzed data on local life sciences employment and educational attainment levels, as well as relevant real estate indicators across the central office markets, and ranked the top 20 U.S. metros for life sciences companies in 2022.

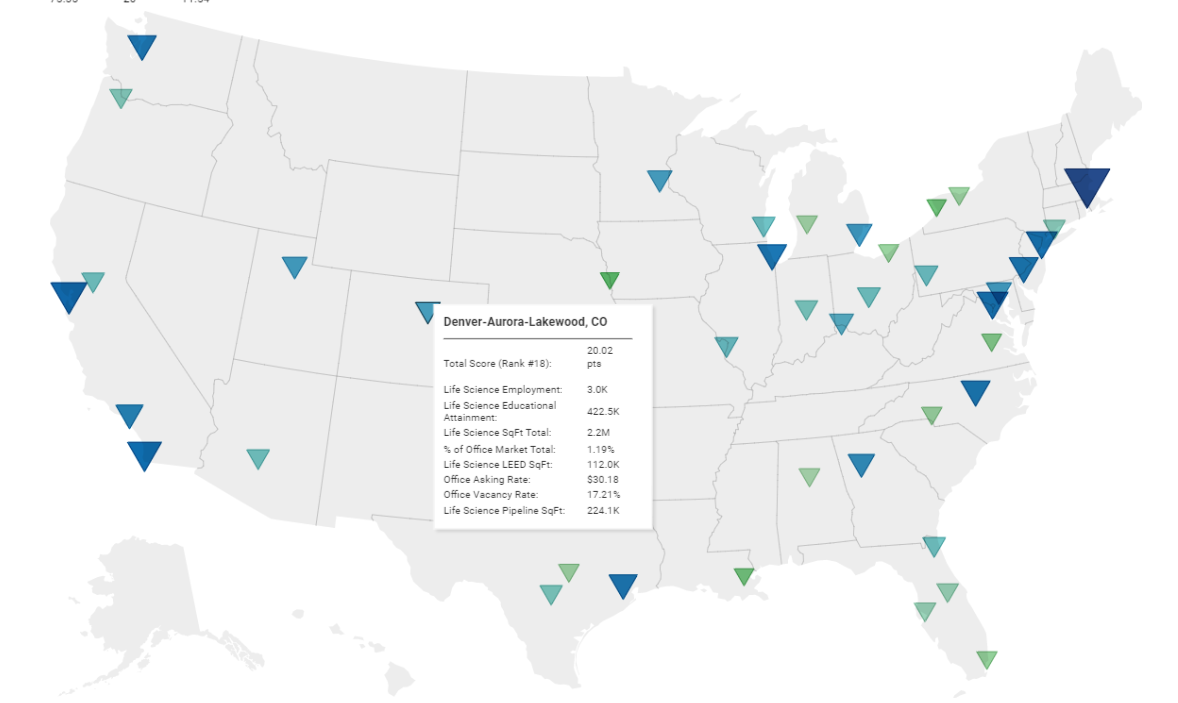

Denver ranked 18th-best metro for life sciences companies and research

The Denver metropolitan area has been steadily establishing itself as an important hub of innovation and has consistently ranked among the top cities for startups in the U.S. Although not as synonymous with life sciences as markets positioned higher in the ranking, Denver has been a growing area of interest since at least 2016 when major biopharma companies had already established a notable presence in the region.

With a total score of 20.02 points, Denver placed 18th in the ranking of top U.S. metros for life sciences research and businesses. Similar to other metropolitan areas at this end of the rankings, the Denver-Aurora-Lakewood MSA earned its highest scores for the accessibility of its office market: 5.81 points out of 10 for average vacancy rate and 7.8 points out of 10 for average office asking rate.

Similarly, the Denver metro was the 11th-largest life sciences real estate market among the 45 entries CommercialCafe compared for this ranking. Totaling 2.2 million square feet, local life sciences stock accounted for nearly 1.2% of office space in Denver and included nearly 112,000 square feet of LEED-certified property.

In 1st place was the Boston metropolitan area with a total of 75.35 points out of 100, earning top scores across several metrics like life science labor force, life science educational attainment, and life science commercial real estate.

To read the full report click here