The growth of U.S. life sciences researchers remains resilient in the face of economic concerns, according to a recent analysis conducted by CBRE. The Metro Denver/Boulder region, including Aurora, saw the second-fastest rate of growth in life sciences jobs over the past five years, helping to propel the market into the top 10 for national research talent.

The number of life sciences researchers in the U.S. increased by 87% over the past 20 years, compared with 14% for all U.S. occupations. Research jobs have not fallen across those 20 years, through three recessions and amid a tight labor market of recent years.

Life sciences research professions – from biochemists to epidemiologists and data scientists – increased in headcount by 3.1% in 2022 to a record 545,000 specialists. In comparison, the overall U.S. job growth rate last year was 2.2%.

“Ranking among the top 10 U.S. markets for research talent is a testament to the continued strength of the life sciences industry in Colorado. Companies and talent seek out the Denver/Boulder region for its world-class research institutions and universities and renowned quality of life. The ability to attract and retain talent in Colorado is unrivaled compared to other markets,” said Erik Abrahamson, senior vice president with CBRE’s Life Sciences group in Boulder.

CBRE evaluated each of the largest 74 U.S. life sciences labor markets against multiple criteria, including the number and concentration of life sciences researchers, the number of new graduates with life sciences degrees and specifically with doctorate degrees in life sciences, the concentration of all doctorate degree holders, and concentration of jobs in the broader professional, scientific, and technical services professions. The analysis produced CBRE’s second annual ranking of the leading markets for U.S. life sciences talent.

Denver/Boulder Region Advances to Top 10

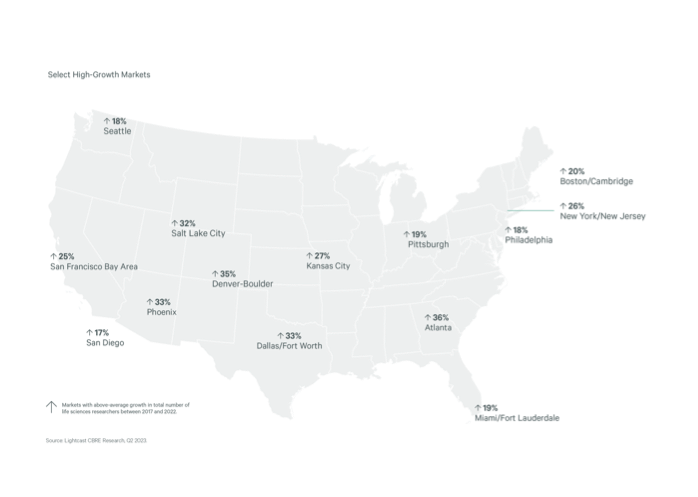

Metro Denver/Boulder advanced one spot from last year’s inaugural ranking to emerge among the top 10 U.S. markets for life sciences talent. The region’s life sciences talent pool grew 35% between 2017 and 2022, the second-fastest growth rate of any major U.S. market. The national average in that span was 16%.

Other markets that saw above-average growth in the total number of life sciences researchers between 2017 and 2022 include Atlanta (36%), Dallas/Fort Worth (33%) and Phoenix (33%). It’s important to note that, like Denver/Boulder, each market is home to leading research and higher education institutions. The number of graduates and certificates in Biological and Biomedical Sciences from Denver/Boulder universities and colleges grew by 20% between 2016-2021, above the 16% national growth rate.

“The growth in talent aligns well with Denver/Boulder’s strong pipeline of new and converted life sciences projects with institutional ownership,” added Abrahamson. “This combination is giving a growing number of innovative companies the confidence to choose Colorado for where to base and expand their operations.”

Metro Denver/Boulder is home to the 10th-largest pool of life sciences research talent overall (10,630 employees) and is the ninth-most-concentrated market for life sciences talent with researchers representing 0.5% of Denver/Boulder’s total workforce.

“Demand for life sciences research workers is above pre-pandemic levels,” said Matt Gardner, CBRE Advisory Services Life Sciences leader. “We’re also seeing a closely balanced ratio of hiring to job cuts in the biopharma industry compared with the technology sector and the broader economy, which positions the life sciences to remain stable despite an economic downturn.”

“It’s worth mentioning that large lab markets, such as Boston and the San Francisco Bay Area remain stable,” he said. “But in the second year of our analysis, we’re seeing cities like Atlanta, Philadelphia, and Denver/Boulder gain ground as hubs for life science research talent.”

CBRE’s analysis allows for examining the industry from various angles, including shifts in the type of life science research occupations. For example, the number of digital and analytics roles has increased by 101% in the last five years due to innovation in artificial intelligence and machine learning. The industry is also experiencing a shift from chemistry to biology, resulting in a 1.2% decrease in the number of chemists over the past five years.

To read the full report, click here.