According to Rider Levett Bucknall’s Q2 2021 construction cost report, national construction costs saw their biggest quarter-to-quarter increase in more than 20 years. National average construction costs increased approximately 4.35 percent between April 2020 and April 2021. Denver construction cost increase was recorded below the national average at 1.49 percent.

With data current to mid-Q2 2021 and featuring construction cost information for 14 U.S. and Canadian markets, the QCR provides a statistical view of the state of the construction industry, detailing indicative construction costs for eight building sectors.

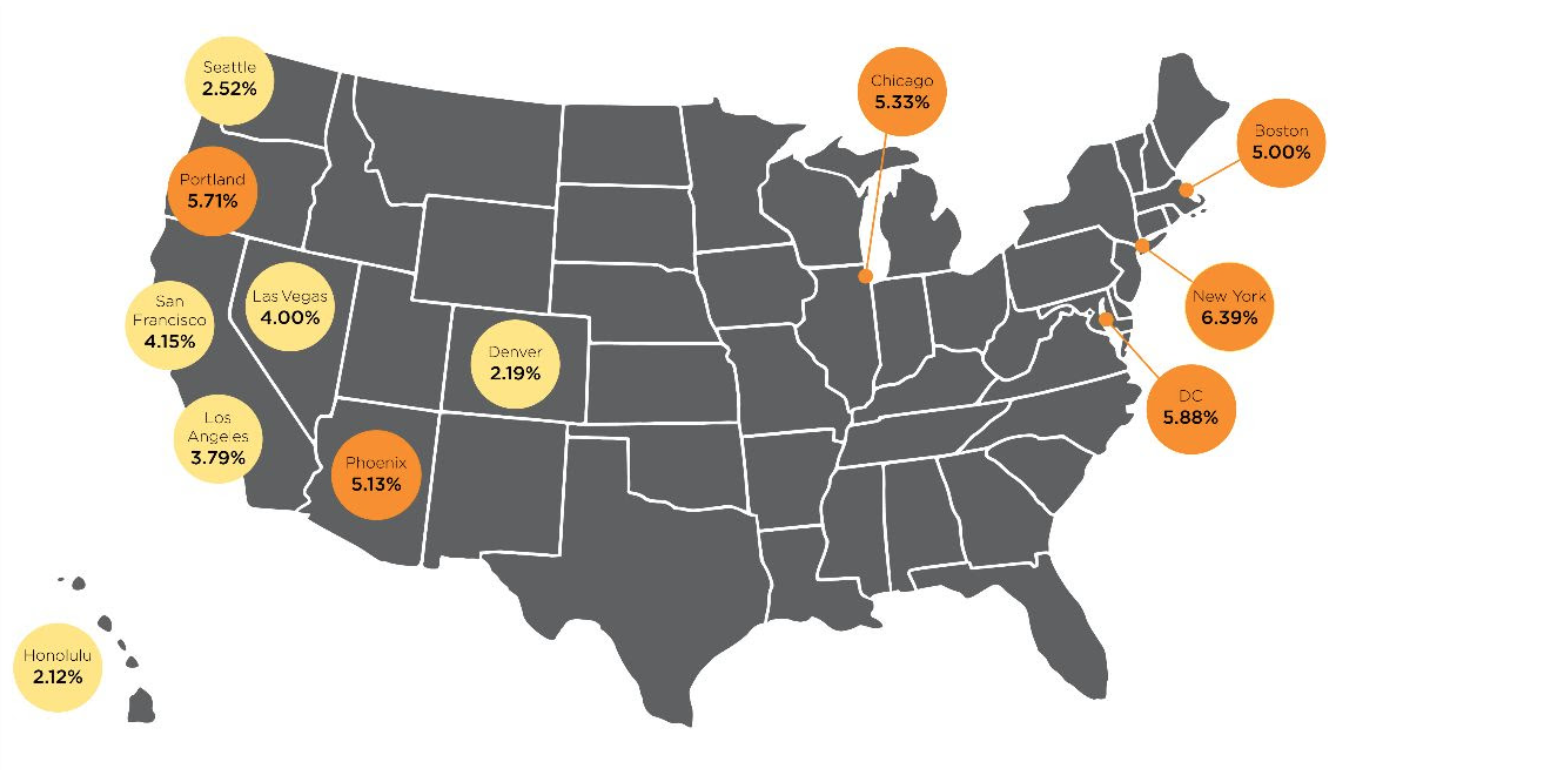

Market highlights:

- RLB reports that from January 2021 to April 2021, the U.S. national average increase in construction costs was approximately 2.91% (11.64% annualized). This is the largest quarter-to-quarter increase since we’ve recorded QCR data (previous high was 2.75% in April 2004).

- While the annualized rate is 11.64%, the year-over-year increase a more ‘normal’ 4.35%.

- Boston (3.07%), Chicago (4.67%), New York (3.38%), Phoenix, (4.29%), Portland (3.90%), and Washington DC (3.48%) are the markets with cost increases above the national average during the second quarter

- Markets seeing construction cost increases below the national average, during the second quarter, include Denver (1.49%), Honolulu (0.92%), Los Angeles (2.79%), San Francisco (2.15%), and Seattle (1.81%)

Key fiscal barometers:

- The U.S. Consumer Price Index (CPI) shows a year-over-year increase, and is up 1.70% from the previous quarter

- The U.S. Gross Domestic Product (GDP) remains higher than normal, increasing from 4.3% in Q4 2020 to 6.4% in Q1 2021

- The Architectural Billings Index (ABI) reports its first index above 50 since Q4 2019, with a 55.6 reading in March 2021

According to Julian Anderson FRICS president, North America, some of the issues that came strongly into play during the height of the pandemic, like bottlenecked supply chains, volatile commodity prices, delayed permitting processes, and materials tariffs, will likely linger for a while. As well, a long-familiar problem—the ongoing dearth of qualified labor—will continue to cloud the construction field. The worker shortage makes projects more costly and slower to build, destabilizing the industry.

Looking ahead, there are some relatively new factors that will affect the industry. A couple are economic in nature; the possibility of climbing interest rates and construction cost escalation will making budgeting challenging and bidding highly uncertain. Another is the prioritization of clean energy and reduced carbon levels by the Biden administration, in response to the climate crisis.