Flexible workspaces are no longer expanding in every direction at once. Instead, the industry is growing with more intention, shaped by clearer demand patterns and a better understanding of what performs well over time. Rather than chasing footprint alone, operators are refining their portfolios; investing in larger, more versatile spaces; and consolidating where demand is strongest.

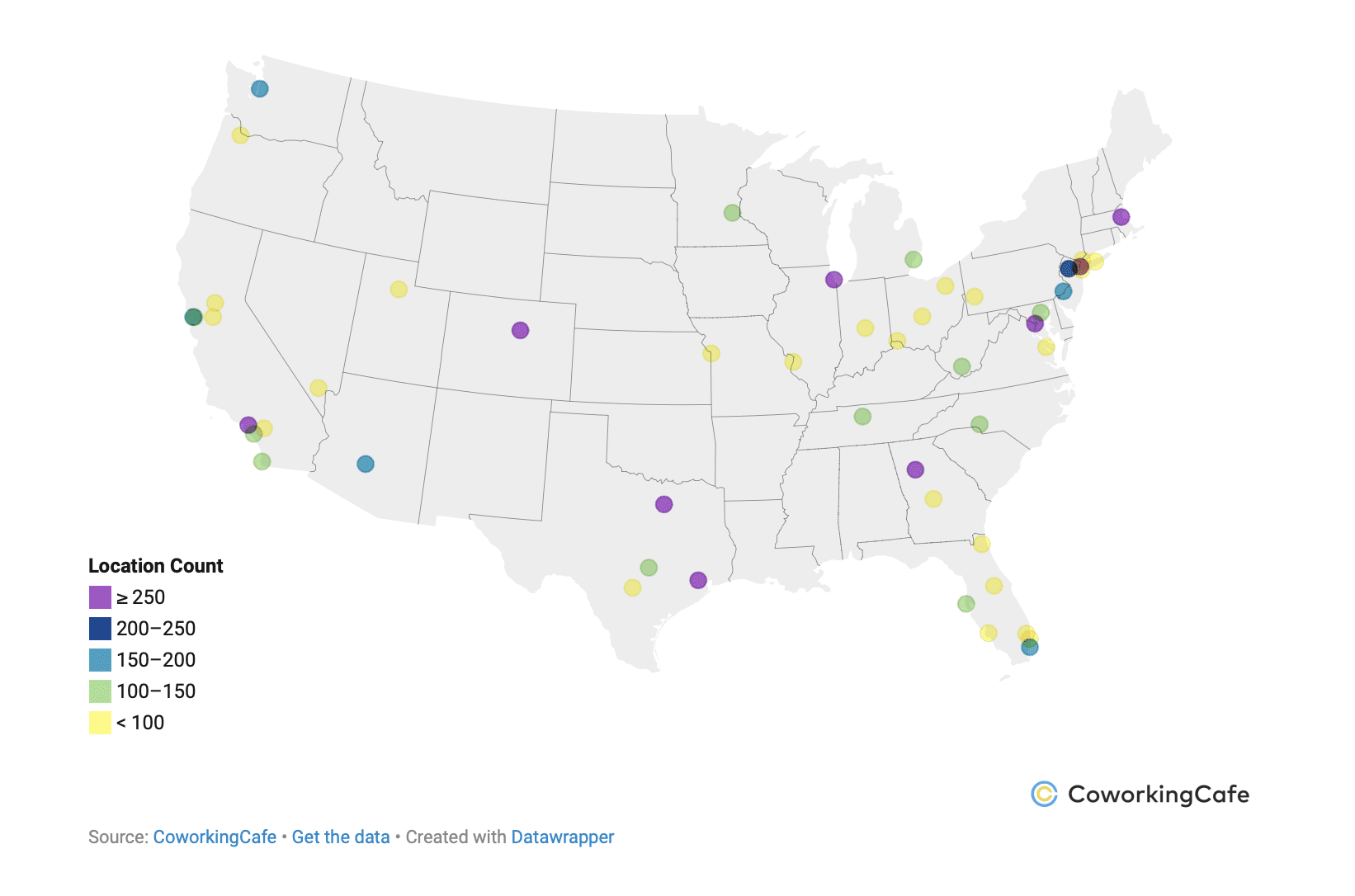

The latest Q4 2025 coworking industry report from CoworkingCafe shows that by the end of Q4 2025, the U.S. coworking market reached 8,854 locations, up from 8,420 in Q3 to reflect a 5% quarter-over-quarter increase. Total coworking footprint rose in tandem, expanding from more than 152 million square feet to 159 million square feet for more than 7 million square feet in growth in a single quarter.

Peter Kolaczynski, director at Yardi Research, offered his opinion on coworking expansion trends: “The theme coming out of Covid was operators bringing the office to the employee, with expansions in secondary and suburban markets to meet domestic migration trends. The theme looking forward seems to be where can operators and office building owners meet the needs of corporate occupiers that are committed to growing coworking and flexible footprints.”

Denver Market

- More Inventory: The Denver market had 11 more coworking spaces by the end of Q4 2025—reaching 260—representing a 4% increase quarter-over-quarter.

- Square Footage Growth: Denver reached close to 4.15M sq. ft., registering a 3% increase Q-o-Q. This number represents just 2.4% of Denver’s total office space, signaling there’s still room to grow.

- Less Average Square Footage: the average square footage dropped by 2% Q-o-Q, from 16,234 sq. ft. in Q3 to 15,957 sq. ft. in Q4, signaling a favor towards smaller coworking spaces.

- Pricing: Denver saw a stabilization in prices across the board of subscriptions: virtual offices remained $129 / month; meeting rooms remained $40 / hour, day passes kept their median at $30 / day and memberships remained at a median of $220 / month.

- Operators: The top operators in the Denver market are Regus (43 spaces), Humanly (16 spaces), Office Evolution (12 spaces), Spaces (six spaces) and WeWork (six spaces).

- Q4 2025 vs. Q4 2024: In December 2024, Denver had 232 coworking spaces – marking a 12% growth in the span of a year. In terms of total square footage, the registered growth was 17%, equivalent to 600K sq. ft. added to the inventory in 2025.

Read the full analysis here: https://www.coworkingcafe.com/blog/national-coworking-report/