According to Cushman & Wakefield’s Americas Data Center Update, in the second half of 2022 established data center markets began to feel the growing pressures of limited power and land. As a result of this, there has been growing interest in secondary markets such as Denver, Portland, Columbus, Austin and Canadian markets as operators seek larger sites with affordable power.

The Denver data center market has been capturing a wide variety of interest and activity recently. Denver has an edge over more established markets like Silicon Valley or Northern Virginia in that cost of power, cost of land, and cost of construction are lower, environmental risks are not as high, and the central location grants access to a plethora of networks. However, the incentive environment leaves much to be desired. Should the state decide to implement an incentive plan akin to nearby regionally competitive states such as Arizona, Utah, or Nevada it could catalyze development in the market and edge Denver toward rapidly becoming a tier-1 market.

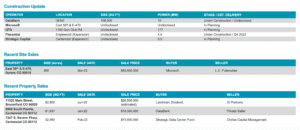

Existing operators are expanding their presence, new operators are entering the market, investors are targeting stabilized assets, and the first hyperscaler land purchase has now taken place. QTS, a Blackstone-backed colocation provider, entered the Denver market with a 67-acre land purchase in Aurora, as did Microsoft with a 260-acre land purchase, Flexential announced a 4.5MW expansion to their data center in Englewood, DataBank acquired a data center it was previously leasing with an adjacent property where they plan to build DEN5, Landmark Dividend acquired a data center from GI Partners which is leased to TIAA- CREF and Strategic acquired a single-tenant facility with a 15-year lease in place. In the absence of a bonafide incentive program, future large-scale development will likely take place in Aurora where Microsoft and QTS acquired land as local utilities offer discounted power.

Ecosystem Developments

- Microsoft has purchased 260 acres of land for $63.5 million in Aurora, south of Denver International Airport, where the company plans to build a data center. Microsoft’s purchase marks the first large site purchase for a hyperscale data center user in the Denver market.

- QTS has purchased 67 acres of land directly north of the JPMorgan Chase data center along Gun Club Rd. While the project is currently in its planning phase, at full build out QTS plans 177MWs of power capacity.

- Following their earlier acquisition of the data center/office property at 1500 Champa, IPI Partners has launched a new data center company called RadiusDC focused on metro edge facilities. The 1500 Champa property is currently expanding up to 10MW of capacity and should be complete by the end of 2022.

- DataBank acquired DEN2 which they were previously leasing in Centennial, allowing them to consolidate the property with their adjoining property where they’re redeveloping a light industrial building into a 108,000-square-foot building with 15MW of capacity called DEN5. The two properties combined will make up DataBanks “Centennial Campus” spanning 11 acres and a total capacity of 20MW.

- Flexential has a data center undergoing expansion on S Peoria St., which will bring the total capacity of the building to 11.25MW by the end of 2022.

According to the report, a possibility to consider for Aurora is that the Microsoft and QTS developments could spur further hyperscale development in the region. Major tech companies and as-a-service providers enjoy economies of agglomeration and large-scale data center clusters are an extension of that principle. With JPMorgan Chase having occupied their data center in the area for nearly two years, and Microsoft and QTS planning to build, evidence of permitting timelines, power deliverability, and network connectivity will become concrete and make the area much more attractive to some of the biggest investors in the data center space.

Additional factors that could drive demand toward the Denver market include utility companies unable to fulfill power contracts elsewhere in the country, which has been happening in Northern Virginia, and rising interest rates that have impacted the economics of deals in more expensive markets that have a higher degree of land scarcity.