According to JLL‘s Q4 2023 Denver Industrial research report, the industrial market has been resilient throughout 2023 and optimism remains as 2024 kicks off.

Here are five things to know:

- Near-record deliveries led by large build-to-suit projects.

- The second largest quarter of new construction deliveries in Denver’s history was headlined by three large BTS projects delivering.

- The Denver metro area saw the construction pipeline shrink by 2 million SF as deliveries outpaced starts, signaling the first major slowdown in new development since the construction boom in 2020.

- Quarter-over-quarter leasing volume remained flat to close out the year.

- Deal activity reflected that of the third quarter, yet the average deal size increased to over 50,000 SF.

- Signs point to tenants having an increased appetite to take down large spaces to kick off 2024.

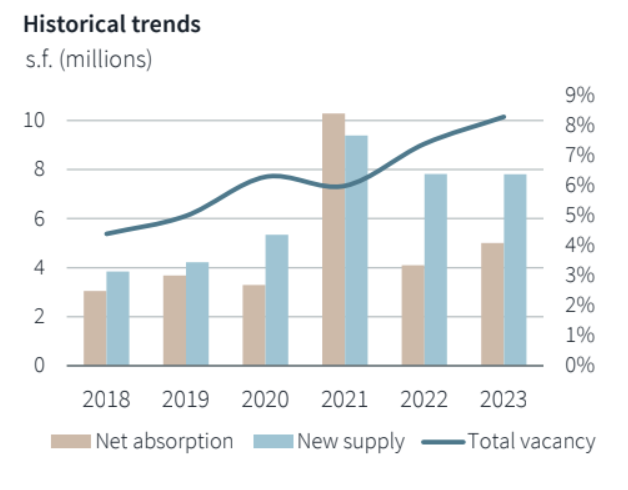

- Vacancy rises yet again but at a slower pace.

- Vacancy rose for the second consecutive quarter after a brief dip during Q2 of this year.

- If leasing activity holds true and tenants stay operational until subleasing their space, vacancy should remain in the 8% range during early 2024.

- Positive absorption persists for a 6th consecutive quarter.

- Industrial product continued to absorb at a steady pace as over a dozen properties absorbed 50,000+ SF of space.

- Despite a substantial portion of absorption coming from large BTS projects in the Airport and Northeast submarkets, the Southeast, North I-25, and I-70/East submarkets saw speculative space that had been sitting vacant absorb for the first time.

- Asking rents climb across most areas of the metro.

- Eight out of Denver’s eleven submarkets saw positive rent growth during the fourth quarter.

- Despite rising asking rates, leverage in many markets remains neutral. Landlords are remaining optimistic, but as new product delivers available, leverage may shift.

2024 Outlook

The industrial market has been resilient throughout 2023, and optimism remains as 2024 kicks off. Landlords have seen asking rent growth persist across nearly the entire market. Sizable leases signed during Q4 could be a sign of things to come as tenants have shown a willingness to take down larger spaces. Tenants in the market can expect to see some leverage as options remain in many submarkets. Some newly delivered space could see a discount if activity remains compressed. Overall, the market’s tenant-landlord leverage pendulum is poised to remain in neutral over the near-term horizon.