The Denver metro area’s industrial-centric employment is now larger than it was prior to the pandemic, according to Avison Young’s Q2 2021 Denver Industrial Insight Report. Between February 2020 and May 2021, Denver added 3,000 new industrial jobs as total industrial employment now stands at 327,500. Transportation, warehousing & utilities jobs have accounted for most of the job gains within industrial-central employment after adding 5,000 new jobs between February 2020 and May 2021.

Strong leasing demand coupled with job growth in the industrial sector is expected to continue which will help manage vacancy levels across the region. Demand will continue to keep pace with new development for the foreseeable future.

Economic conditions: 5.9%

The unemployment rate in Denver improved from 12.4 percent at the height of the pandemic.

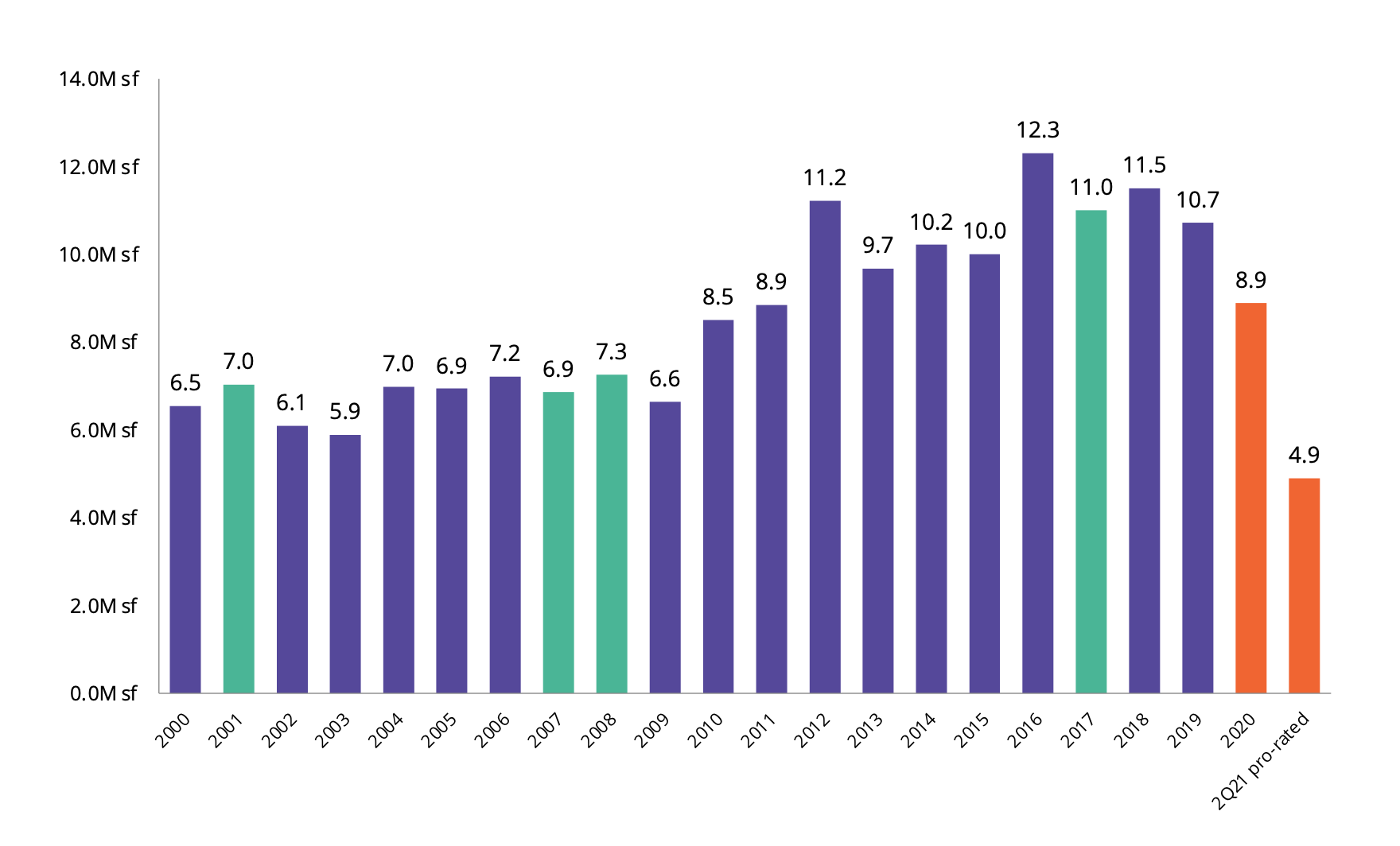

Industrial demand: 4.9 msf

Leasing activity for Q2 2021. Total leasing activity in 2021 has kept pace with Q1 & Q2 2020 leasing activity.

Industrial supply: 7.1%

Direct vacancy for Q2 2021. The market has seen over 3 msf deliver so far in 2021 while close to 10 msf of new product is currently under development.

Pricing trends: 7.5%

Industrial asking rent growth since Q2 2020.

Capital markets: $145 psf

Average asset pricing in 2021, up from $138 psf in 2020.