CBRE has released its Q4 2019 MarketView reports analyzing year-end performance for metro Denver’s office, industrial and retail sectors.

“Metro Denver closed out 2019 strong, and we are now focused on some headwinds and tailwinds moving into 2020,” said Pete Schippits, senior managing director of CBRE’s Mountain States. “Looming questions remain around slowing population growth, high housing costs, the stability of the oil and gas sector and hiring in an increasingly competitive labor market. Fortunately, Denver also has many bright spots. Big-name companies continue to locate here, both in office and industrial, helping to attract more talent, especially in the tech sector. Our construction pipeline is strong across all property types with many development projects poised to bring new vitality to our market. Foreign capital is also increasingly interested in Denver as investors look to stable markets to increase their yields late in the cycle.”

Office Market Highlights

Office Market Highlights

- Positive net absorption of 429,249 sq. ft. was recorded in Q4 2019, bringing annual net absorption to just under 2.0 million sq. ft.—marking the second highest annual net absorption since 2014.

- The average direct asking lease rate at year-end 2019 was $28.62 per sq. ft. full-service gross (FSG), a 1.0% increase from 2018.

- Direct vacancy was down 50 basis points (bps) year-over-year to 11.6%.

- Investment sales volume totaled $524.5 million in Q4 2019, rounding out the annual 2019 sales total at $2.9 billion—just below the $3.0 billion volume recorded in 2018.

Industrial Market Highlights

Industrial Market Highlights

- Over 916,000 sq. ft. of positive net absorption was recorded in Q4 2019—the 39th consecutive quarter of positive net absorption.

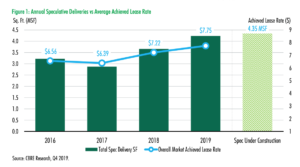

- The overall average achieved lease rate for 2019 rose 6.9% year-over-year to $7.75 per sq. ft. triple net (NNN).

- The overall average direct asking lease rate increased 1.0% year-over-year to $8.24 per sq. ft. NNN in Q4 2019.

- Direct vacancy increased 72 bps year-over-year to 6.6%.

- In 2019, 35 buildings delivered totaling 5.0 million sq. ft. Construction activity remained strong in Q4 2019 with 6.5 million sq. ft. underway.

Retail Market Highlights

Retail Market Highlights

- Positive net absorption of nearly 260,000 sq. ft. in Q4 2019 helped annual net absorption exceed 884,000 sq. ft.—the second highest year-end level since 2013.

- Direct vacancy decreased to 6.8%, down 41 bps year-over-year.

- The average direct asking lease rate was $19.64 per sq. ft. NNN, up 1.6% year-over-year.

- Metro Denver’s retail construction pipeline remained healthy with 1.5 million sq. ft. underway in Q4 2019, up 5.2% year over-year.

- Quarterly investment sales priced $3.0 million and greater totaled $167.1 million, down 25.6% year-over-year.

Graphics courtesy of CBRE