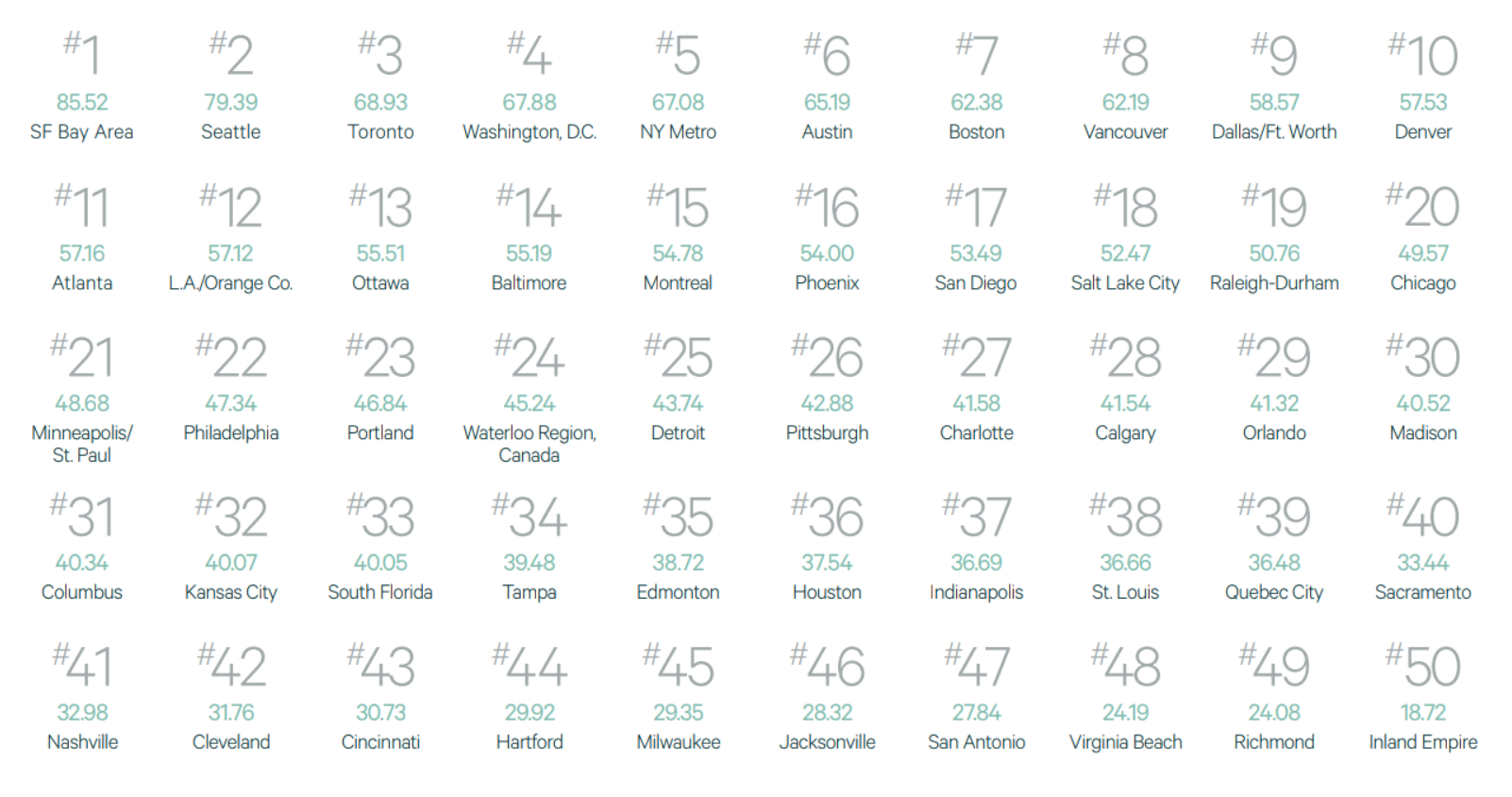

Today marks the official launch of CBRE’s 2022 Scoring Tech Talent Report, which ranks the top 50 markets in North America for tech talent. Denver jumped two spots to No.10 in this year’s ranking, due in part to strong tech talent job growth over the past five years.

The U.S. added a net 136,000 tech talent jobs last year across established hubs such as the San Francisco Bay Area, New York and Seattle as well as smaller markets like Nashville, Cleveland and California’s Inland Empire. Both tech job growth and tech office leasing proved resilient by rebounding in 2021 from slowdowns in 2020.

Denver increased the size of its tech talent pool and innovation infrastructure in the form of tech degree graduates and research and development spending, among other factors.

“Denver’s tech talent workforce has expanded steadily in recent years due to new job creation by local and out-of-state employers and relocation of many tech companies and tech employees to the area. Specifically, we have seen strong in-migration of tech workers from the San Francisco Bay Area, New York City and Chicago,” said Ryan Link, senior vice president with CBRE’s Tech & Media practice in Denver.

“Fifteen years ago, there were less than five venture capital firms working with Denver-area start-up companies. Today, there are over 20 VC firms active in Denver’s tech ecosystem. The Mile High City is now known for its highly skilled and specialized tech workforce and growing concentration of tech companies. Cracking the top 10 of this list puts Denver in elite company,” Link added.

Denver stood out in the report in several other key areas:

- Denver’s tech talent workforce of 117,620 grew by 23 percent from 2016 to 2021. That’s the seventh-biggest gain among large tech talent markets, positioning Denver as home to the 12th-largest tech talent workforce in North America.

- It has the sixth highest ratio (46.5 percent) of residents with a bachelor’s degree or higher. The U.S. average is 32.9 percent.

- It creates nearly as many tech jobs (21,810 from 2017 to 2021) as tech graduates (22,581 from 2016 to 2020).

- Denver’s population of millennials (aged 25 to 39) increased by 14.1 percent from 2015 to 2020, the seventh-largest gain among large markets in that span. And it is the third-most concentrated market for millennials at 24.1 percent of its population.

- Denver has relatively affordable real estate costs for a leading tech hub. Its average annual office asking rent is 16th most expensive, its average monthly apartment rent is 11th most expensive and its ratio of tech salary to apartment rent of 20.9 percent is 12th highest.

CBRE’s report, now in its 10th year, ranks the top 50 North American markets by analyzing 13 measures of their ability to attract and develop tech talent, including tech graduation rates, tech-job concentration, tech labor pool size, and labor and real estate costs.

CBRE also ranks the Next 25 emerging tech markets on a narrower set of criteria, with Colorado Springs ranking No. 3 among the emerging markets. Tech talent is defined as 20 key tech professions – such as software engineers and systems and data managers – across all industries.