CBRE just released its Q2 reports for metro Denver’s office and industrial sectors. Significant rent growth can be attributed to the industrial market’s sustained success, while the office construction pipeline strongly rebounded this quarter with seven properties breaking ground.

Metro Denver Q2 Office Highlights

- Leasing momentum continued in Q2 2022 with 1.1 million sq. ft. of deals transacted—marking the fifth consecutive quarter of deal volume exceeding 1.0 million sq. ft.

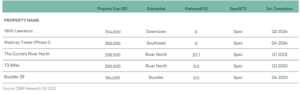

- The office construction pipeline strongly rebounded with 2.4 million sq. ft. under construction at the end of Q2 2022. Seven properties totaling 1.6 million sq. ft. broke ground this quarter across multiple submarkets.

- Metro Denver posted negative 108,000 sq. ft. of direct net absorption in Q2 2022.

- Year-to-date, 121,000 sq. ft. has been absorbed, marking a significant improvement from the negative 1.8 million sq. ft. recorded through the first half of 2021.

- Q2 2022 investment sales totaled $1.0 billion, up 75.9% from the volume in Q2 2021.

- Total vacancy increased moderately on a quarter-over-quarter basis, up 60 bps to 20.0%.

- Sublease availability increased 6.2% from the previous quarter to 4.8 million sq. ft. but is down from the peak of over 5.0 million sq. ft. at mid-year 2021.

- The average direct asking lease rate rose less than 1.0% to $32.08 per sq. ft. FSG.

Metro Denver Q2 Industrial Highlights

- Metro Denver continued to see strong rent growth with the year-to-date average achieved lease rate increasing 21.1% year-over-year to $8.39 per sq. ft. NNN.

- Nearly 262,000 sq. ft. of net absorption was posted in Q2 2022, pushing the YTD total to just over 1.9 million sq. ft.

- Vacancy increased 40 bps quarter-over-quarter to 5.9%, largely due to a 1.3 million-sq.-ft. move out in the I-76 Corridor submarket.

- Availability declined to 6.5%, down 20 bps quarter-over-quarter and 220 bps year-over-year.

- Sales activity pushed on at record pace through the first half of the year, recording $810.6 million in overall volume in Q2 2022 and driving YTD volume to nearly $1.3 billion.

- Construction activity showed a slight dip compared to the record-setting volume over the past year but finished the quarter with 8.7 million sq. ft. underway.