JLL has just released its Q3 2023 Denver Industrial and Office insight reports. Here are the key takeaways:

Office Key Trends:

- Employment and Occupancy Trends:

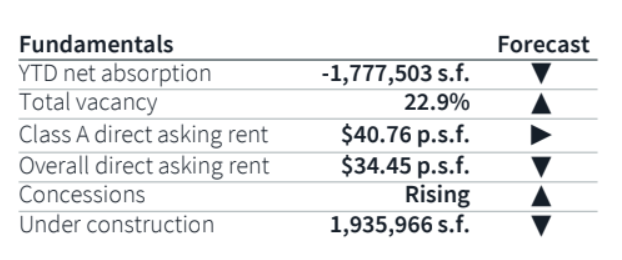

- Denver’s office market faced challenges in Q3 as office-using employment continued to decline. Despite reported return-to-office mandates, the overall occupancy rate fell for the fifth consecutive quarter, reaching a record low of 77.1%, nearly three percentage points below the U.S. average.

- Demand for Premium Assets:

- There continues to be demand for highly amenitized, top-tier trophy assets. These properties are likely to remain attractive to tenants seeking quality office environments.

- Market Outlook:

- Despite these challenges, there are positive signs on the horizon for Denver’s office market. Return-to-office initiatives are expected to gain momentum in the coming quarters, and there will be a continued “flight to quality”. Leasing activity, although for reduced office footprints, is projected to rebound as economic uncertainties subside.

Industrial Key Trends:

- Leasing Activity:

- While leasing activity has dipped slightly compared to recent quarters, the year-to-date total volume is on track to exceed 2022 figures by year-end. Smaller spaces under 50,000 square feet continue to dominate leasing activity, with 77.1% of leases falling into this category.

- Supply and Demand:

- Despite the uptick in vacancy rates, investor confidence in speculative products remains high. Over half of the new supply expected to come online is likely to deliver vacant and available, but significant build-to-suit projects by industry giants like Pepsi, Dollar General, and Home Depot are set to counterbalance this trend and maintain market equilibrium.

- Market Outlook:

- Looking ahead, the Denver industrial market remains resilient, catering to both landlords and tenants. Tenants can expect an array of options and potentially rising concessions. Meanwhile, landlords, particularly those with large 300,000+ square foot spaces, are poised to capitalize on the demand for single-user facilities. The market’s robust performance in the sub-100,000-square-foot segment underscores its adaptability and strength in uncertain times.