While activity at the beginning of the quarter was slow, September saw a return to the increased activity seen in the

previous quarter. However, according to Newmark’s Q3 Denver Office Market report, the rise of the Delta variant has once again brought uncertainty for some tenants. Many have delayed their return to the office, and those in the market have changed their size requirements multiple times during their search as their plans change with the news cycle. The continuing supply problems also caused delays in construction and tenant improvements, contributing to other tenants having to push back their occupancy date into the fourth quarter. High-quality space, new construction and certain micro-markets are still attracting high interest.

Current Conditions

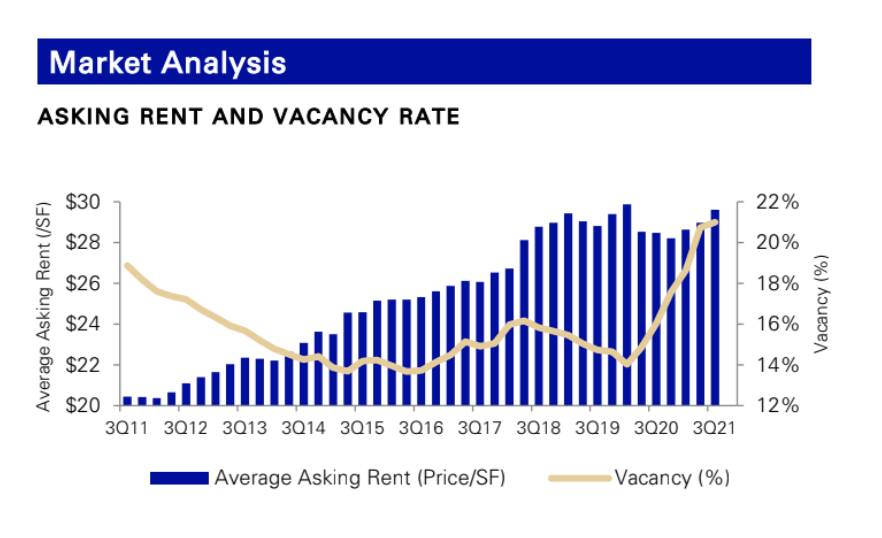

– Quarterly net absorption of -215,616 SF

– Vacancy rate of 21.0%

– The loss of occupancy was concentrated in Class B product

– There is 3.7 MSF of available sublease space in the Denver market with 2.7 MSF of it vacant. While vacant sublease space

increased slightly from last quarter, the total amount available continued to decrease.

Submarket Activity

Two of Denver’s nine submarkets posted positive net absorption for the third quarter of 2021; Midtown, which has the highly

sought-after Cherry Creek micro-market, led the market with 105,435 square feet of quarterly absorption, followed by the

Southeast, with 21,782 square feet. Most landlords are holding firm on rates but the increase in operating expenses continues to

push full-service rates, especially in new construction. Some landlords in select areas, like Cherry Creek, are even tentatively

trying to push rates again. Those landlords looking to be aggressive to entice deals continue to offer concessions rather than lower rents. Negotiating power remains on the tenant side, with many asking for multiple concessions from landlords for tenant improvements, free rent and maximum flexibility, such as shorter terms or the right to terminate. These are not new requests but are being requested and granted more often than in pre-pandemic negotiations.

Sale Transactions Limited but Still Historic

Transaction activity picked up in the last half of 2020, but the year still ended with only $1.6 billion across 24 transactions, down from 12.4 million square feet valued at $2.5 billion in 2019. Although investor activity continued to be thin for office product through third-quarter 2021, select products are still pulling in record-breaking numbers. After VF Corp.’s HQ in Downtown sold in August for nearly $800/SF, MetLife Investment Management purchased Civica Cherry Creek in Midtown for a total of $108.0 million, or $921/SF.

Looking Forward

Denver’s office sector deal flow is expected to continue into the fourth quarter. Although some companies searching for new space might drag their feet until the new year, many of the companies that had their move-in delayed till the fourth quarter will be anxious to occupy, and few companies are discussing radically downsizing. Rental rates will continue to increase, mostly due to the increased operating expenses and taxes, rather than landlords pushing rates. Sublease space will continue to gradually decrease after reaching its plateau. More space may trickle onto the market as companies continue to evaluate space while planning to reoccupy, but few large new blocks of space will enter the market. Vacancy will continue to level out in the last quarter of 2021 due to the new and delayed move-ins, while the new vacancies will be mostly to companies downsizing, rather than tenants leaving the market. Continued job and population growth are forecasted to continue through the next several years, and the anticipated strong pent-up demand for high-quality space in select markets, combined with a restrained development pipeline, will likely turn the corner to positive absorption in 2022.

Download the full report here.