CBRE has released its latest quarterly office and industrial reports. In Q3 2022, office sublease availability in metro Denver reached a peak of 5.4 million square feet. Increasing 13.9% quarter-over-quarter, sublease availability soared above its previous peak of 5.1 million sq. ft. in Q2 2021. While sustained tenant demand fueled healthy industrial leasing activity through Q3 2022 with over 3.9 million sq. ft. transacted in the metro area – the highest volume recorded in 2022 so far and a 23.7% increase from Q3 2021.

Q3 Metro Denver Office Highlights

- Sublease availability increased 13.9% quarter-over-quarter to 5.4 million sq. ft., surpassing the previous peak of 5.1 million sq. ft. recorded in Q2 2021.

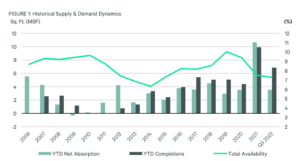

- Leasing activity remained stable in Q3 2022 with nearly 1.1 million sq. ft. of leases transacted, bringing the year-to-date total to 3.4 million sq. ft.

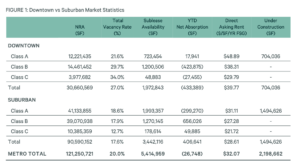

- Negative 110,202 sq. ft. of direct net absorption was recorded in Q3 2022. Year-to-date, metro Denver has posted negative 26,748 sq. ft. of net absorption.

- Total sales volume decreased 34.9% quarter-over-quarter for a total of $676.3 million with 18 properties trading hands.

- Total vacancy remained relatively flat on a quarterly basis, increasing 20 bps to 20.0%.

- The overall average direct asking lease rate experienced minimal change, decreasing less than 0.5% to $32.07 per sq. ft. FSG.

Q3 Metro Denver Industrial Highlights

- Total leasing volume transacted in metro Denver climbed to over 3.9 million sq. ft., the third-highest quarterly total in the past five years.

- Over 1.6 million sq. ft. of positive net absorption was posted in Q3 2022, pushing the YTD total to 3.5 million sq. ft.

- Construction activity increased 2.6% quarter-over-quarter with 8.9 million sq. ft. under construction at the end of Q3 2022.

- 3.8 million sq. ft. of new construction delivered in the third quarter, causing the total availability rate and direct vacancy rate to both rise 80 bps to 7.3% and 6.7%, respectively.

- Due to the larger availabilities added to the market in the third quarter, the average asking rate marginally decreased (1.4%) quarter-over-quarter to $8.61 per sq. ft. NNN.

- Sales activity remained strong through Q3 2022, recording $440.9 million in overall volume and driving YTD volume to over $1.6 billion.