North American tech-talent employment weathered the pandemic better than most other professions, according to CBRE’s 2021 Scoring Tech Talent report. Despite slipping from its No.7 position in 2020, Denver currently has the 12th largest tech talent labor pool nationally with 114,900 tech workers and remains a top choice for tech companies.

“With an expanding talent pool, strong employee in-migration and affordable cost of living, Denver remains a top consideration for tech companies who are considering their expansion plans. The market’s tech talent base remains strong as we continue to move up in the report’s Brain Gain category, which confirms our ability to keep talent local by offering great employment opportunities. As we look at the continued trajectory of companies moving their headquarters to Colorado, we suspect that our tech talent pool will not only continue to grow, but also attract new types of talent that choose Denver as a home,” said Alex Hammerstein, senior vice president, CBRE.

Numerous indicators underscore the resilience of tech talent during COVID-19. These occupations registered job growth of 0.8 percent in 2020 in the U.S. while non-tech occupations declined by 5.5 percent. Software developers and programmers were the most in demand tech-job category last year, adding 85,000 U.S. jobs for a 4.8 percent growth rate from a year earlier. Beyond the tech industry itself, those that added tech workers last year include financial activities, professional & business services, and government.

Tech jobs account for 7 percent of total jobs in Denver’s workforce, 1.8 times higher than the national average of 3.9 percent. Following the pandemic, factors including the size of a market’s talent labor pool is a key indicator of a region’s economic recovery.

Denver stood out in the report in a number of other key areas:

- Denver has the sixth fastest-growing tech labor pool in North America. Over the past five years, Denver added 27,290 tech jobs.

- Denver’s millennial population aged 22 to 36 grew 20.1 percent since 2014. It is also the third-most concentrated millennial market, with about one-third of Denver’s population in this cohort. That’s above the U.S. average of 22 percent.

- The metro churned out nearly 22,000 tech degree graduates between 2015 and 2019, ranking ninth for “brain gain,” meaning it added 5,344more tech jobs than tech graduates over the past five years.

- The market ranked seventh for educational attainment with 45.8 percent of residents over age 25 holding a bachelor’s degree or higher (compared to a U.S. average of 33.1 percent).

- Denver’s average tech wage ($107,481) is ninth highest in North America. It has grown by 11 percent over the last five years.

- Denver’s average office rent is the 18th most expensive among top tech markets. Office rent growth increased 17 percent over the last five years.

- In terms of cost, Denver is the seventh most expensive market for operating a 500-employee tech company occupying 75,000 sq. ft. in Denver, with an estimated annual operating cost of $51.4 million.

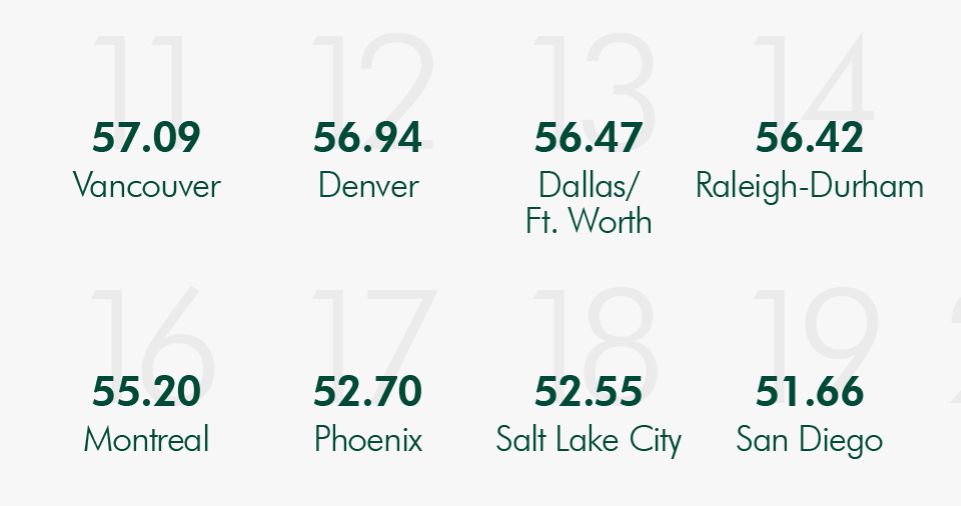

CBRE’s annual report, now in its ninth year, ranks the top 50 North American markets by analyzing 13 measures of their ability to attract and develop tech talent, including tech graduation rates, tech-job concentration, tech labor pool size, and labor and real estate costs, among others.