Denver, CO – With food-and-beverage outlets now among the fastest-growing categories in retail centers, a new CBRE Group, Inc., report identifies four emerging eatery formats poised for significant expansion: food trucks, food halls, celebrity-chef restaurants and “grocerants.” Denver is recognized in the study as a prime market for restaurant growth thanks to high job, income and population growth in recent years.

The CBRE report highlights numerous data points that underscore the booming growth of restaurants, including that total U.S. restaurant sales surpassed grocery sales for the first time last year, according to government data, and that they have fared better since the recession than any other retail category. It also points out that, while millennials dine out more often, older generations spend more overall at restaurants. This implies more growth for restaurants as millennials age and earn more.

The CBRE report highlights numerous data points that underscore the booming growth of restaurants, including that total U.S. restaurant sales surpassed grocery sales for the first time last year, according to government data, and that they have fared better since the recession than any other retail category. It also points out that, while millennials dine out more often, older generations spend more overall at restaurants. This implies more growth for restaurants as millennials age and earn more.

The report finds that secondary urban markets with high job, income and population growth are best positioned for restaurant spending growth, most notably Minneapolis, Denver, Baltimore and Philadelphia. This is evidenced in Denver where a recent CBRE report on retail expansion found that the city’s number of quick-service restaurants increased by 67 percent in 2015 compared to the previous year.

The report finds that secondary urban markets with high job, income and population growth are best positioned for restaurant spending growth, most notably Minneapolis, Denver, Baltimore and Philadelphia. This is evidenced in Denver where a recent CBRE report on retail expansion found that the city’s number of quick-service restaurants increased by 67 percent in 2015 compared to the previous year.

Those factors and others collectively suggest that this growth in spending at restaurants is more than a cyclical, post-recession recovery but instead a fundamental shift in American dining and spending habits.

“We know that the strength of the food-and-beverage category has led to many shopping center owners seeking restaurants as anchor tenants to draw in shoppers, whereas department stores and other retailers previously filled that role,” said David Orkin, Executive Vice President and Restaurant Practice Leader, CBRE. “What’s particularly interesting today is that retail center owners are not only focused on traditional, proven restaurant concepts, but they are more willing than ever to embrace a broader range of emerging and, in some cases, untested concepts like food trucks which don’t pay traditional rent. They are willing to take risks to compete.”

CBRE enlisted its restaurant experts, led by Mr. Orkin, to identify the up-and-coming restaurant formats likely to drive the category’s further expansion in retail property. These four categories offer many or all of the attributes that appeal to modern diners and shoppers: diversity, convenience, uniqueness, relative affordability and experiential focus.

- Food trucks: While food trucks don’t often pay traditional rent, they attract shoppers to a center and have served as incubators to develop restaurant concepts that later become brick-and-mortar tenants.

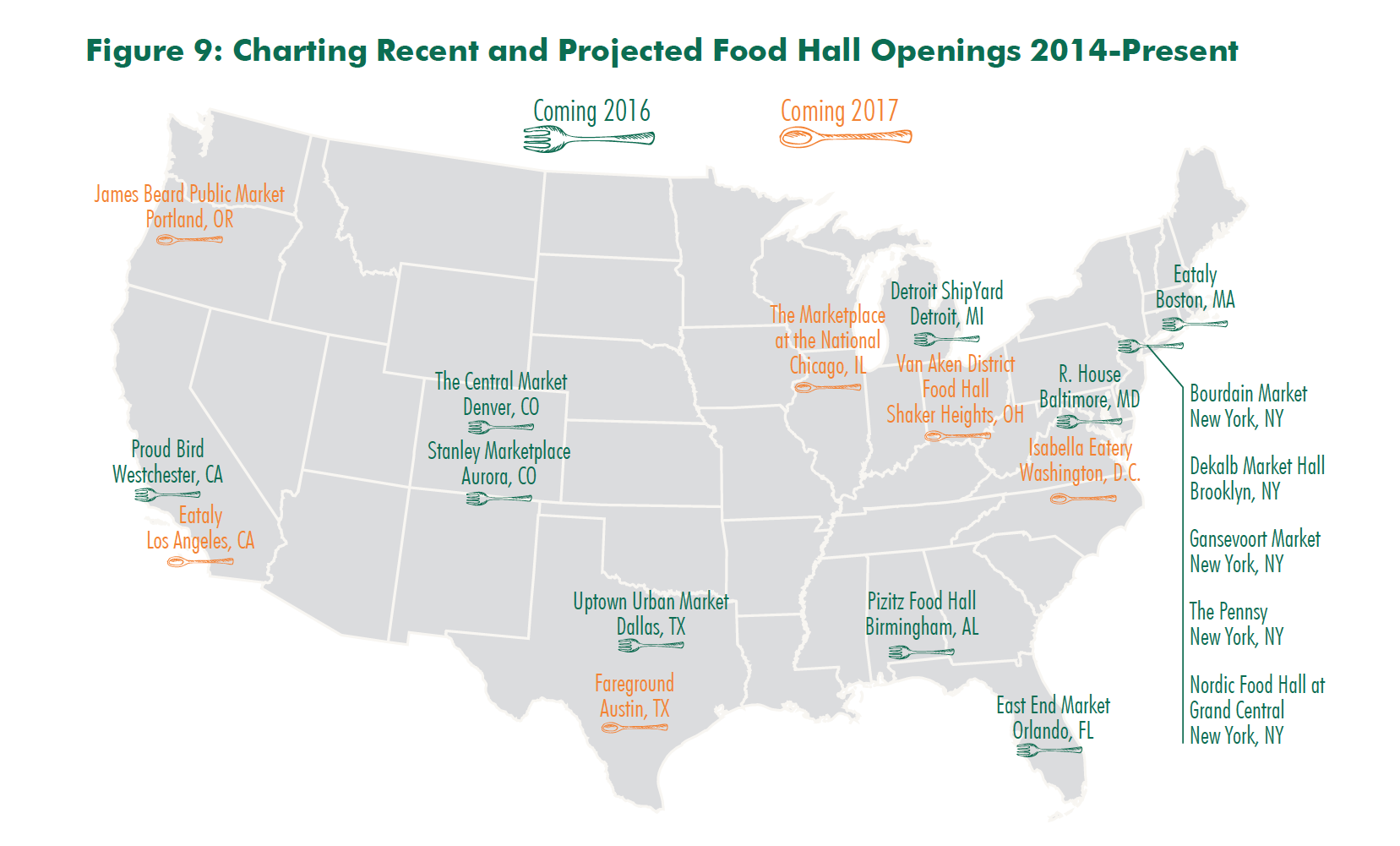

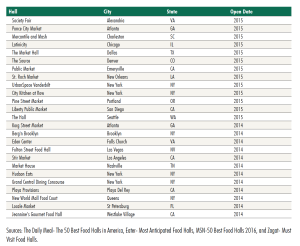

- Food halls: This urban retail format features a changing mix of local and often independent food-and-beverage outlets that collectively add to the center’s atmosphere and uniqueness.

- Celebrity-chef restaurants: While sometimes expensive and risky to establish in a center, restaurants helmed by well-known chefs can be significant, exclusive traffic generators for a property when they succeed.

- “Grocerants”: Grocery stores that also offer prepared foods and made-to-order meals provide a mix of freshness, convenience and affordability that prove attractive to shoppers and, by extension, property owners.

Though these formats are popular, cultivating them can be risky for property owners. Restaurants— especially new, independent restaurants—have a notoriously high failure rate. What’s more, most property owners must contribute substantial capital to outfit their space for restaurant use. One solution CBRE has seen property owners undertake is to forego immediate repayment of buildout costs or to keep base rents low in exchange for an ownership stake in the restaurant. In that approach, the property owner receives a share of that restaurant’s profit even after its initial investment is repaid, thus providing the property owner a return on its assumption of risk.

“There’s a move toward financial partnership rather than traditional tenant-landlord relationships,” said Melina Cordero, CBRE’s Head of Retail Research in the Americas. “That’s something that landlords are going to have to be open to if they are pursuing some of these categories. In many cases, the customer draw generated by these food-and-beverage categories and the atmosphere they foster make the investment worthwhile.”

Images courtesy of CBRE Research